Canton Coin is listed on Bybit, Kucoin and MEXC exchanges today, a detailed explanation of $CC token economics

This article analyzes the dynamic supply mechanism of the Canton Coin token economic model. There is no hard upper limit on the supply, but is balanced through minting and destruction. Additional news: Canton Coin (CC) token spot will be listed on Bybit, Kucoin and MEXC exchanges at noon today.

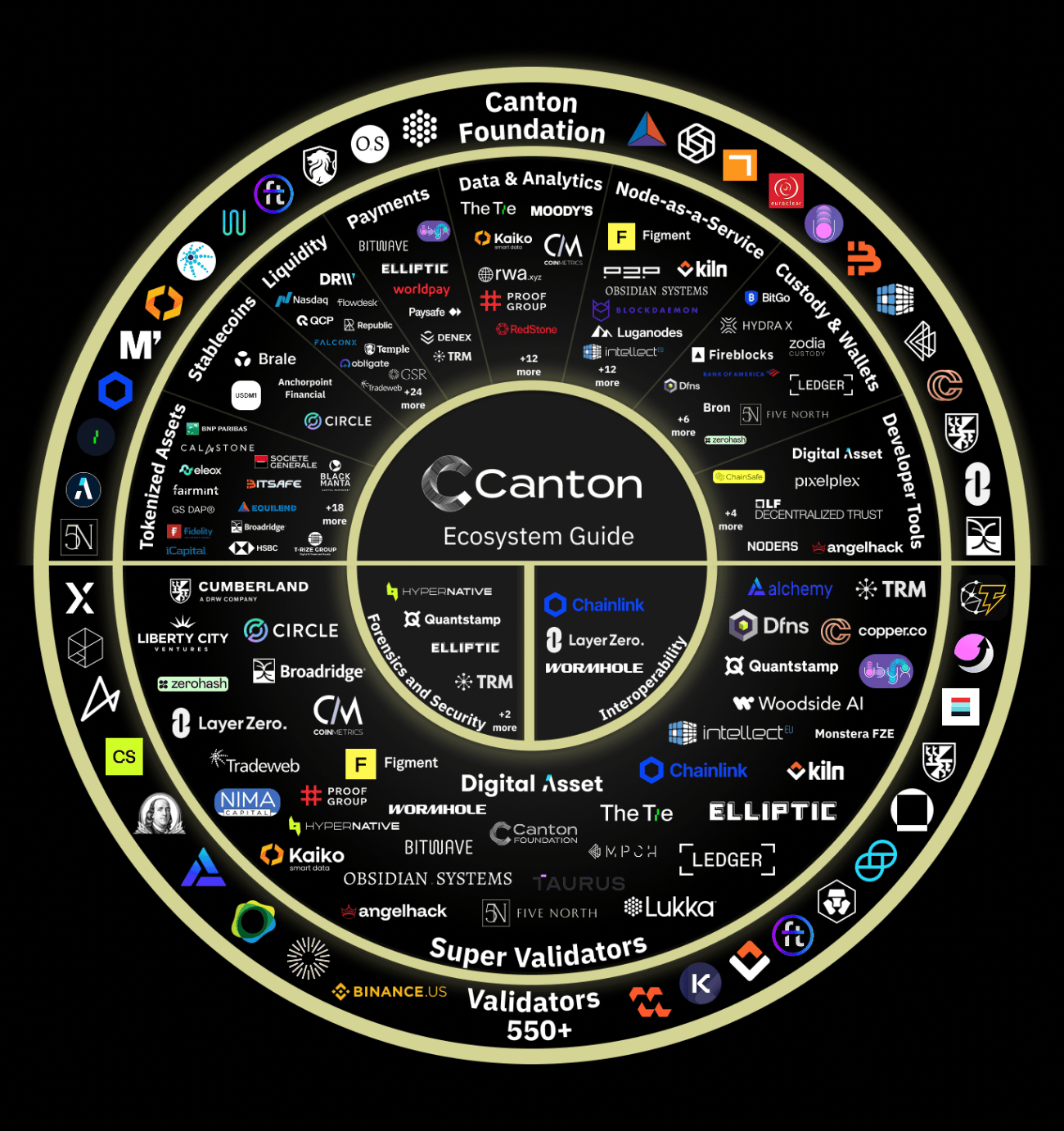

(Preliminary summary: Full analysis of Canton Network ecology: Breaking the barrier between TradFi and DeFi, the era of AllFi is coming)

(Background supplement: Canton Network’s daily processing volume has exceeded 600,000 transactions)

Contents of this article

(This article was edited by Canton Network The article is written and provided and does not represent the position of Dongzhong, nor does it represent investment advice, buying or selling advice. See the liability warning at the end of the article for details. )

When everyone sees the minting curve of Canton Coin (CC), they think that its maximum supply is fixed at 100 billion. This is wrong - and here's why:

Dynamic supply, not fixed cap

The supply mechanism of Canton Coin (CC) is very similar to that of Ethereum (ETH) or Solana (SOL): theoretically uncapped, but in practice quite stable. There is no hard cap on its issuance. However, every transaction on Canton destroys CC, thus offsetting new issuance. Over time, these two forces - minting and burning - will balance out around network activity and market prices.

This means that as rising usage drives higher burn rates, the total supply will stabilize at a level well below the theoretical issuance curve.

FDV vs. Market Cap

For Canton Coin, Fully Diluted Valuation (FDV) and Market Cap are effectively the same:

FDV = Market Cap = Current Total Supply × Current Market Price

Future supply depends on how much is burned versus how much is minted—a function of network demand. Inflation will be higher than Ethereum or Solana in the short term, but will steadily decrease as issuance halves and burn increases as adoption increases.

How supply is adjusted

Canton’s handling fees are denominated in US dollars (USD price per MB of transaction data), but are paid through the destruction of CC at the on-chain exchange rate. When network demand is high (i.e. CC prices are low relative to usage), more CC is burned, and supply growth slows—even turning deflationary. When there is less activity, the rate of destruction slows, allowing the supply to expand. This dynamic creates a natural burn-mint equilibrium (BME)—a feedback loop between usage, price, and supply.

Equilibrium over time

Once the market finds an equilibrium point under the BME mechanism, issuance and destruction should be roughly balanced. Until then, total supply should remain fairly stable and adjust slowly around long-term demand. Because supply dynamically adapts, market cap—not theoretical maximum supply—is the correct way to measure value.

Illustrative example

Scenario: The network reaches equilibrium in the validator + application pool

Assumption: All tokens minted to validators and applications are destroyed in a block

Super Validator (SV) rewards are the only source of inflation

So, if by 2026 Reaching equilibrium mid-year, total supply could be as follows:

Estimated total supply

July 2026:

July 2029:

July 2034:

These estimates may be on the high side. Over 1 billion CC has been destroyed so far, and the network is currently destroying approximately $900k worth of CC every day.

In this scenario, if SV were the only source of issuance, the annual inflation rate would be approximately 32.5 million CC, or

Key Release Milestones

The most important upcoming event in Canton supply dynamics is the halving on January 1, 2026, which is a double reduction for Super Validators (SV). First, the total issuance per block will be halved. Second, SV’s share of this issuance will drop from 48% to 20% as more rewards are redirected to validators and applications. Three years later, a similar "double halving" will happen again:

The total circulation is halved again, and the share of SV drops again, from 20% → 10%.

This compounding effect means that once the network reaches burn-mint equilibrium (BME) between validators and applications, the SV pool will become the primary – and rapidly shrinking – source of new issuance. By the early 2030s, SV issuance will represent only a tiny fraction of the total supply, making Canton Coin’s inflation profile one of the lowest among major Layer-1 networks.

Conclusion

As with any resilient network, value comes from utility. Through the fee burning mechanism, each transaction helps improve scarcity and consistency. The image below captures this dynamic.

Disclaimer from the Advertising Editor: The content of this article is a publicity manuscript provided by the contributor. The contributor has no relationship with Dongzhong, and this article does not represent the position of Dongzhong. This article is not intended to provide any investment, asset advice or legal advice and should not be considered an offer to buy, sell or hold assets. Any services, solutions or tools mentioned in the content of Guangxuan manuscripts are for reference only, and the final actual content or rules are subject to the announcement or explanation of the contributor. Dongzhu is not responsible for any possible risks or losses, and reminds readers to check carefully before making any decisions or actions.