Interest rate cut catalyzes final stage of Bitcoin bull market: Will BTC crash again next year?

The Federal Reserve’s interest rate cut may catalyze the final stage of the Bitcoin bull market, but history shows that there may be a huge crash in 2026. This article originates from an article written by Frank Corva, compiled, compiled and written by Foresight News.

(Preliminary summary: The Federal Reserve cut interest rates by 1 yard in September, Powell shouted "the impact of tariffs is limited," and Bitcoin rose above 117,300)

(Background supplement: CoinDesk: If the Federal Reserve cuts interest rates by 1 yard, Bitcoin will resume its rise; Matrixport: Market leverage levels show that BTC's downside space is limited)

Historically, the price of Bitcoin is about 20 years after the Bitcoin halving. peaked in months. The last Bitcoin halving occurred in April 2024, which means we may see a cycle top in December this year.

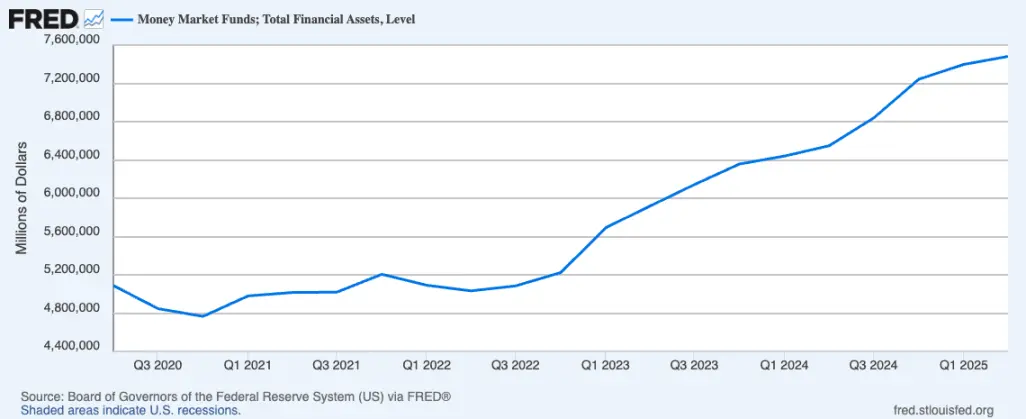

This scenario is increasingly likely as Fed Chairman Powell cut interest rates by 25 basis points this week, giving the roughly $7.4 trillion in money market funds a reason to leave the sidelines and flow into assets like Bitcoin, especially now that Bitcoin exposure is easier to obtain through proxy vehicles such as spot Bitcoin ETFs and Bitcoin Treasury Bonds.

Powell also said that there may be two more interest rate cuts before the end of the year, which will further reduce the returns of money market funds and may push investors to anti-inflation assets such as Bitcoin and gold, as well as riskier assets such as technology and artificial intelligence-related stocks.

This could catalyze the final stages of a "melt-up," similar to what technology stocks did in late 1999 before the dot-com bubble burst.

In addition, similar to the views of Henrik Zeberg and David Hunter, I believe that the bull market that began in late 2022 is entering the final parabolic rise stage.

Using traditional financial indexes as a reference, Henrik Zeberg believes that the S&P 500 will break through 7,000 points before the end of the year, while David Hunter believes that it will rise to 7,000 points within the same timeframe. 8000 points (or higher).

More importantly, according to macro strategist Octavio (Tavi) Costa, we may be witnessing USD 14 The collapse of support levels in 2020 means we may see significant USD weakness in the coming months, which would also support the bullish thesis for anti-inflation assets and risk assets.

What will happen in 2026?

Starting early next year, we may see the largest crash of any market since the collapse of U.S. financial markets in October 1929 that triggered the Great Depression.

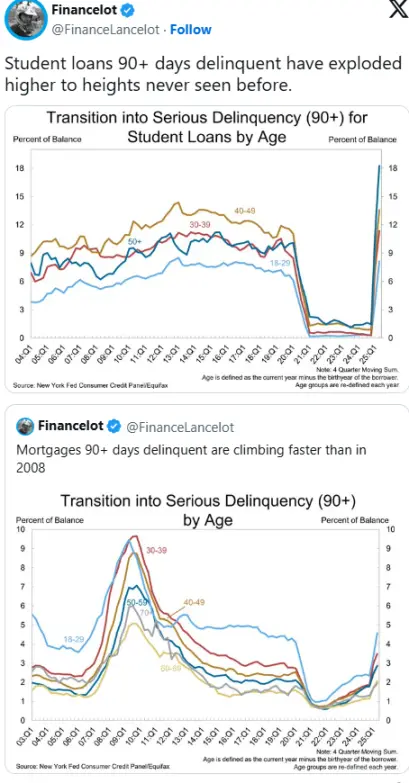

Henrik Zeberg's reasons included the fact that the real economy was at a standstill, evidenced in part by the number of homes on the market.

David Hunter believes we are at the end of a half-century long debt-driven cycle that will end with a deleveraging unprecedented in modern history, as he shared on Coin Stories.

Other signals such as loan payment defaults also indicate that the real economy is coming to a sharp halt, which will inevitably have an impact on the financial economy.

Bitcoin decline is not inevitable, but it is very likely

Even if we are not headed for a global macro collapse, if history repeats itself, the price of Bitcoin will be in 2026 suffered historical selling pressure.

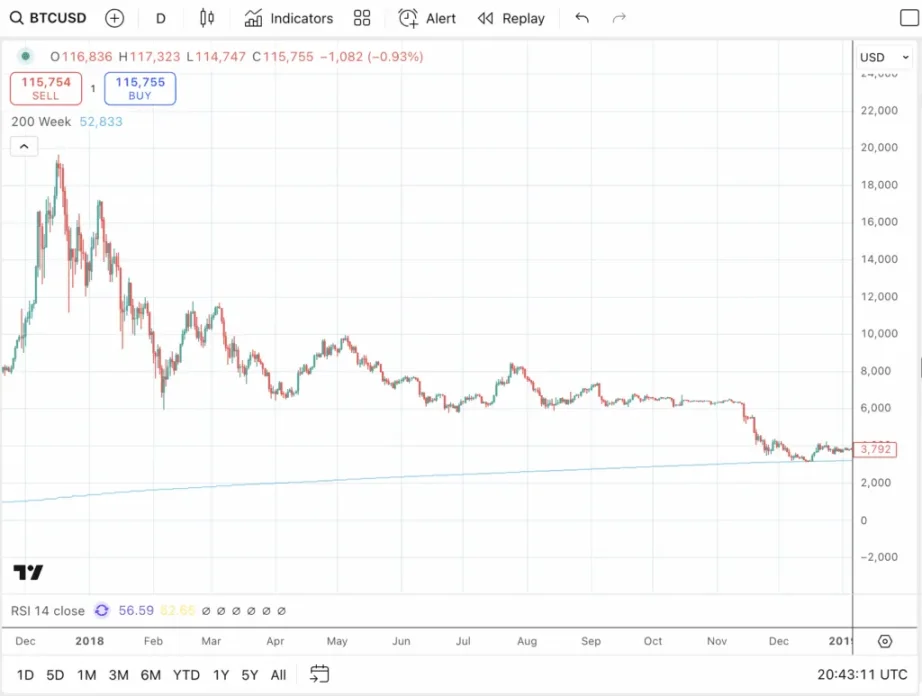

That is, the price of Bitcoin fell from nearly $69,000 at the end of 2021 to about $15,500 at the end of 2022, and from nearly $20,000 at the end of 2017 to just over $3,000 at the end of 2018.

In both cases, Bitcoin’s price hit or fell below its 200-week standard moving average (SMA), the light blue line in the chart below.

Currently, Bitcoin’s 200-week standard moving average sits at around $52,000. If Bitcoin prices go parabolic in the coming months, it could rise to as high as $65,000 before Bitcoin prices fall to that price point or lower sometime in 2026.

If we do see the kind of crash predicted, Bitcoin's price may also be well below that threshold. Still, no one knows what will happen in the future, and it may be worth remembering that history doesn't necessarily repeat itself, but there are often similarities.