The market value of the micro strategy is lower than that of Bitcoin holdings "mNAV fell below 1". Will the stock price evaporate 60% from the high point and shake the MSTR currency hoarding strategy?

The market value of MicroStrategy fell below the value of its Bitcoin holdings, and mNAV fell below 1. Are investors wavering on the leveraged currency hoarding strategy?

(Preliminary summary: MicroStrategy no longer "crazy shopping", is this the reason for the decline of Bitcoin?)

(Background supplement: MicroStrategy spent US$45.6 million to increase its position in 397 coins BTC, the villain of Bitcoin: The buying intensity is too weak to prevent Bitcoin from continuing to fall)

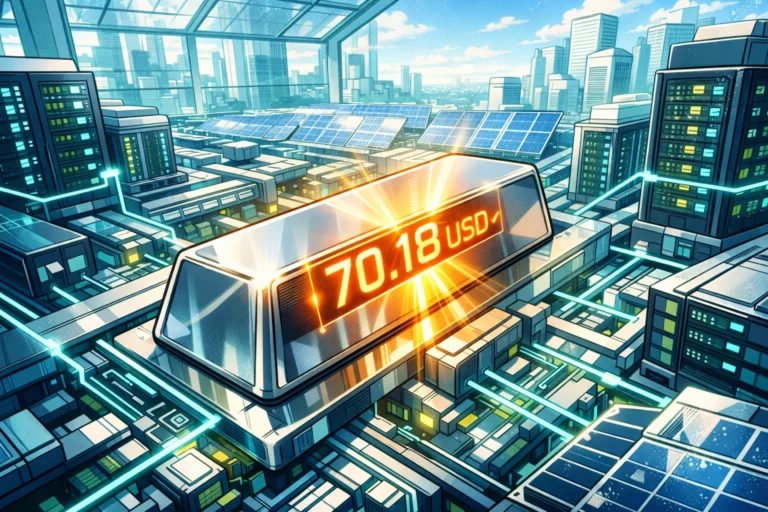

The micro-strategy (Strategy), the dominant Bitcoin holdings, has reached a critical moment: the company’s stock price has fallen by more than 25% this year and continues to hit new lows in 2025 (it fell nearly 3% last night and is now at $224.61).

The current market value is approximately US$64.5 billion, which is lower than the 641,692 Bitcoins it holds, which is a book value of approximately US$65.7 billion based on US$102,500. mNAV, which represents market capitalization divided by Bitcoin’s net assets, fell below 1 for the first time, potentially ending the long-term premium pattern seen in the past.

mNAV fell below 1: Multiple factors attacked

The price of Bitcoin has recently backtested to US$100,000 several times, and MicroStrategy's stock price has fallen by nearly 60% from this year's high of US$542.99. The double pressure has caused the premium to evaporate.

In this context, some people in the market have also begun to worry that Strategy's continuous purchase of coins through debt issuance and capital increase may amplify leverage risks and dilute equity. In addition, 2027 The $1.01 billion in convertible bonds due in 2018 and the 10.5% preferred dividend of approximately $689 million per year are all regarded as subsequent cash flow burdens.

On the other hand, investor behavior is also changing. As more and more direct currency holding channels appear, Strategy is no longer the only "U.S. stock version of Bitcoin leverage tool". The risk of holding MSTR has increased than that of direct currency holdings, resulting in a weakening of buying incentives.

Three paths for the future: hoarding, repurchasing or hedging

At present, Strategy may face three options:

First, continue "buy and hold" and accumulate Bitcoin through further issuance of shares or bonds, at the expense of continued dilution of equity shares

Second, use part of the Bitcoin position to repurchase stocks and increase the price mNAV, but will reduce long-term exposure (the probability should be low, which is tantamount to abandoning the previous strategy)

Third, introduce derivatives hedging to balance leverage and volatility risks.

For investors, the mNAV discount is both a risk and an opportunity; if the discount expands, value investors may enter the market, but if the price of Bitcoin stagnates or falls again, MicroStrategy's high-leverage model may face more tests.