President of the European Central Bank: The digital euro CBDC core system has been completed and will be on the road as soon as the second half of 2026

The President of the European Central Bank (ECB) stated that the development of digital euro (CBDC) technology has been completed, and the next step is to await political approval, and it is expected to be online in the second half of 2026 at the earliest.

(Preliminary summary: BNP Paribas and 10 European banks launched the Qivalis euro stablecoin, which is planned to be launched in the second half of 2026)

(Background supplement: Amundi, Europe’s largest asset management company, has entered Ethereum and launched a tokenized euro currency fund: opening all-weather trading)

Contents of this article

European Central Bank (ECB) President Lagarde announced at the last press conference of the year yesterday that the core system development of the digital euro has been completed, and the next step is for the European Council and Parliament to decide on legislation. If the schedule goes as planned, the Eurozone will usher in the era of simultaneous official CBDC and private stablecoins in the second half of 2026.

The technology is in place, waiting for political green light

Lagarde pointed out that the goal of the digital euro is to provide "public digital payment options" for the 340 million euro area residents and ensure that the settlement role of the euro in cross-border e-commerce and online platforms is not weakened. According to the ECB’s internal schedule, the core of the legislation includes three major modules: privacy protection, anti-money laundering (AML) and cross-bank interoperability.

The ECB emphasized that the digital euro will coexist with existing banknotes, and people can freely convert between different forms.

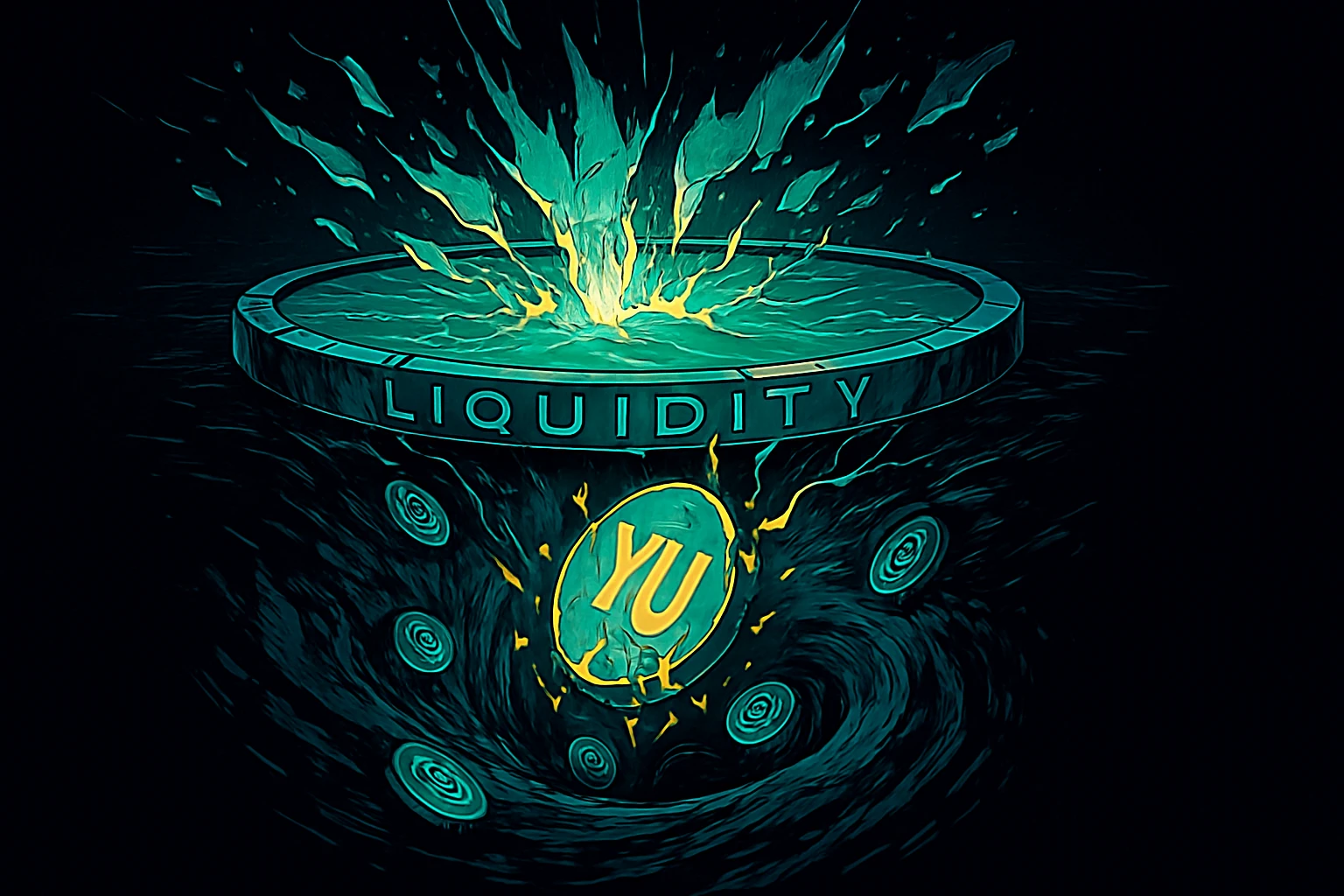

MiCA opens up private stablecoins

At the same time, the MiCA Act, which will officially take effect in 2025, draws regulatory boundaries for stablecoin companies. For example, Dongzhong reported in July that AllUnity, a joint venture jointly established by Deutsche Bank’s asset management subsidiary DWS, cryptocurrency investment company Galaxy Digital, and market maker Flow Traders, officially issued the euro stablecoin EURAU in Germany, which is fully compliant with the European MiCA Act.

On the other hand, the Qivalis Alliance, composed of 9 to 10 large banks including BNP Paribas, also plans to launch a private version of the euro stablecoin in 2026, focusing on cross-chain interoperability and instant settlement. The euro stablecoin market is growing rapidly.

CBDC and stablecoins run in parallel

In the foreseeable future, official CBDCs and private stablecoins will compete on the same field. The former is minted and liquidated by the public sector, emphasizing inclusiveness and legal status; the latter provides speed and customized services to facilitate rapid turnover of enterprises in decentralized finance (DeFi) or trade finance.

Analysts believe that dual-track parallelism can increase the visibility of the euro in global digital payments and reduce dependence on U.S. dollar stablecoins and U.S.-based payment networks.

Observers remind that the European Parliament is expected to hold a key vote in May 2026, the result of which will determine whether the ECB can issue a digital euro as scheduled in the second half of the year. If the legislative process goes smoothly, 2026 may become the "Year of the Digital Euro."