Silver breaks $70 to hit another all-time high! The market value is approaching US$4 trillion. What’s the next step to overtake Apple and Huida?

Spot silver continued its strong rise today (23rd), with the price officially breaking through the $70/ounce mark, setting a new all-time high again!

(Previous summary: Silver has reached a record high of US$67! Its market value has overtaken Google parent company Alphabet, ranking the fourth largest asset in the world)

(Background supplement: The crisis behind the skyrocketing silver: when the paper system begins to fail, the financial order is collapsing)

Spot silver continued its strong rise today (23rd), and the price officially exceeded the US$70/ounce mark, setting a new all-time high again! The main driving factors for the rise in silver prices include: strong industrial demand, especially the rapid expansion of green energy and technology fields such as solar photovoltaics, electric vehicles, and AI data centers; investment demand has increased significantly, and investors regard silver as a safe-haven asset; global silver supply inventories continue to tighten, and supply and demand deficits have occurred for many consecutive years. These factors combine to make silver the best-performing precious metal in 2025.

What is the next step to overtake Apple?

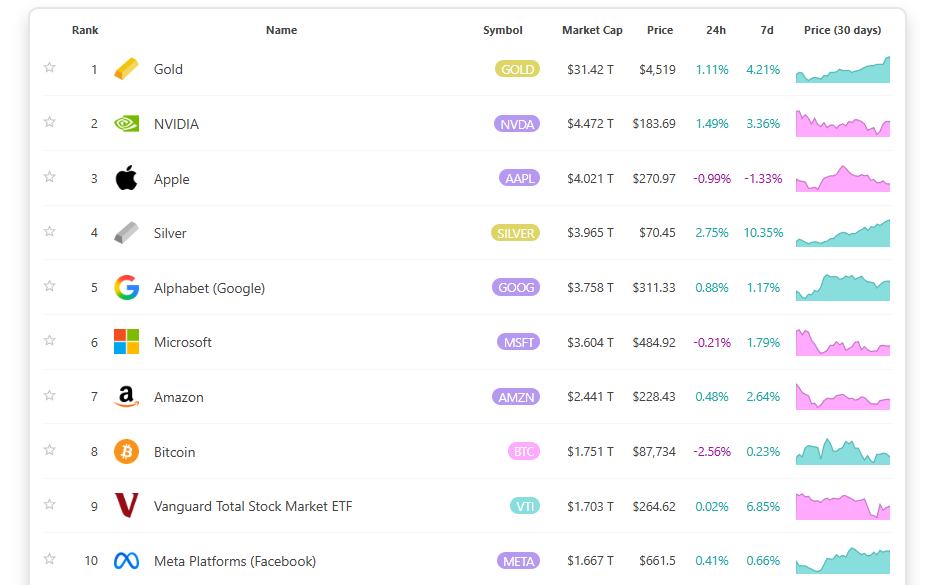

For the entire year of 2025, silver’s growth has reached 130%-140%, far exceeding the performance of most years in history and becoming one of the strongest performing commodities this year. As prices soar, the total market value of silver is now approaching the US$4 trillion mark, ranking second only to gold, NVIDIA and Apple in the global asset rankings.

But if the rally continues, the market value of silver will soon surpass Apple, further consolidating its position on the global asset list. This silver bull market reflects the dual support of industrial transformation and safe-haven demand.