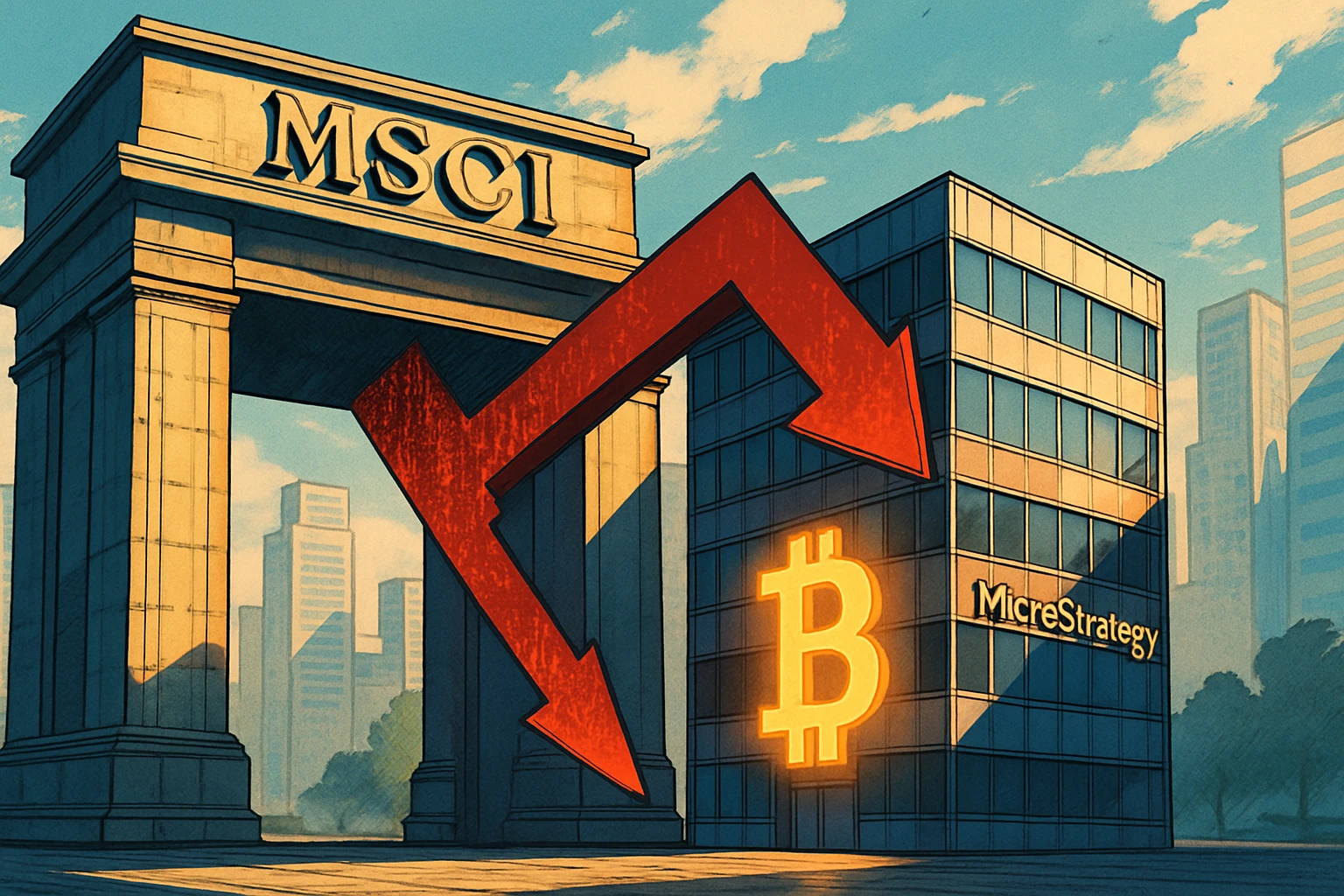

CryptoQuant: Bitcoin must hold on to the "Bull-Bear Bifurcation" of $87,000, and $74,000 is the last line of defense for collapse

In the past seven days, Bitcoin has fallen from US$100,000, and US$87,000 has become the "bull-bear turning point", which has attracted great attention from all investors.

(Preliminary summary: Bitcoin once fell below $90,000, down nearly 30% from this year’s high)

(Background supplement: Bernstein: Bitcoin’s 25% retracement does not mean that the bull market has peaked, and the fundamentals have not changed, which is like a phased adjustment)

Bitcoin has fallen from its October high of $126,000 The decline has exceeded 30%, and global investors are keeping a close eye on the three key supports of US$87,000, US$79,000, and US$74,000. Axel Adler Jr., senior analyst at crypto analytics firm CryptoQuant, warned that holding on to these levels is a bullish and bearish crossroads.

Key levels the market needs to hold:

Fair Value: $87K

US Bitcoin ETF Average Cost Basis: $79K

Lower bound of the volatility range: $74KWhy these levels were chosen and the data behind them, is explained in detail in my recent post:img/datapic/sc/2025122918161386 pic.twitter.com/BtBajyj9Jf

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) November 18, 2025

Bitcoin's three "lifelines"

CryptoQuant senior analyst Axel Adler Jr. said that Bitcoin's $87,000 is defined as "fair value." He pointed out that this threshold not only measures the strength of long and short, but also represents whether the bull market structure is intact.

If the price remains below this line for a long time, it means that the market fundamentals have begun to shake. The second line of defense of $79,000 is the average holding cost of the U.S. Bitcoin ETF. ETF is the main channel for institutions to enter the market. This line is related to the risk appetite of institutions. Once it falls below, the potential selling pressure may be unstoppable.

The last line of defense of $74,000 is the lower limit of the short-term fluctuation range. It is also the area where institutions have built a large number of positions in the past and is regarded as the "last line of defense."

Axel Adler Jr. emphasized:

If Bitcoin can consolidate above these prices, the correction is a healthy washout; otherwise, especially if the $87,000 round number falls, the market may face a more severe test.

Technical: Death Cross and Falling Wedge Seesaw

Technical indicators have released contradictory signals. The price of Bitcoin has appeared a "death cross", which in the past was usually regarded as a precursor to a decline; short-term holders are therefore facing heavy floating losses. However, the same report also noted that the chart is forming a bullish "falling wedge." If it can break above the $106,000 to $107,000 range, there is still a chance that the bull market fire will be rekindled.

According to statistics from CryptoQuant Insights, net inflows into exchanges have increased recently, showing that investors are transferring coins to exchanges in preparation for selling, but the level of inflows has not yet caused a full panic. The real focus falls on the $79,000 ETF cost line. If the price breaks below, institutional positions may face losses, triggering rebalancing or redemptions, forming a second wave of selling.

Beyond ETFs, OTC whales are also waiting and watching. The current trading volume is not strong, which means that both groups of funds are waiting for deterministic signals. If $87,000 falls, bulls may be forced to reduce their positions; if it holds and rebounds, bears may cover.

The above is not investment advice. Market volatility has increased, so investors should be cautious.