CryptoQuant: The indicators on the Bitcoin chain are "mostly bearish", and without macro liquidity, it will enter a bear market

A sudden drop in U.S. employment boosts interest rate cut bets, but CryptoQuant says alarms are going off on the Bitcoin chain.

(Preliminary summary: BlackRock CEO publicly admitted his mistake: Bitcoin is not only a crime, it is a fear asset with high volatility)

(Background supplement: Glassnode: The current structure is similar to that before the crash in 2022, whether Bitcoin can return to 96,000 mg is the key)

On December 4, Eastern Time, ADP The private employment report (small non-agricultural sector) continues to play out the script of "bad news as good news". Employment fell by 32,000 people in November, breaking expectations. Interest rate futures instantly raised the probability of the Federal Reserve cutting interest rates by 25 basis points this month to 90%. However, it also caused Bitcoin to stagger at the $93,000 mark. Funds simultaneously poured into Ethereum, indicating that the crypto market has entered a new stage of risk restructuring.

Employment is colder, and interest rate cuts are expected to be greater

ADP data shows that companies with less than 50 employees laid off 120,000 people in a single month, and the annual wage growth rate fell to 4.4%. High interest rates have squeezed end demand and the financing environment, making American small businesses the hardest hit. Gold returned to $4,220 as risk aversion increased and investors bet the Federal Reserve will ease off the accelerator after pumping the brakes on the economy.

The popularity of the Bitcoin chain is freezing

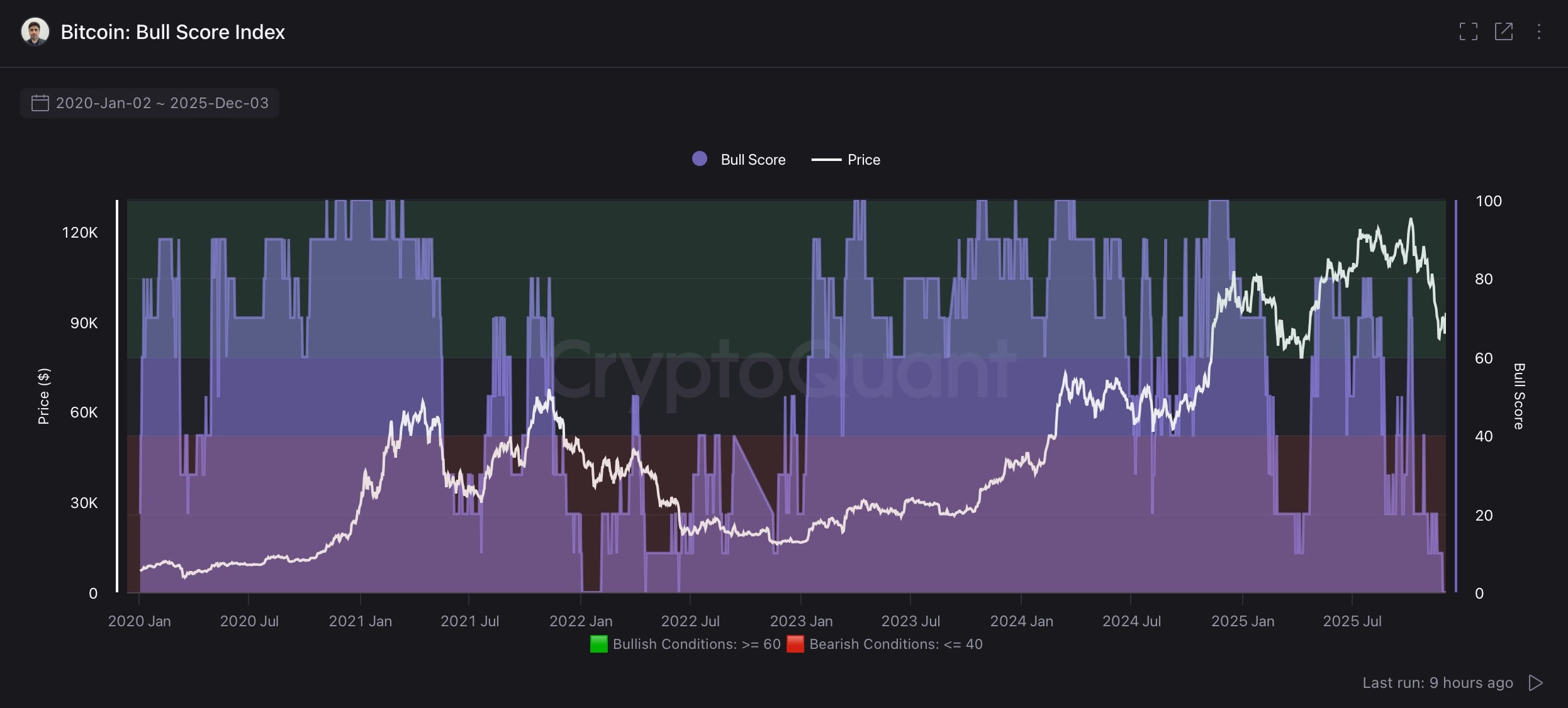

Bitcoin is fluctuating back above $90,000, but Ki Young Ju, founder of CryptoQuant, issued a post stating that most indicators on the Bitcoin chain are bearish. Without macro liquidity support, the crypto market will enter a bear market cycle.

Most Bitcoin on-chain indicators are bearish. Without macro liquidity, we enter a bear cycle. pic.twitter.com/6uy298q5Wo

— Ki Young Ju (@ki_young_ju) December 3, 2025

CryptoQuant’s own Bull Score Index has dropped to the sub-20 range.

CoinDesk also pointed out that the monthly MACD of Bitcoin has shorted, which has been the case in 2018 and 2022. Years have predicted long-term declines. Currently, more than 25% of Bitcoins are in floating losses, and any decline may trigger new selling pressure.

The market has shifted from the "four-year halving cycle" to the "65-month cycle" in sync with global liquidity, which means that if Bitcoin lacks loose support, the bull market script will be unsustainable.

In the short term, Bitcoin must hold $93,000, with the next line of defense for bulls and bears falling at $90,500. The December Fed meeting became a decisive moment. Glassnode indicates that the on-chain structure is similar to that of early 2022, but if liquidity expands smoothly in 2026 as shown by stablecoin supply growth, the current shock may be the last washout.

None of the above is investment advice. Crypto-asset investment is risky, so please make decisions with caution.