Sentora Research: Bitcoin is expected to challenge $150,000 in 2026! Three key catalysts are brewing

Research firm Sentora Research pointed out that with the expiration of the largest Bitcoin option in history, the reallocation of institutional funds through ETFs, and the possible cooling of geopolitical risks, a number of key factors are fermenting simultaneously, paving the way for a new wave of Bitcoin's rise in 2026.

(Preliminary summary: Michael Saylor calls for Bitcoin to reach one million or ten million dollars again: wait until the day when Strategy controls 5% or 7% of the total BTC supply)

(Background supplement: Arthur Hayes predicts that Bitcoin will bottom out in January: the Federal Reserve will use QE in disguise, and I have All-in 90% of the assets)

Contents of this article

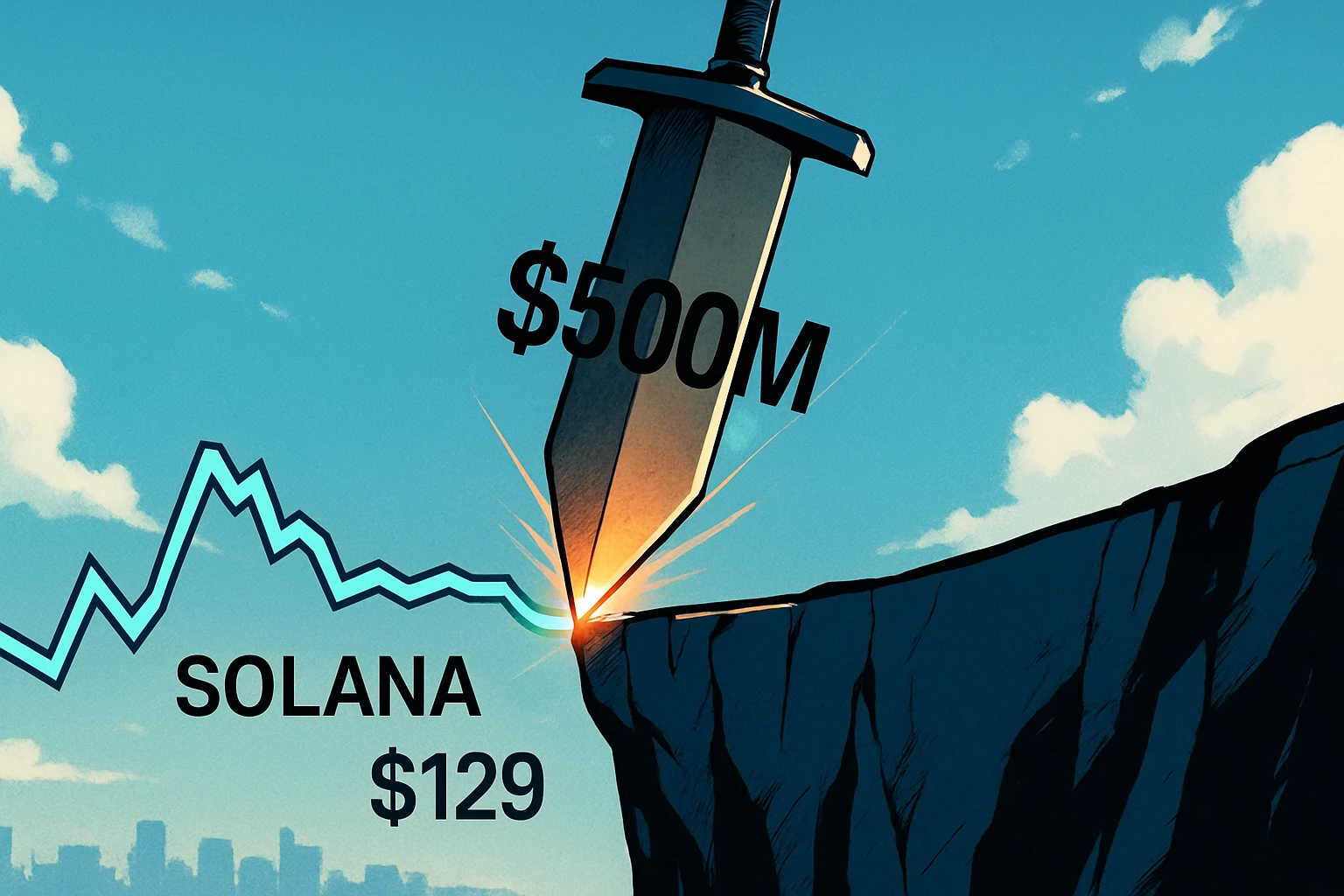

Research institution Sentora Research The latest market outlook recently released pointed out that although Bitcoin (BTC) will still be affected by short-term fluctuations at the end of 2025, with the price hovering below $90,000, a number of structural factors are brewing simultaneously, laying the foundation for Bitcoin to launch a "sustained rise" in 2026.

The agency believes that with the lifting of option pressure, the large-scale entry of institutional funds through ETFs, and the cooling of geopolitical risks, Bitcoin has the opportunity to exceed $150,000 in 2026.

The largest option in history expires, and the depressing factors are about to dissipate

Sentora Research pointed out that on December 26, 2025, Bitcoin will usher in the largest option expiration date in history, with a nominal value of approximately US$24 billion, mainly concentrated on derivatives platforms such as Deribit. Since a large number of open positions are concentrated at strike prices above US$100,000, the market is affected by the hedging operations of market makers before expiration, and price fluctuations are amplified, which has also become an important reason for the recent weak trend of Bitcoin.

However, Sentora Research emphasized that based on historical experience, the market will often usher in a "pressure release period" after large options expire. Potential buying of Bitcoin is expected to resurface as traders no longer need to continue selling spot for safety. The agency believes that this will create favorable conditions in the first quarter of 2026, and Bitcoin has a chance to regain the $100,000 level.

The January effect fermented, and institutional fund allocation became a key driving force

The report also pointed out that the emergence of spot Bitcoin ETFs has completely changed the way institutional investors participate in the crypto market. In 2025, the scale of capital inflows into U.S.-listed ETFs hit a record high, showing that Bitcoin has gradually been regarded as a part of mainstream asset allocation.

Sentora Research specifically calls out the "January asset reallocation effect": at the beginning of each year, retirement funds, endowments and large asset management institutions often reallocate investment portfolios based on annual investment mandates and risk budgets. The agency pointed out that if Bitcoin accounts for 1% to 5% of the investment model, it will bring considerable buying power.

Looking back at the beginning of 2025, Bitcoin attracted more than $900 million in capital inflows in a single day. Sentora Research believes that if Bitcoin outperforms the U.S. stock index after the option expires, institutional capital allocation may further accelerate, pushing the price to challenge the level of above $120,000 in mid-2026.

If the situation in Ukraine cools down, risk assets are expected to fully benefit

In addition to market structure and financial factors, Sentora Research also pointed out that geopolitics may become an important "tailwind" for Bitcoin. The report pointed out that the Russia-Ukraine conflict has long pushed up energy prices and global uncertainty, putting pressure on risk assets. However, recent negotiation signals released by all parties show that the possibility of breakthrough progress in early 2026 is increasing.

If the situation slows down, it will not only help reduce inflation and oil price pressure, but may also create more loose space for global monetary policy. Sentora Research believes that once the geopolitical risk premium is revised downwards, market funds will be more willing to flow to high-risk, high-growth assets, including cryptocurrencies, and Bitcoin prices may gain an additional 20% to 30% upside as a result.

Bull conditions will gradually be in place in 2026, but risks still need to be paid attention to

Overall, Sentora Research believes that the market reset after the expiration of options, the inflow of institutional funds in January, and the improvement of the macro environment will echo each other at the point of time, forming a "long combination punch" that is quite beneficial to Bitcoin.

However, it is worth noting that the agency also reminded that it is still necessary to pay attention to potential risks such as delays in geopolitical negotiations and tightening liquidity in financial markets. However, under the baseline scenario, the price of Bitcoin exceeding US$150,000 in 2026 is not an overly radical prediction. Sentora Research concluded that if the above conditions are successfully realized, Bitcoin is expected to usher in a wave of structural rather than short-term speculative rises.