Ben Zhou predicts that the distinction between “traditional finance and encryption” will disappear within five years: Bybit is creating a clear, efficient, and most trusted trading ecosystem

At the BIG conference held recently in Dubai, Bybit CEO Ben Zhou mentioned that 2026 will be a critical year, and reliability and compliance will bring huge value to customers.

(Preliminary summary: Bitwise Chief Investment Officer: Compliant ICO will be the core narrative in 2026, and it will be the "fourth pillar" for cryptocurrency to subvert traditional finance)

(Background supplement: Former BlackRock executive: Ethereum has become the infrastructure of Wall Street, and finance will no longer be divided into Defi and traditional finance in the future)

Contents of this article

The Bybit Institutional Gala was held recently (9) in Dubai, United Arab Emirates. At the conference, Bybit CEO Ben Zhou gave a speech on his observations of the industry. He mentioned that 2026 will be a critical year, because in the future the market will no longer distinguish between traditional and encryption, but a holistic single market, in which "reliability" is the most important.

Why is reliability important?

Ben Zhou mentioned that institutions are accelerating adoption, and Bybit has achieved amazing growth in the market trend. This means that the market is looking for operators with operational scale and regulatory certainty, and there is a huge demand for reliability. Providing these reliable and clear infrastructure is what Bybit is good at:

Customers need certainty - liquidity, compliance and reliable performance. Net product inflows jumped from US$1.3 billion in the third quarter to US$1.3 billion in the fourth quarter. US$2.88 billion; assets under management (AUM) also increased from US$40 million to US$200 million. Institutions need partners who can expand under discipline, transparency and governance

Advantages of leading compliance to customers

In order to achieve consistency and objective reliability of user needs, compliance has now become a trusted product for institutions, Bybit Legal and Compliance Officer Robert MacDonald In addition, compliance has become an absolute factor driving institutions to participate in crypto finance, bringing more predictable processes and regulatory frameworks, such as standard account opening standards for customers, compliance frameworks for products, and windows and enthusiasm for regulatory communication, which have gradually turned into advantages.

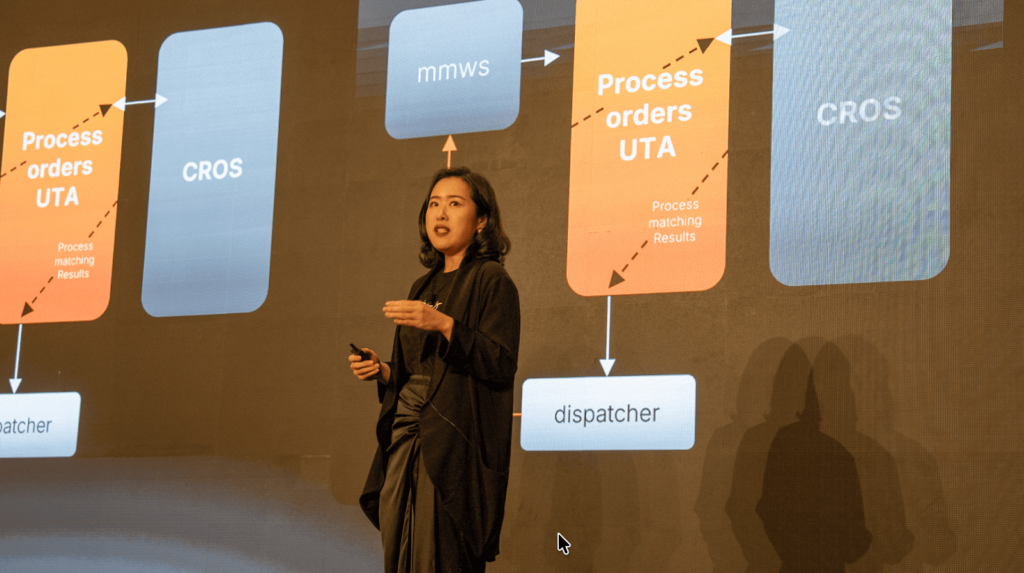

In this regard, Yoyee Wang, head of Bybit’s institutional business, also demonstrated Bybit’s institutional-level digital asset transaction table standard at the conference, which brought about the launch of two new upgrades. The first is the optimized INS Credit. Suite, and the newly built Market Maker Gateway (MMGW) low-latency execution architecture, which integrates custody, credit, trade execution, governance and operational resilience into a single collaborative platform, which can strengthen communication with bank customers and reduce transaction costs for professional investors. It also shows the market trend:

From the perspective of the entire market, what institutions care about most is capital efficiency, but they cannot sacrifice control of assets. We provide up to 5x leverage and LTV that is in line with traditional finance (TradFi). parameters and supports up to 1,000 sub-accounts to create a true institutional-grade credit structure.

Ben Zhou It was also added that Bybit is continuously strengthening its cooperation with major financial institutions in Europe and the Middle East to further provide professional market participants with a reliable trading venue.

UAE’s VAPO license provides exactly the framework that institutional investors have long expected - A set of systems that can still support innovative development under a strict regulatory system. For institutions, the most expensive thing is not the fee rate, but the uncertainty. This establishes our compliance-first strategy and sets an example for the maturity of global digital finance

The moment of integration of traditional finance and encryption

When both institutional users and encryption users can enter the popularization of encryption in an increasingly clear environment, Ben Zhou He also talked about the industry trends he sees happening within five years. He believes that the future of traditional finance and crypto assets will establish a common infrastructure, standards, integrated workflow and liquidity under compliance, allowing users to expand:

In the next five years, TradFi and Crypto will no longer be two worlds. We are moving towards a single global market supported by institutional-grade liquidity, custody and infrastructure - and Bybit We are building this future operating backbone, and we will continue to build the most trusted institutional trading ecosystem - based on transparency, efficient execution and clear regulatory standards.

Finally, Ben Zhou also mentioned that the UAE Virtual Asset Platform Operator (VAPO) license that Bybit has obtained will reshape Bybit. Global positioning, and setting new standards for governance, infrastructure resilience and institutional-level market access, which will also provide market leadership and competitiveness for a new era of compliance and reliability.