Bitcoin fell below $89,000 and rebounded back to $92,000. US stocks stopped falling and rebounded. Pay attention to the September non-farm payrolls report tonight.

Bitcoin started to rebound after falling below $90,000 again at midnight today, and is now back above $92,000. Tonight's reissue of the September non-farm payrolls report is likely to further exacerbate volatility.

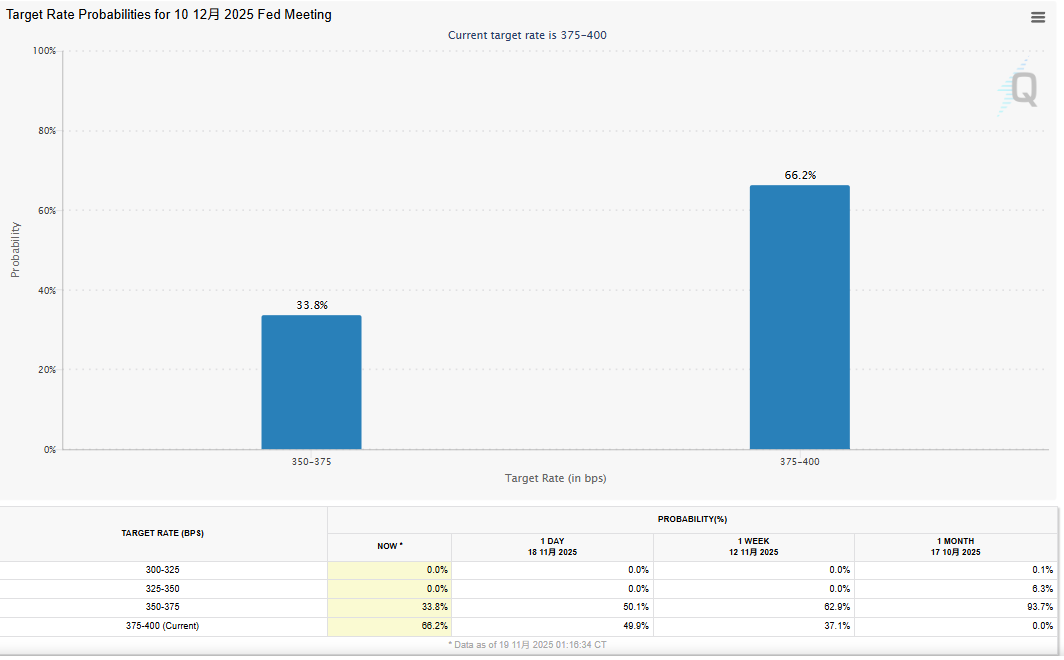

(Preliminary summary: The probability of an interest rate cut in December plummeted to 33%! Minutes of the Federal Reserve's October policy meeting: Internal differences are extremely serious, the good news is to stop shrinking the balance sheet)

(Background supplement: Abu Dhabi sovereign fund increased its investment in Bitcoin! Q3 increased its holdings of 5.5 million shares of IBIT, with a total investment of nearly US$1 billion )

Bitcoin fell below its previous low again after 0:00 today (20th), reaching the lowest level of US$88,600, and Ethereum fell by US$2,870. However, it continued to rebound thereafter, with BTC back above $92,000 and Ethereum back above $3,000 before the deadline.

Tonight the U.S. Bureau of Labor Statistics (BLS) will reissue the September non-farm payrolls report. If the data changes drastically, please be careful of potential fluctuations. On the other hand, the BLS earlier stated that it would not release the non-farm payrolls report for October and would include it with the data released in December.

U.S. stocks stopped falling and rebounded on Wednesday

In terms of U.S. stocks, last night, although the minutes of the latest meeting of the Federal Reserve showed that most members tended to "not move this year," and hopes of an interest rate cut in December were greatly reduced, the four major indexes stopped falling and rebounded after falling for many days.

- The Dow Jones Industrial Average rose 47.03 points, or 0.1%, to close at 46,138.77 points.

- The Nasdaq rose 131.383 points, or 0.59%, to close at 22,564.229 points.

- The S&P 500 index rose 24.84 points, or 0.38%, to close at 6,642.16 points.

- The Philadelphia Semiconductor Index rose 119.00 points, or 1.82%, to close at 6,670.03 points.

According to the CME Group’s FedWatch tool, market forecasts for a rate cut in December have fallen to about 33%.

Matt Hougan: 9 Below US$10,000 is the “generational level” buying point

Although in the short term, there are still great variables in the cryptocurrency market, Bitwise’s chief investment officer recently described US$90,000 as a “once-in-a-lifetime long-term opportunity” in an exclusive interview with NewsBTC. He pointed out that in the past two weeks, retail investor sentiment indicators have fallen to two-year lows, which is "a typical reverse signal."

Hougan believes that compared with the strong gold trend in 2025, Bitcoin still has room to make up for its gains. At the same time, he added that the current lack of a crazy rebound in the market is "instead healthy" and can reduce the risk of a deep correction in early 2026. Therefore, institutional funds take advantage of the panic of retail investors to find bargain hunting positions, "which can not only lock in long-term returns, but also prepare for next year's potential bull market in advance."