Standard Chartered Bank slashes Bitcoin predictions! The target will be halved to US$100,000 by the end of 2025, and it will take another five years for BTC to reach US$500,000.

Standard Chartered Bank has halved the target price of Bitcoin by the end of 2025 from US$200,000 to US$100,000. The reason is that the "dual engines" that have pushed up the market in the past two years have ceased: corporate treasury buying has cooled down and ETF capital flows have disappeared.

(Preliminary summary: Standard Chartered Bank: The RWA market will reach US$2 trillion in 2028, and most of the value will be concentrated in Ethereum)

(Background supplement: Standard Chartered: Bitcoin may "never" return to below $100,000, four major forces support BTC)

Contents of this article

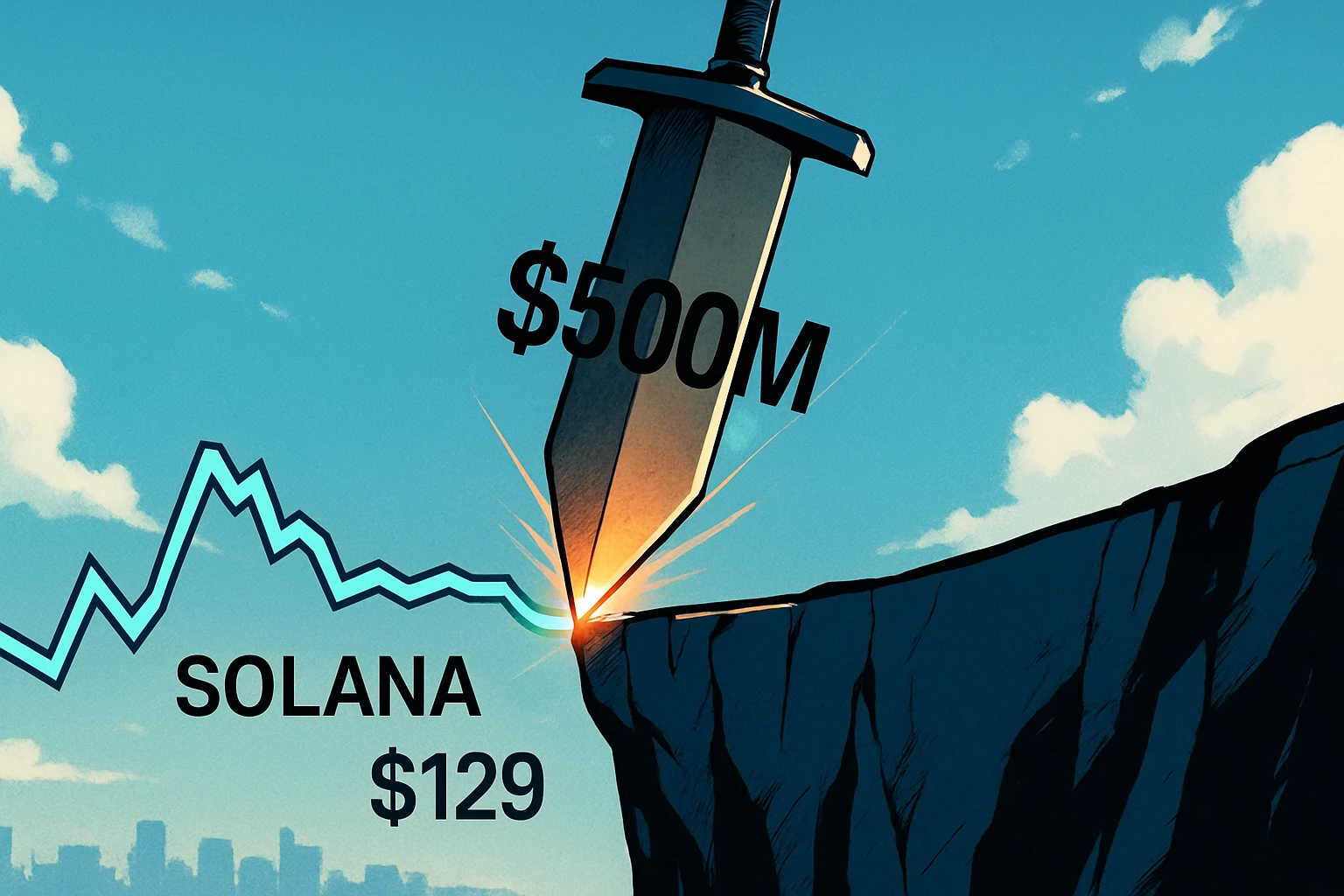

Since Bitcoin will be in 2025 Performance significantly deteriorated in the fourth quarter of the year and the upward trend stalled. Standard Chartered significantly lowered its multi-year price forecast for Bitcoin. According to the latest report released by Standard Chartered Bank today (9th), the bank has significantly lowered its price target for Bitcoin at the end of 2025 from the original US$200,000 to US$100,000. At the same time, although Standard Chartered is still optimistic that Bitcoin can eventually reach US$500,000 in the long term, it predicts that the time for Bitcoin to achieve this goal has been postponed from 2028 to 2030.

Reason 1: The DAT craze is officially over

Geoffrey Kendrick, global head of digital asset research at Standard Chartered Bank, bluntly stated that the aggressive buying in the past by companies such as MicroStrategy (formerly MicroStrategy, now Strategy) to include Bitcoin on their balance sheets "has come to an end." These so-called "digital asset corporate treasuries" (DATs) were once one of the main forces pushing up currency prices, but now they have suspended further increases due to excessive valuations, causing the market to lose its strongest buying support.

Reason two: U.S. spot Bitcoin ETF inflows hit a record low

Another "leg" that originally had high hopes - institutions' indirect purchases of Bitcoin through ETFs has also shown a sharp slowdown. The current net inflow of ETFs in the fourth quarter of 2025 is only 50,000 BTC, which is not only far lower than expected, but also the lowest record since the launch of the US spot Bitcoin ETF.

In comparison, at the peak period at the end of 2024, the total quarterly inflow (ETF + corporate treasury) was as high as 450,000 BTC, and the intensity of inflow can be said to have dropped off a cliff.

Reason 3: Uncertainty about Federal Reserve policy suppresses risky assets

The report also pointed out that the U.S. Federal Reserve is facing political pressure and the direction of monetary policy is unclear, which will also affect the performance of risky assets such as Bitcoin. Although the market generally expects that this week's FOMC meeting will continue to cut interest rates by 1%, investors are more concerned about the Fed Chairman's guidance on the interest rate path in 2026, which will directly determine whether funds will continue to flow into high-risk assets.

It is worth noting that Kendrick emphasized in the report that "this time is really different" and clearly rejected the old valuation model that "the halving cycle must rise sharply" in the past.

For investors, this report from Standard Chartered Bank is undoubtedly a basin of cold water, but at the same time, it also retains the imagination of Bitcoin’s long-term five-fold increase.