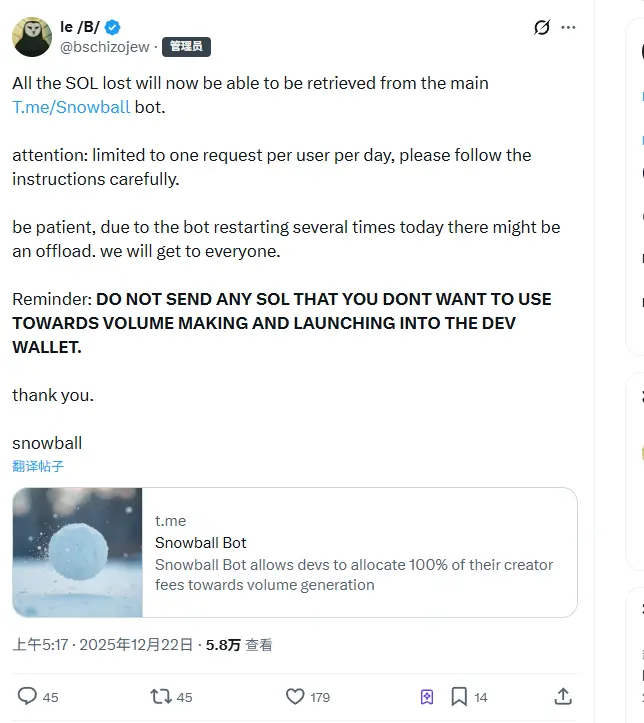

Soared 20 times in 2 days! pump.fun How big can Snowball’s “automatic market making” snowball roll?

Through the unique "automatic repurchase + liquid market making" mechanism, the $BALL token achieved an astonishing 20-fold increase in two days on pump.fun. The team even publicly promised to use 100% of the transaction fees for repurchase, creating a "positive value cycle" model that is rare in the Meme currency field.

(Preliminary summary: What is the meme currency issuance platform Pump.fun? Super simple currency issuance process, fairness & full interpretation of risks)

(Background supplement: DeFi science | The rise of decentralized finance, what is an "automatic market maker AMM"?)

Contents of this article

Recently, a topical project Snowball ($BALL) appeared on pump.fun. In just two days, $BALL surged nearly 20 times from its issue price, and its market value once approached $25 million. What is this concept? Against the backdrop of the current overall weakness in the meme currency market, this performance can be called a “long-lost golden dog.”

But compared to the increase itself, what deserves more attention is the mechanism design behind Snowball - a token economic model that combines "automatic repurchase" and "liquidity market making". Can this model truly realize the "snowball effect" and allow value to continue to accumulate?

$BALL Price Trend Chart | Image Source: Shenchao TechFlow

The core mechanism of Snowball: automatic repurchase + liquidity market making

Snowball The token economic model can be summarized in one sentence: 100% of transaction fees are used to buy back tokens and deposited into the liquidity pool for market making.

Specifically, this mechanism is divided into three levels:

- Transaction fee collection: A fee of about 1% is charged for each transaction

- Automatic repurchase: All fees collected are used to repurchase $BALL in the market

- Liquidity market making: The repurchased tokens will not be destroyed, but will be deposited into the liquidity pool to continue to provide depth to the market

Schematic diagram of Snowball automatic market making mechanism | Image source: Shenchao TechFlow

The team explained the reason why they chose "market making" rather than "destruction":

"If the repurchased tokens are directly destroyed, it will only reduce the supply once. But if they are deposited into the liquidity pool for market making, these tokens will continue to generate transaction fees. , forming a positive cycle - the more active the transactions, the more repurchases; the more repurchases, the deeper the liquidity; the deeper the liquidity, the better the trading experience, attracting more transactions. "

Differences from the traditional repurchase model

The traditional token repurchase model usually adopts "repurchase. →Destruction" route creates scarcity by reducing circulation. The advantage of this approach is that it is intuitive and easy to understand, but the disadvantage is also obvious: the destruction is one-time and cannot continuously generate value.

Comparison between Snowball and traditional models | Image source: Shenchao TechFlow

The innovation of Snowball is to combine repurchases with liquidity market making. There are several potential advantages to this approach:

The first is the compound interest effect. The repurchased tokens become liquidity providers (LP) and continue to earn transaction fees. These newly generated fees will be used for repurchases again, forming a compound interest effect similar to a "snowball".

The second is price support. As the liquidity pool becomes deeper and deeper, the impact of large transactions on the price will be reduced, which will help reduce violent price fluctuations and provide holders with a more stable holding experience.

Finally, sustainability. Unlike one-time destruction, the market-making model allows the repurchased tokens to continue to "work" and continuously contribute value to the ecosystem.

Team background information | Image source: Deep Tide TechFlow

Risks and challenges: Snowball may also be an "avalanche"

Of course, any innovative mechanism is accompanied by risks. The core assumption of the Snowball model is that "trading volume continues to be active." Once market enthusiasm subsides and trading volume shrinks, the entire positive cycle will stagnate or even reverse.

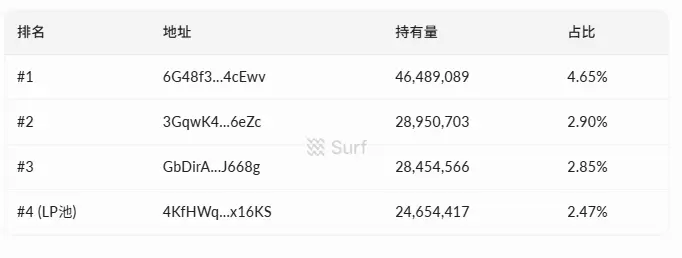

$BALL Contract Address and Market Data | Image Source: Deep Tide TechFlow

In addition, the meme currency market itself is extremely dependent on narrative and emotion. No matter how sophisticated the mechanism design is, if it cannot continue to attract new users and maintain community popularity, it may eventually become a "flash in the pan". But for now, Snowball at least proves one thing: On pump.fun, a platform that is considered "involved to death", innovative token mechanism design can still find a way out.

This may also provide a new idea to other project parties: instead of burning money on marketing and getting involved, it is better to work hard on mechanism design. After all, in this era of information explosion, the best marketing is innovation that can really make people’s eyes shine.