Bitcoin fell by 87,000, technology stocks helped the S&P 500 hit a new high, and the chance of not cutting interest rates in January next year exceeded 80%

The S&P 500 hit a new all-time high on Christmas Eve, with AI weight and strong GDP becoming key drivers; the Fed’s independence and M&A trends became the focus of follow-up observation.

(Preliminary summary: Fidelity analysts: Bitcoin will be a "fallow year" in 2026, with a support range of $65,000 to $75,000)

(Background supplement: Market share dropped from 80% to 20%, what happened to Hyperliquid? )

Bitcoin fell after the opening of US stocks last night (23), hitting a low of 86,578 The U.S. dollar once again extinguished the bullish offensive. It was currently trading at $87,658 at the time of writing, once again returning to the previous shock range. With the Christmas holiday approaching, BTC may stay in this range for a while longer.

The four major U.S. stock indexes closed up

However, U.S. stocks are still strong, and the S&P 500 The index closed at 6,909.79 points, setting a new high, driven by AI leader Huida and unexpectedly strong, delayed third-quarter GDP data.

The U.S. Department of Commerce’s revised GDP for the third quarter was 4.3%, a full percentage point higher than market expectations, with personal consumption expenditures growing by 3.5% being the biggest bright spot. The interest rate path originally focused on the interest rate cut cycle in 2026.

The four major indexes closed in the red at the same time: the Dow Jones Industrial Average rose 67 points to close at 43,150 points; the S&P 500 rose 0.46%; the Nasdaq rose 0.57% to close at 18,850 points; and the Federal Reserve rose 0.55% to close at 5,210 points.

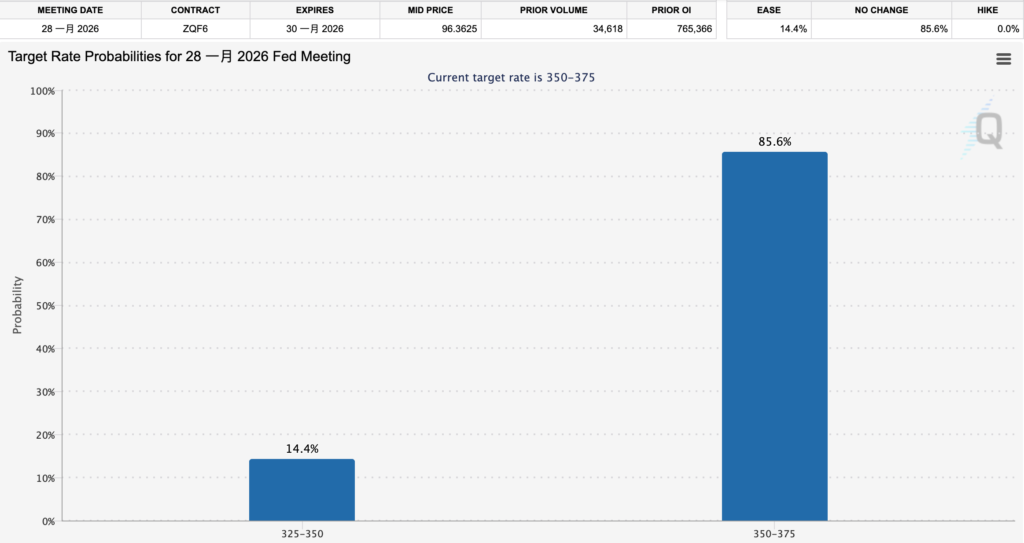

Market consensus: No action in January

According to CME FedWatch data, the probability that the Federal Reserve will maintain the current range of 3.5% to 3.75% has climbed to 85.6%, and only 14.4% are expected to cut interest rates by 1 point (25 basis points). The shift echoes a modest rebound following November's CPI data, which showed inflation has yet to fall below the Fed's target range.

Chairman Ball earlier emphasized:

The current interest rate is already in a good position, and the next step will be adjusted depending on the data.

Vice Chairman Hammaker also said recently that he is more worried about the stickiness of inflation and it is more appropriate to "maintain interest rates until at least the spring."