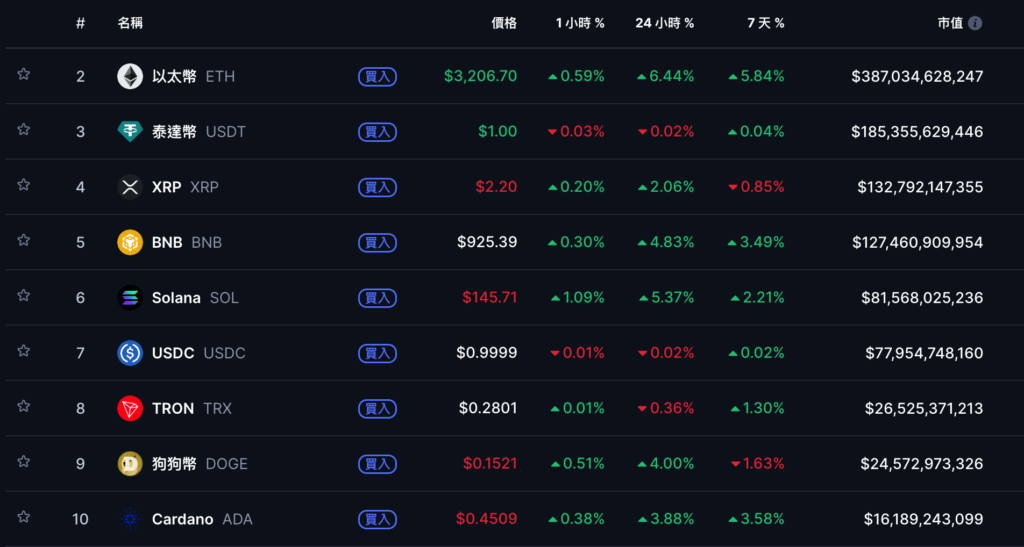

Bitcoin climbed US$94,000, Ethereum exceeded US$3,200, and cryptocurrency ETFs saw a net inflow of US$1.1 billion last week. Institutions returned to the team

Bitcoin’s rally has not stopped, briefly breaking through $94,000 this morning, and Ethereum simultaneously breaking through the $3,200 mark. Cryptocurrency ETFs ended four weeks of outflows with an influx of $1.1 billion last week, with U.S. funds leading the return.

(Preliminary briefing: Bank of America has approved wealth advisors to "actively recommend" clients to buy Bitcoin! The investment ratio is 1%-4%, and it will officially start in January next year)

(Background supplement: Can Bitcoin be saved? Vanguard will open investment in encrypted ETFs, and 50 million users will have trillions of dollars of funds pouring in)

Bitcoin has continued to fluctuate within a narrow range at the level of $93,000 in the past 24 hours, and broke through earlier. $94,162. At the time of writing, it was temporarily trading at $93,279, up 2.01% in the past 24 hours.

Ethereum’s gains are even stronger, possibly due to the Fusaka upgrade. As of this writing, it has exceeded $3,200, up 6.37% in the past 24 hours.

According to statistics released by KobeissiLetter last night, global cryptocurrency funds had a net inflow of US$1.1 billion last week (covering the end of November to early December), a seven-week high, ending the previous four consecutive weeks of cumulative 47 A billion-dollar outflow.

In terms of regions, U.S. funds absorbed US$994 million, accounting for more than 90% of the total inflow. Canada and Switzerland received US$98 million and US$24 million respectively; Germany bucked the trend and saw an outflow of US$57 million. In terms of underlying allocation, Bitcoin (BTC) saw a net inflow of US$461 million, and Ethereum (ETH) followed suit, absorbing US$308 million. Meanwhile, bearish positions are on the way out: short Bitcoin ETPs withdrew $1.9 billion last week.

Crypto ETFs are making a comeback:

Crypto funds recorded +$1.1 billion in inflows last week, the largest in 7 weeks.

This marks a reversal from 4 consecutive weekly withdrawals totaling -$4.7 billion.

The US led withdrawals with +$994 million in inflows, followed by Canada with +$98… pic.twitter.com/cnh9HVc9nZ

— The Kobeissi Letter (@KobeissiLetter) December 3, 2025

U.S. stocks closed higher

U.S. stocks closed higher on Wednesday. The ADP report showed that private employment fell by 32,000 in November, which was very different from the small increase originally expected. It once again highlighted the cooling of the labor market and made investors more certain that the Federal Reserve meeting this month will start a cycle of interest rate cuts.

CME FedWatch shows that the probability of a 1-point rate cut on December 9-10 is close to 90%. Market focus next falls on the PCE price index and personal income and expenditure data released on Friday, as the final key indicators to judge the direction of inflation and the pace of policy.

- The Dow Jones gained 408.44 points, or 0.86%, to close at 47,882.9.

- The Nasdaq rose 40.417 points, or 0.17%, to close at 23,454.092 points.

- The S&P 500 index rose 20.35 points, or 0.3%, to close at 6,849.72 points.

- The Philadelphia Semiconductor Index rose 131.04 points, or 1.83%%, to close at 7,280.51 points.

The entire network has liquidated positions of US$404 million

In addition, according to Coinglass data, amid the market fluctuations in the past 24 hours, a total of 112,248 people liquidated their positions across the network, and the liquidation amount reached US$404 million.