Trump opens up the export of Huida H200 to China! However, a 25% commission is required, and the U.S.-China chip war enters a new paid unlock mode.

Trump approved Huida’s export of H200 to China, but it must pay a 25% commission to balance national security and financial interests, triggering market and legal concerns.

(Previous summary: Bloomberg: Trump plans to open up the sale of NVIDIA H200 chips to China, the latest result of the US-China "technology exchange for minerals"? )

(Background supplement: The United States signed a contract to supply Australian rare earths to "fight China", Trump laughed: there are too many key minerals to use up)

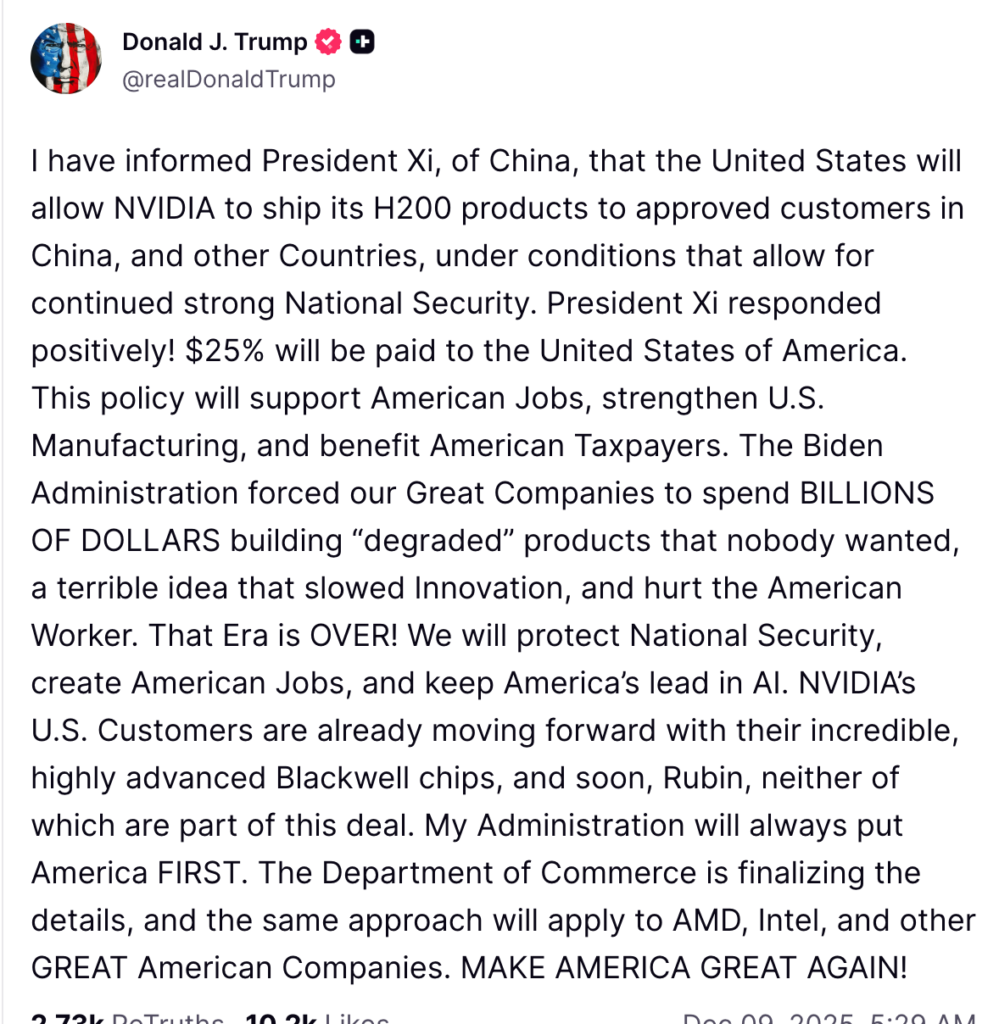

US President Trump announced on social media this morning (9) that NVIDIA will be allowed to sell H200 to China. Artificial intelligence chips, but each transaction must first pay 25% of sales to the U.S. government. This decision immediately rewrote the chessboard of the U.S.-China technology war, and also showed that Trump bundled national security and treasury revenue into the same quotation.

I have informed President Xi of China that the United States will allow NVIDIA to export H200 products to "approved customers" in China and other countries, but will do so while maintaining strong national security. President Xi responded positively to this!

25% of proceeds will be paid to the United States of America. This policy will support American jobs, strengthen American manufacturing, and benefit American taxpayers.

The Biden administration has forced our great companies to spend billions of dollars to build "reduced" products that no one wants. This is a bad idea, slowing down innovation and hurting American workers. That era is over! We will create American jobs and maintain America’s leadership in AI while protecting national security.

NVIDIA's customers in the US are already adopting their stunning, highly advanced Blackwell chips, followed by Rubin, both of which are not part of this agreement. My administration will always put America first. The Commerce Department is finalizing the details, and the same approach will apply to AMD, Intel, and other great American companies.

Make America Great Again!

The new export model of "paid unlock"

According to reports, 25% The commission was higher than the 15% originally anticipated by the market. The same mechanism is likely to be applied to chip manufacturers such as Intel and AMD in the future, requiring them to "pay a deposit" whenever they sell to China.

Although this approach breaks through tradition, it also steps on a red line. Analysis points out that current U.S. regulations in principle prohibit the government from charging export licenses, and this "tax collection" design is bound to be challenged in Congress and the courts.

Actuarial calculations under the technological generation gap

Why choose H200? Because it belongs to the previous generation Hopper architecture, which is about 18 months technology generation apart from Huida's latest Blackwell series, the U.S. Department of Commerce determined that the risk is controllable. Advanced Blackwell chips are still locked on the embargo list, ensuring that the United States maintains its technological leadership.

For Huida, this is long-lost business vitality. It is expected to recoup the billions of dollars in revenue lost due to the ban over the past two years. However, the biggest question mark remains whether Chinese buyers are willing to pay a 25% premium for used chips.

If the price is too high, the Chinese market may turn to local solutions such as Huawei, or force Chinese companies to diversify procurement and reduce their reliance on the US supply chain. On the other hand, if the U.S. government is forced to lower or cancel the commission due to legal challenges, Trump’s tax-based national security strategy will also lose its leverage.

In general, the lifting of the ban on H200 represents a shift in the U.S.-China technological rivalry from “all blockades” to “negotiable payment.” Investors go on to lock in 25% of the cost and who ultimately absorbs it? And whether China accelerates its own research and development to replace it will determine whether this business is a win-win situation or whether no one can win.