Billionaire Kevin O’Leary shouts that “the next step in the AI wave is web3”: LLM cannot create Starbucks, but blockchain can

Kevin O’Leary pointed out that AI and blockchain will reshape retail, but on-chain scalability is still the biggest problem, and the market is looking for a breakthrough with DAG and Agentic protocols

(Previous summary: Rich dad said that "Ethereum and silver" are the best assets at the moment: the global economy will collapse this year, and paper assets will become garbage)

(Background supplement: Buffett, who has always been negative about gold, is also quietly buying? Rich dad: It means that the market crash is not far away. )

Contents of this article

Venture capitalist and well-known billionaire Kevin O’Leary made a prediction at a public event on the 19th: In the future, consumers will just say a word, and AI agents will be able to complete store selection and ordering, and the blockchain will synchronize settlement, and the whole process will take less than two minutes without picking up a mobile phone. This speech immediately sparked discussion on the X platform because it connected the two technological waves of AI and blockchain to the most sensitive pain points in the retail industry—speed, cost, and experience.

AI automatically places orders, and blockchain makes senseless payments

The scene described by O’Leary is very visual:

“I want a fat-free latte, and it will arrive in 90 seconds.”

Through the so-called “Agentic AI” AI)", the system first reads the user's location and preferences, then compares nearby channel inventory, queue time and delivery routes, and finally sends the instructions to the blockchain payment layer to complete the deduction. For retailers, the benefits are more detailed demand forecasting and instant collection; for consumers, it is automation from price comparison, ordering to payment.

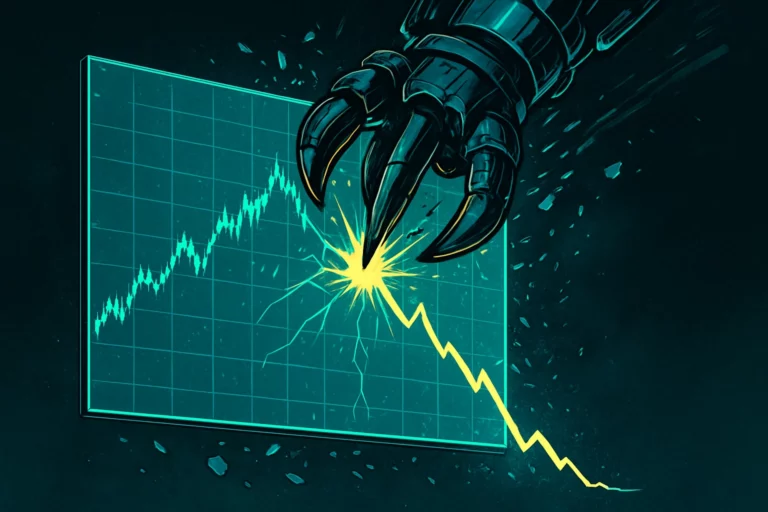

The test of huge traffic on blockchain

Behind the enthusiastic vision, the biggest shadow comes from the scalability of blockchain. O’Leary likened the current mainstream chain to a “highway toll station”: when there are more vehicles, there will be traffic jams. Take the handling fees and processing speed of Ethereum as an example. During peak periods, each fee may be much higher than the price of ordinary coffee, which is simply unable to support Wal-Mart-level daily transaction volume. Retail payments must achieve millisecond-level confirmation, near-zero fees, and all-weather stability at the same time. The current on-chain structure is still far from this threshold.

DAG and ACP: potential paths to disruption

The market has not stopped complaining. At a low level, developers are turning to directed acyclic graphs (DAGs). DAG adopts a "spider web" layout. Multiple transactions at the same time can be mutually verified without queuing to wait for packaging. The theoretical TPS is tens of thousands. Some new companies such as BlockDAG, Hedera and Nano have commercialized this structure with the intention of entering the small high-frequency market.

At the application level, agent-based AI is waiting for standardization. Stripe and OpenAI teamed up to propose the Agentic Commerce Protocol (ACP); Google's AP2 is also moving in the same direction. These protocols attempt to define how AI agents can securely access wallets, verify identities, and process refunds, allowing large retailers and payment providers to connect.

Risks, Opportunities and Timelines

Research institutions predict that the market size of blockchain in retail will reach US$6.01 billion by 2030, and more than half of generative AI companies will deploy autonomous agents in 2027. This means that if the infrastructure can break through in the next two to three years, early participants can directly reap double dividends. Risks also exist: identity verification, user fund control, and national supervision are still being explored. Even if the technology matures, large retailers will still need time to transform their checkout systems and back-end ERP.

For investors, the threshold is both a resistance and a moat. DAG projects, wallet service providers and payment API providers are all on the same starting line, competing for the key nodes of "on-chain second-level settlement" and "AI agent scheduling". Once the iteration speed is verified, consumers only need a password, and the entire retail process from decision-making to payment can be handed over to the algorithm, just like O’Leary’s blueprint.

O’Leary talks about the future in a calm manner, but for “90-second ordering” to be truly implemented, engineers still have to face the cold gray area of blockchain throughput and regulations. Even so, the parallel processing of the DAG architecture and the standardization of ACP-like protocols have opened up a feasible path for this revolution. When the benefits of AI agents are gradually aligned with efficient settlement on the chain, a new critical point in the retail industry will emerge—at that moment, ordering a cup of coffee may be faster than opening your wallet.