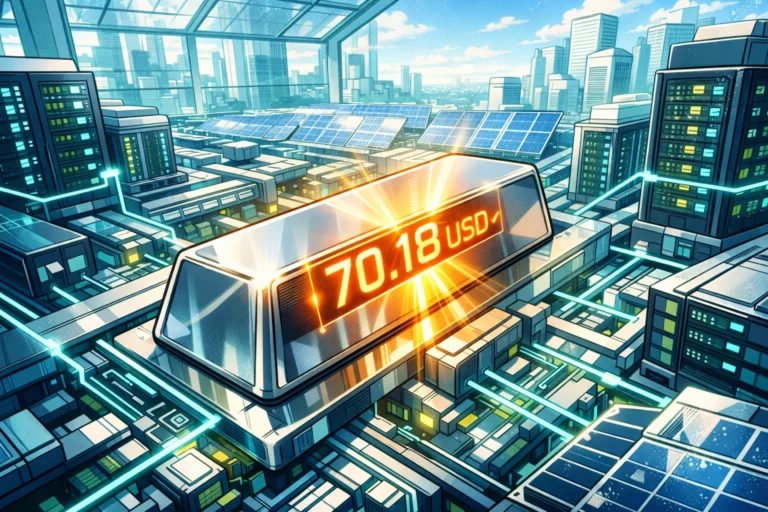

Silver hits $67 to extend record high! Market value surpasses that of Google parent company Alphabet, ranking fourth in the world by assets

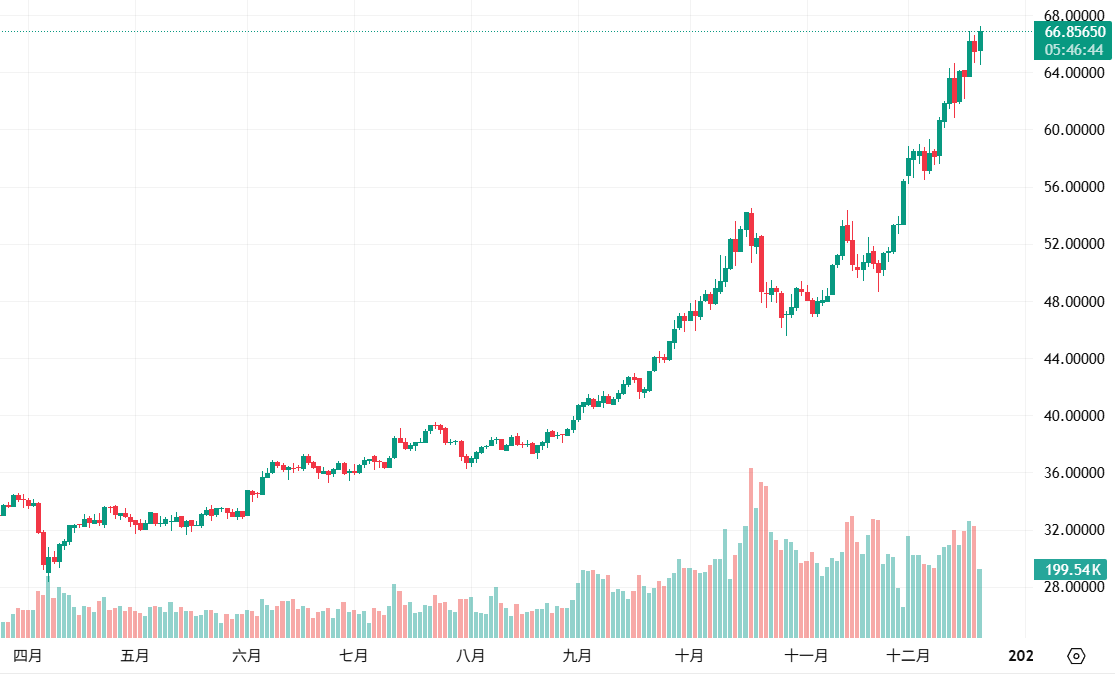

The international precious metals market once again experienced strong gains today, with spot silver prices successfully breaking through the $67/ounce mark, setting a new historical record. According to the latest quotation, spot silver rose 2.38% during the day, hitting a maximum of more than $67.

(Preliminary briefing: Silver has reached a record high of $63! This year it has risen more than 100%, far surpassing gold and Bitcoin. Will it challenge the $100 mark next year?)

(Background supplement: Silver has exceeded $60 and hit a record high! This year it has increased by more than 100% and ranks as the sixth largest asset in the world)

The international precious metal market has experienced strong gains today, and spot silver prices have successfully exceeded The $67/oz level broke the historical record. According to the latest quotation, spot silver rose 2.38% during the day, hitting a maximum of more than $67. At the same time, silver futures on the New York Mercantile Exchange (COMEX) performed even more brilliantly, with an intraday increase of 3.00%, and the latest price was $67.18 per ounce.

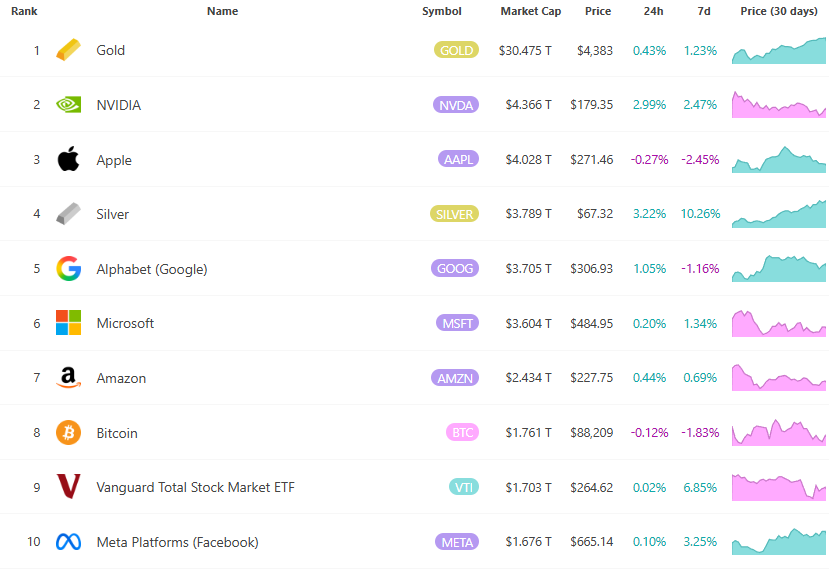

Driven by the rise in silver, the market value of silver has also reached US$3.789 trillion, surpassing Google's parent company Alphabet has become the fourth largest asset in the world after gold, Huida and Apple. During the recent retracement, Bitcoin's ranking among global assets has dropped to eighth place.

This wave of gains continues silver's recent strong trend, mainly driven by increased investor demand for safe havens, expansion of industrial applications, and market expectations for loose monetary policy. Analysts point out that silver, as a precious metal with both safe-haven and industrial properties, is particularly prone to attracting large capital inflows in the current economic environment.

However, the dynamic zone reminds that although the price of silver continues to rise, the potential volatility cannot be ignored, and investors should pay attention to the risks.