Another Bitcoin mining company announced its transformation into an AI computing center. Bitfarms CEO: Make more money than mining BTC

Bitfarms, one of the largest Bitcoin mining farms in North America, announced that it will exit Bitcoin mining within two years and invest in AI high-performance computing services.

(Preliminary summary: Marathon takes the lead in selling coins, is the selling wave of mining companies coming?)

(Background supplement: What is the probability of independent miners successfully producing blocks in Lone Warrior? Full decryption of Bitcoin mining)

Contents of this article

The price of Bitcoin is volatile and the difficulty of mining is rising, making it more difficult to obtain profits from "digital gold". Bitfarms, a large North American miner, announced on the 13th that it will end Bitcoin mining within the next two years and fully invest in high-performance computing (HPC) and artificial intelligence infrastructure services.

Another mining company announced its transformation, revealing that crypto mining continues to shift to AI computing power supply. Mines are no longer just machine rooms for mining tokens, but a new "computing power arsenal" for the digital economy.

Mining profits are compressed, AI brings 25 times revenue potential

The direct reason for Bitfarms’ transformation is the reduction in the opportunity cost of Bitcoin mining revenue.

The company lost $46 million in the third quarter of 2025, and internally estimated the cost of mining a single Bitcoin Cash at $82,400. In contrast, the generative AI craze is driving up demand for GPU computing power, with industry reports pointing out that the revenue potential per megawatt (MW) of AI data centers can be several times higher than that of mining, and AI hosting contracts can be worth up to $6 million per MW.

Bitfarms is not the first mining company to do this. Cipher, Terawulf and other peers are also cooperating with technology giants such as SoftBank and Google to deploy AI. About 70% of large miners have launched diversified revenue plans.

The 18 MW mine in Washington State has been transformed into a liquid-cooled GPU center

It is understood that Bitfarms’ first wave of transformation will target the 18 MW mine in Washington State. It is expected to be completed by December 2026 and has secured US$128 million in funding. The core of the hardware is the introduction of Nvidia GB300 GPU. The company will adopt a liquid cooling system with a rack power density of up to 190 kW and control the PUE (power usage efficiency) at 1.2 to 1.3.

Faced with the future business model shifting from computing power consumers to computing power providers, we provide GPUaaS and hosting. CEO Ben Gagnon emphasized:

While the Washington mine site represents less than 1% of our total developable mine site, we believe that simply transitioning it to GPU-as-a-service has the potential to generate higher net operating income than our historical Bitcoin mining operations, providing the company with a strong cash flow base to fund operations and contribute to capital expenditures as we phase out our Bitcoin mining operations over the course of the year.

The company estimates that the overall investment is less than 1% of the total development portfolio, but it can release huge production capacity, showing that the natural energy and computer room advantages of the mine are sufficient to support AI upgrades.

High capital expenditures to compete with cloud giants are still risks

However, transformation is not easy. Costs of $8 million to $11 million per MW mean Bitfarms must manage capital well to avoid project delays or performance that doesn't meet expectations. In addition, the company will compete head-on with cloud service providers such as Amazon AWS, Microsoft Azure and CoreWeave.

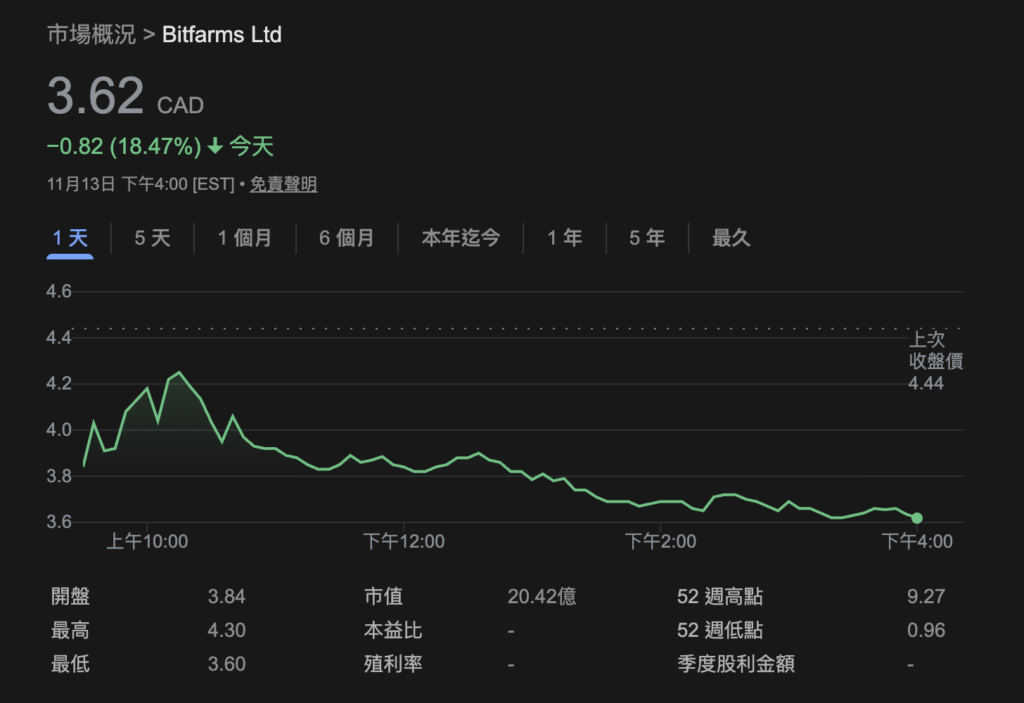

After the news was announced and the price of Bitcoin fell, Bitfarms’ stock price fell by 18.47% last night, reflecting market concerns about execution risks.

In conclusion, Bitfarms has taken advantage of its existing power and site advantages to shift from Bitcoin mining to AI data centers. Although capital pressure, technology integration and market competition cannot be underestimated, if it can be implemented according to the schedule, stable GPU contract revenue will bring more predictable cash flow to the company, opening up greater imagination space for the overall mining industry to move towards AI infrastructure.