Upset! U.S. small non-farm employment "dropped by 32,000" in September, the largest drop in two and a half years, and the chance of the Federal Reserve cutting interest rates in October rose to 99%

ADP employment in the United States plummeted and the government shut down simultaneously. The market is betting that the probability of the Federal Reserve cutting interest rates by another 1% in October has reached 99%.

(Preliminary summary: The White House announced the official shutdown of the U.S. government, and Trump officials praised: Take the opportunity to fire all redundant employees)

(Background supplement: Is Bitcoin still in a bull market or entering a bear market? Let’s see what analysts think)

Contents of this article

The United States released ADP private sector employment data last night, known as small non-agriculture, showing that private sector employment decreased by 32,000 in September, which was in line with the expected increase of 5 The gap of 10,000 people is huge, setting the largest monthly decline since March 2023 and the third decline in four months.

According to Investing News, cyclical industries bear the brunt, with leisure and entertainment losing 19,000 jobs, and professional technology and other services each losing more than 10,000. It is worth noting that small and medium-sized enterprises laid off about 60,000 employees in total, while large enterprises with more than 500 employees added 33,000 positions, indicating that pressure is concentrated in smaller areas that are more sensitive to business cycles.

The salary aspect also revealed signs of cooling: the annual salary increase of retained employees remained at 4.5%, but the salary increase of employees who changed jobs slowed from 7.1% to 6.6%. When the market experiences the three low phenomena of "low recruitment, low layoffs, and low labor force".

Government shutdown background and index performance

But despite this, U.S. stocks closed higher on Wednesday (October 2):

- The Dow Jones Industrial Average edged up 43.21 points to close at 46,441.10 points

- The S&P 500 rose 22.74 points to 6,711.20 Points

- Nasdaq rose 95.15 points to 22,755.16 points

- With half effort, it rose 2.05% to 6,500.28 points

Nasdaq reported that the stock market rose this time precisely because the "interest rate cut story" regained its convincing power. The fall in wage growth has also cooled inflationary pressures simultaneously, providing more buffer for monetary policy.

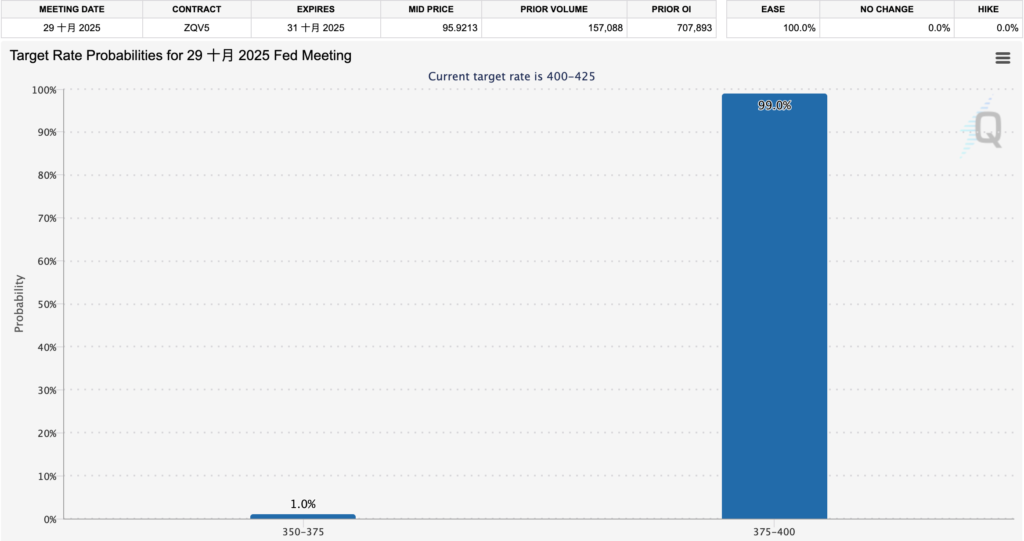

Interest rate cut expectations rose to 99%

Weak data and the government shutdown resonated, making interest rate cut expectations rise overnight. FedWatch data shows that the chance of another 1-size drop in October has reached 99%.

Government shutdown amplifies ADP weight

According to ABC News It is reported that the Bureau of Labor Statistics will suspend services, and the non-farm employment data scheduled to be released on Friday may be difficult to produce, and ADP may become the only public employment reading this week.

Although the impact of government shutdowns on financial markets is often short-lived, Peter Corey of Pave Finance warned that investors may underestimate the risk of economic weakening and extended shutdowns.

If the shutdown lasts longer than market expectations, it may drag down GDP growth by 0.1% per week. 0.15 percentage points, which is further combined with the weak employment data. Although Fitch reiterated that the "AA+" sovereign rating of the United States is safe, the impact of the information window on market sentiment may still amplify defensive operations.