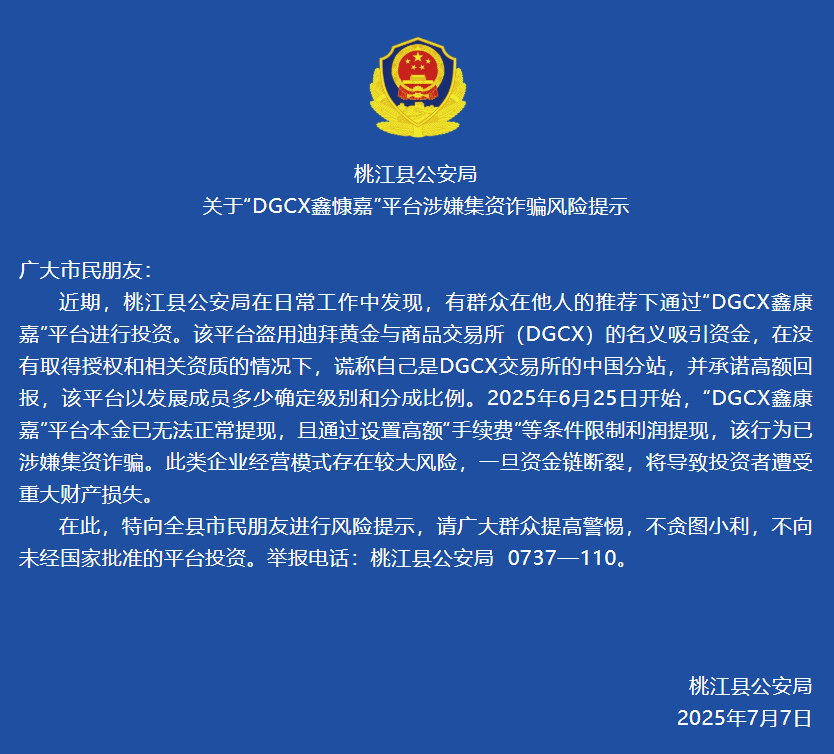

China’s “DGCX Xinkangjia” defrauded RMB 13 billion! Fake Dubai Gold Exchange, more than 2 million victims

The Public Security Bureau of Taojiang County, Hunan Province, China issued an announcement on July 7, naming "DGCX Xinkangjia" as a counterfeit Chinese branch of the Dubai Gold and Commodities Exchange (DGCX). In just two years, it siphoned off about 13 billion yuan, with more than 2 million victims. The scale shocked the Chinese investment community.

(Preliminary summary: Taipower's net worth is "remaining 2.7 yuan" and has not paid dividends for 20 years. Shareholders blasted: defrauding the people's hard-earned money! Cumulative losses exceeded 450 billion yuan)

(Background supplement: Burning the mansion to destroy the certificate! Chinese businessman Guo Wengui was arrested by the FBI and involved in more than 1 billion magnesium of cryptocurrency fraud)

Contents of this article

When "2% per day" When the propaganda of "Reward" is flying all over the WeChat group, it implies not the freedom of wealth, but a bubble that is about to burst. The Public Security Bureau of Taojiang County, Hunan Province, China issued an announcement on July 7, naming "DGCX Xinkangjia" as a counterfeit Chinese branch of the Dubai Gold and Commodities Exchange (DGCX). In just two years, it siphoned off about 13 billion yuan, with more than 2 million victims, and its scale shocked the Chinese investment community.

Huge amounts of money attracted: The true face of DGCX Xin Kangjia

The announcement pointed out that since its launch in May 2023, the DGCX Xin Kangjia platform has used "Official Authorization from Dubai" as a gimmick, claiming to focus on dual investment in gold and cryptocurrency. In fact, DGCX has never authorized related businesses, and the entire website and app of DGCX Xinkangjia were built by its own team, which is full of "high-tech outerwear" but does not have any formal financial products. The police classified it as a fund-raising fraud.

Fraud Chain: High Returns, MLM and Cash Withdrawal Obstacles

According to community members, early members of DGCX Xinkangjia can see 2% returns on their books every day, which quickly attracted an influx of new funds. Subsequently, the platform raised the threshold for withdrawals, with the handling fee rising from 5% to 10%. For deposits exceeding RMB 50,000, there will be a queue of 30 working days.

As a result, investors saw their funds doubled, but their cash was stuck in the system. In order to spread its tentacles, the operation team also designed an "upgrade system". Members can get profit points by attracting more people. It has become a pyramid scheme that spreads rapidly within the acquaintance community. Some netizens bluntly said that this is a "closed invitation code to enter the acquaintance board."

Just before the crash, the platform issued a "system upgrade" announcement, requiring additional funds to unlock the old account, and even shouted out a ridiculous reward of "invest 500,000 and get a Tesla". According to statistics, the total amount involved is approximately 13 billion yuan.

Regulatory failure: why the warning signals did not work

It is worth mentioning that Gong County in Sichuan issued an early warning in October 2024, and the Hunan Provincial Financial Office and the Dubai Multi Commodity Trading Center (DMCC) also reminded again in April this year, but the information has not yet fully reached the investment site. At present, the police have frozen 120 million yuan in assets and arrested many key players. However, the main culprit Huang Xin is suspected of transferring funds to the Cayman Islands through a USDT currency mixer, making recovery more difficult. Victims also posted screenshots of deposits on social platforms and lamented, "In the end, I pledged my mortgage and education funds, and now I can't even withdraw the principal."

Investment self-insurance: three major checks to avoid becoming the next victim

First, for any project that guarantees "guaranteed profits" or returns higher than the market's abnormal returns, you must stop and think first. Second, confirm whether the platform is under official supervision, especially if it is under the name of an international organization, you should go to the official website to verify. Third, as long as the model needs to "develop offline" or "increase the amount before cashing out", it should be regarded as a red warning. Netizens also appealed in the discussion forum: "No matter how familiar a friend recommends it, you should verify it yourself."

The collapse of "DGCX Xin Kangjia" caused 2 million people to lose their money. It also reminds us: high return = high risk is not a slogan, but a required course. Only by improving financial literacy and carefully verifying authenticity can we protect our hard-earned assets amidst information noise.