Do Kwon sentenced to 15 years, judge: tough sentence to stop next $40 billion LUNA disaster

Terraform Labs co-founder Do Kwon was sentenced to 15 years in New York after pleading guilty to two felony counts of "fraud conspiracy" and "wire fraud."

(Previous summary: U.S. prosecutors seek a 12-year sentence for Do Kwon: TerraUSD's $40 billion collapse is "unprecedented", see the results on 12/11)

(Background supplement: Do Kwon pleads guilty but asks for a lighter sentence of "within 5 years in prison"! Is it possible? TerraUSD evaporated $40 billion)

Terraform Labs Co-founder Do Kwon was sentenced on the 11th in the Federal District Court for the Southern District of New York to 15 years in prison, a term higher than the 12 years recommended by prosecutors. Judge Paul Engelmayer pointed out that this case caused investors to lose approximately US$40 billion and severely impacted global financial markets.

Do Kwon pleaded guilty in August to two felony counts of "fraud conspiracy" and "wire fraud" and agreed to forfeit $19 million in assets. The defense team played the "sympathy card", emphasizing that Do Kwon had been detained in Montenegro for a long time and had a good attitude in pleading guilty, hoping to reduce the sentence to five years.

After the sentencing, Judge Engelmayer stated that severe sentences must be used to deter similar behavior:

"This is a disastrous consequence,"

It is understood that the 17 months he was detained in Montenegro can be deducted, and after serving at least half of the sentence in the United States, he may still be transferred to South Korea in the future.

Terra ecological tokens generally fell

After the news was made public, Terra ecological tokens generally fell:

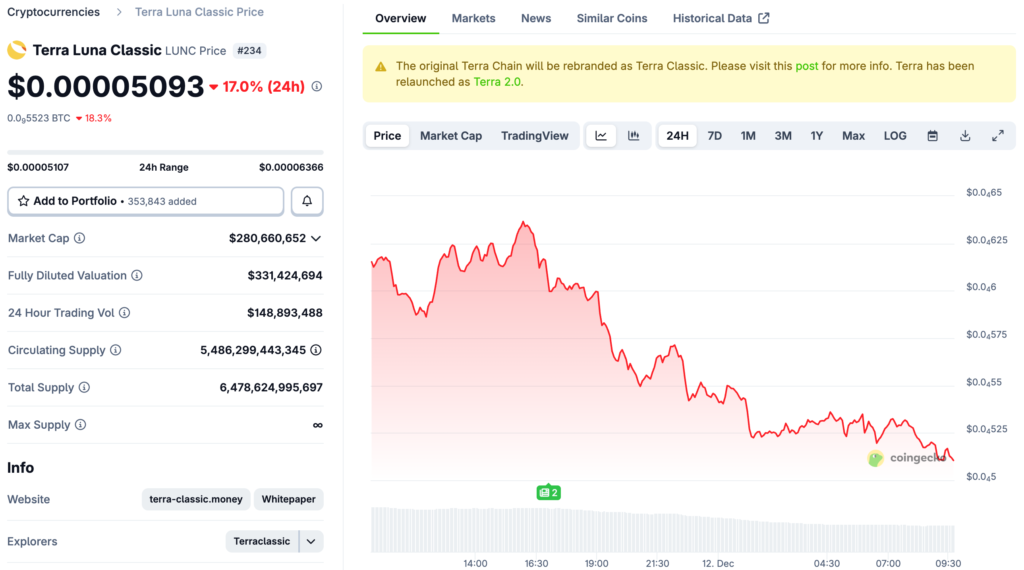

- LUNC fell by more than 17% in the past 24 hours, and its market value fell to US$280 million;

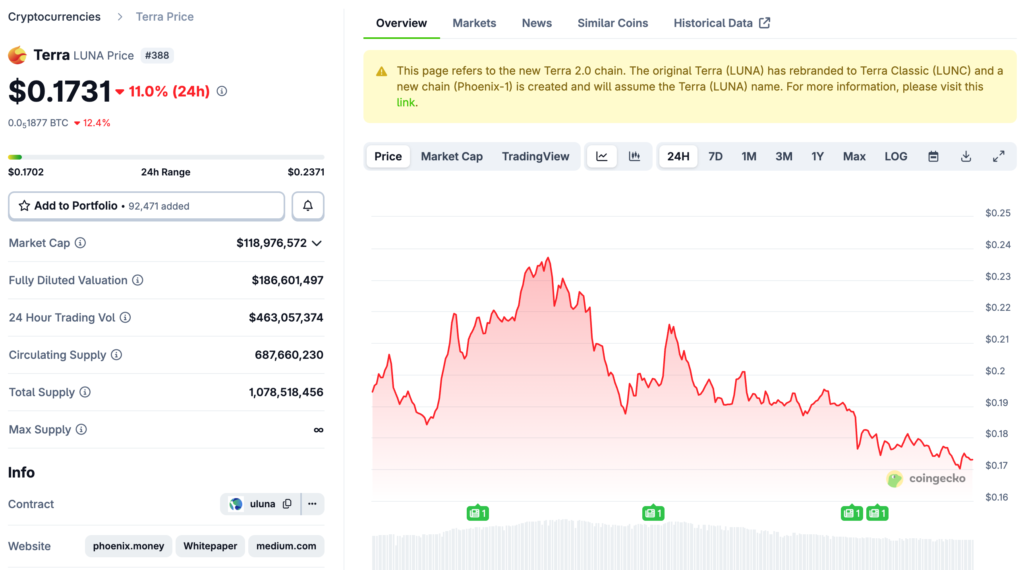

- LUNA fell by more than 11% in 24 hours, and its market value fell to US$118 million;

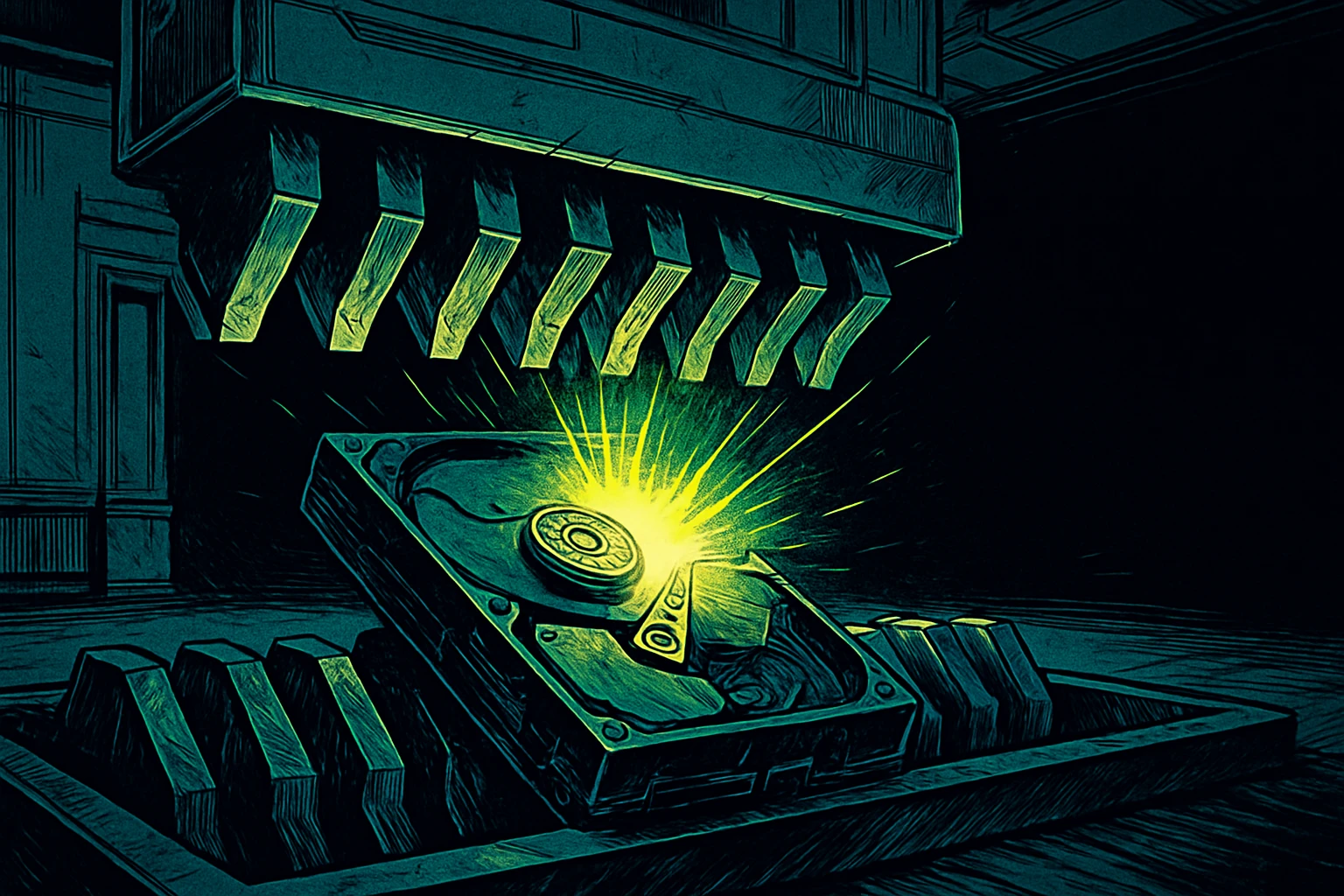

Terra crash review

In May 2022, the decoupling of the algorithmic stablecoin UST triggered a "death spiral", and the sister token Luna returned to zero, evaporating nearly $40 billion in market value in just a few days. Prosecutors pointed out that Kwon exaggerated UST’s automatic repair capabilities and claimed that South Korean payment platform Chai used the Terra blockchain, but there was actually no integration. He also used Anchor Protocol’s revenue of up to 20% to attract money and relied on subsidy support, which was determined by the court to be a Ponzi model.

According to ABC News, Kwon apologized in court and expressed his willingness to take responsibility. Although the 15-year sentence cannot make up for the losses, it declares the bankruptcy of the "high-yield, zero-risk" narrative and also sets the tone for the regulation of algorithmic stablecoins.