Breaking news》U.S. Office of the Comptroller of the Currency: Banks can freely trade crypto assets and custody without prior approval

The U.S. Office of the Comptroller of the Currency (OCC) issued the latest Interpretation Letter 1184, allowing national banks and federal savings associations to provide crypto asset custody and execution services without prior approval, significantly lowering the regulatory threshold for traditional financial institutions to enter the digital asset market.

(Preliminary briefing: U.S. stablecoin legislation is urgent) The Democratic Party has stopped: GENIUS law has loopholes, and crypto-friendly policies have become Trump’s self-enhancement tools)

(Background supplement: Understanding 2025 U.S. cryptocurrency ETFs: pledge, Solana and listing frenzy)

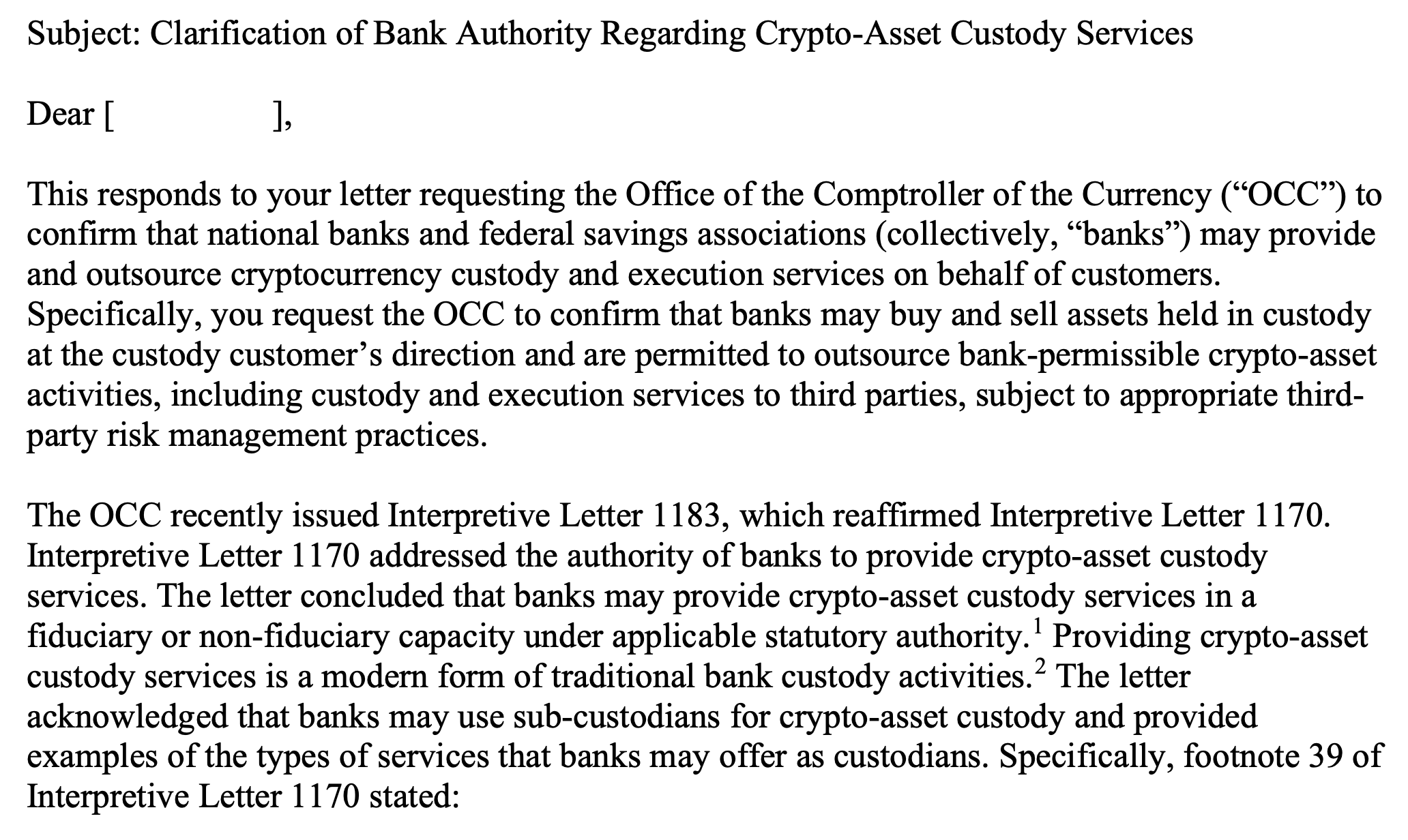

The U.S. Office of the Comptroller of the Currency (OCC) issued a key explanation letter on May 7, 2025, U.S. time 1184, provides clearer guidance for U.S. national banks and federal savings associations to engage in crypto-asset activities. This document continues the discussion based on previous Interpretation Letters 1170 and 1183. Its core breakthrough is to clarify that these federally chartered banks and savings associations can now provide custody (custody) and execution (Execution) services of crypto assets without obtaining additional prior approval or notification from the regulatory agency (supervisory no-objection).

This means that banks are freer to set up their own cryptocurrency trading systems or outsource services to third parties that meet risk control standards, provided that all activities must be conducted in a safe and sound manner to "banking standards" and comply with all applicable laws and regulations, including rigorous due diligence, a comprehensive third-party risk management framework, and robust information security protection.

Core content

The issuance of Interpretation Letter 1184 has significantly lowered the regulatory threshold for banks to participate in the crypto asset business. According to the document, a wide range of specific services that banks can provide include, in addition to core crypto-asset custody, purchase and sale transactions (execution) at the customer's direction, transaction settlement, necessary record-keeping, asset valuation, tax services, client reporting, and other services related to crypto-asset activities.

This move has an important impact on the entire crypto ecosystem. The United States can freely operate crypto asset businesses in the banking industry and may also attract more institutional investors to enter the market, thereby increasing market liquidity and stability and promoting the tokenization (Tokenization, RWA) of real-world assets. In addition, the clarification of the interpretation letter also provides clearer regulatory support for banks to handle stablecoin business, and even allows banks to participate in blockchain verification work under qualified conditions, further expanding the scope of banks’ participation in the cryptocurrency field.