SEC SHOT! Suspension of stock trading of crypto reserve companies QMMM and SDM: involving price manipulation and speculation

The SEC suddenly suspended QMMM and SDM stock trading on suspicion of social media manipulation, sounding the alarm for companies keen on "encrypted treasury."

(Preliminary summary: Standard Chartered warned DAT digital treasury: the narrative is heading for a death spiral, and many mNAVs fell below 1)

(Background supplement: The wind direction has changed! Bloomberg blasted Wall Street for "questioning the DAT narrative": Strategy's stock price plunged, and the market lost confidence in cryptocurrencies)

Contents of this article

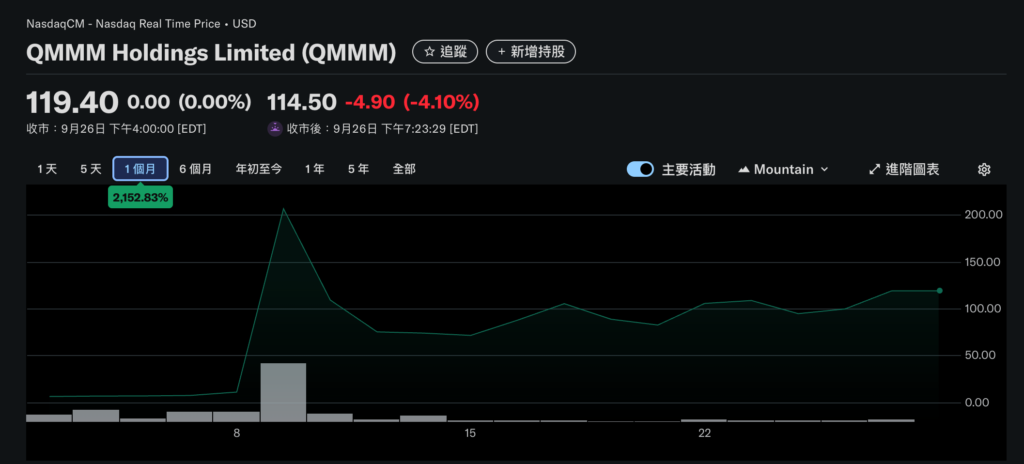

The U.S. Securities and Exchange Commission (SEC) on 29 In a heavy blow late at night, the company announced that it would immediately suspend trading in QMMM Holdings Ltd. until 11:59 p.m. on October 10. This digital media company, headquartered in Hong Kong and listed on the Nasdaq through the Cayman Islands structure, made a high-profile announcement three weeks ago to build a "diversified cryptocurrency treasury" of up to US$100 million. The stock price immediately soared nearly 10 times from the bottom, becoming the next "meme stock" hotly discussed in the community.

However, the carnival came to an abrupt end when the SEC named "unknown persons" in its statement for inciting buying on social platforms, suspecting price manipulation.

The skyrocketing stock price and instantly frozen transactions

After QMMM announced its encryption plan on September 9, the stock price soared from less than $12 to a high of $119.40 on September 27, with a cumulative increase of nearly 1,000%, fully reflecting investors' imagination of the "blockchain + artificial intelligence" narrative.

This time the SEC issued an emergency order to put an end to the surge. The reason was that there were "recommended buy" posts on social platforms, which were enough to affect prices. The official SEC document emphasizes:

"Unknown persons" recommending buying QMMM may manipulate the stock price.

This brief warning reveals that regulatory agencies are highly wary of the interaction between the retail community and the capital market, and also demonstrates to the entire market: As long as there is suspicion that someone is using the community to amplify speculation, crypto concept stocks are no exception, and the trading switch will be pulled at any time.

"Crypto Treasury" is both an opportunity and a trap

"Crypto Treasury" refers to companies converting part of their funds into mainstream tokens such as Bitcoin (BTC), Ethereum (ETH), Solana (SOL), etc., in an attempt to capture both value-added and brand halo. In 2025, this trend will sweep across all industries, and some companies will indeed receive valuation dividends as a result. However, QMMM's financial report showed weak revenue and long-term losses, making it difficult for the industry to support the sudden surge in market value.

When the stock price is out of touch with fundamentals, social enthusiasm may evolve into a bubble. QMMM has become the clearest warning case: relying on only a press release to package digital media companies as "rich people on the chain" will ultimately not be able to withstand the pressure of regulation and the return of market rationality.

Another mirror: Smart Digital Group’s reverse script

Smart Digital Group Ltd. was also suspended from trading by the SEC on the same day. The company also announced the establishment of a crypto asset pool for BTC and ETH, but its stock price trend mirrored that of QMMM, falling by about 86%.

The reason is that the announcement lacks key details such as capital scale and asset allocation. Investors have no way to evaluate the feasibility and can only vote with their feet. The SEC froze the two cases together, showing that the regulatory horizon has expanded from individual companies to the entire "encrypted treasury" craze, and the chemical reaction between social media and retail investors has been listed as a source of risk.

The double suspension of QMMM and Smart Digital Group this time has poured cold water on companies’ enthusiasm for “encrypted treasury” in 2025, and once again reminded the market: Although crypto assets can provide growth imagination, if they lack transparency and substantial revenue support, they are just fragile bubbles.