Itaú, Brazil’s largest bank, advises clients to allocate 3% of Bitcoin to combat the depreciation of the U.S. dollar currency

Itaú Unibanco is recommending that clients move 1% to 3% of their funds into Bitcoin, opening a new front for Brazilian investors against the real's slide.

(Preliminary information: The money printing press is on again! The U.S. Federal Reserve has launched the "Reserve Management Purchase Program" and will buy US$40 billion in short-term government bonds in 30 days starting from 12/12)

(Background supplement: Silver exceeded US$60 and hit a record high! This year's increase exceeds 100% Ranked the sixth largest asset in the world)

Contents of this article

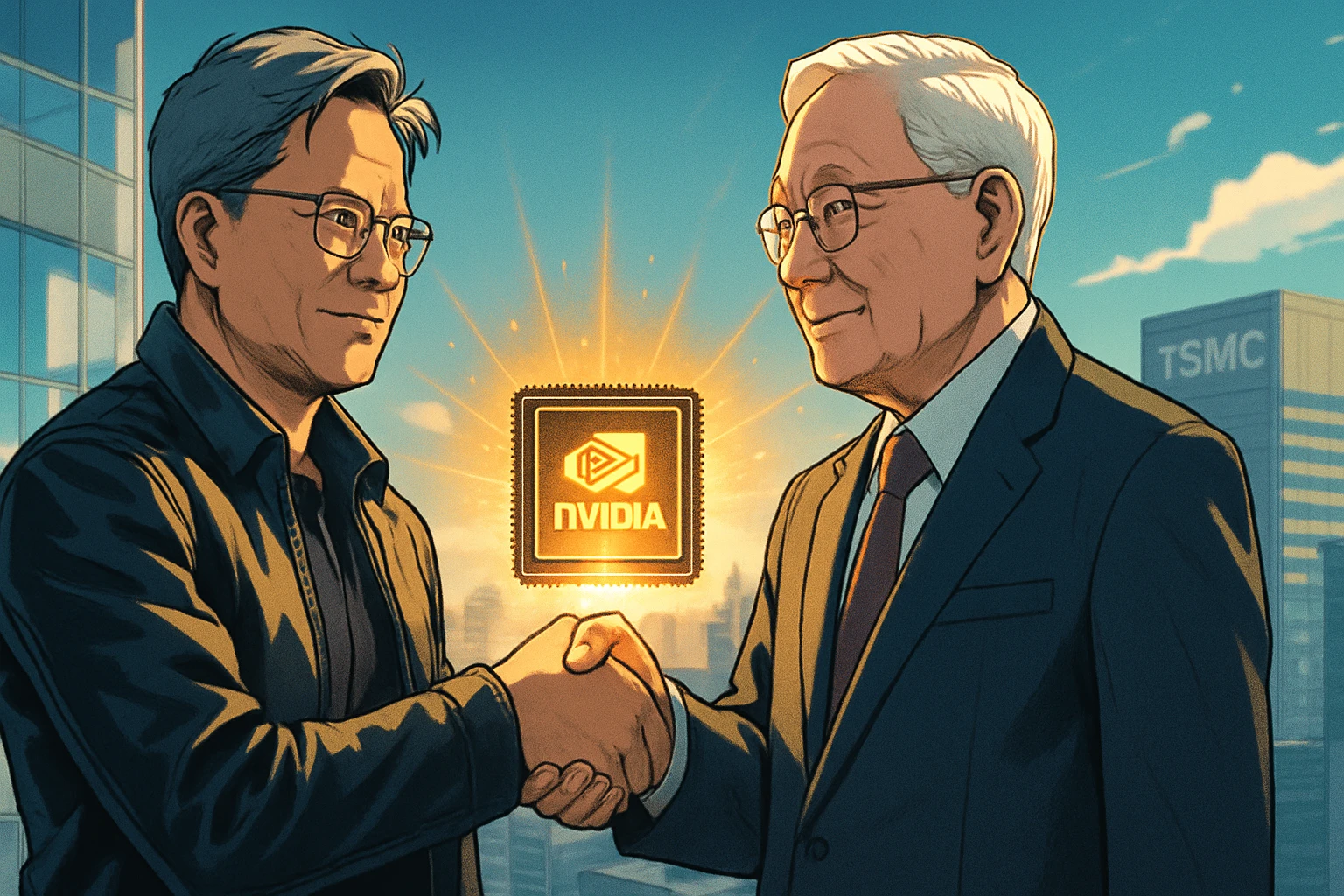

This is not a miracle about sudden wealth, but a survival guide given by Itaú Unibanco, Brazil's leading private bank, at the end of 2025 when the U.S. dollar is strong and the real depreciates. On December 14, Itaú Asset Management, which manages US$500 billion in assets, formally recommended for the first time that clients allocate 1% to 3% of their positions to Bitcoin to put an "airbag" on their investment portfolios.

The 3% golden rule: actuarial results of low correlation

Itaú pointed out in an internal report that the correlation between Bitcoin and traditional Brazilian assets has remained around 0.5 for a long time, and even dropped to 0.17 when the market panicked. In other words, when the São Paulo stock market plummets due to political changes or economic data, Bitcoin often moves in the opposite direction. After many Monte Carlo simulations, the team found the "sweet spot" - converting 1% to 3% of the position into Bitcoin can effectively reduce the overall volatility without letting the violent fluctuations of cryptocurrency drag down the overall return. Renato Eid, head of strategy at Itaú Beta, emphasized:

"Our goal is not to push crypto assets to the center of the stage, but to make it a counterweight to the investment portfolio."

The "digital shield" in the exchange rate storm

In 2025, the "America First" policy promoted by the Trump administration attracted global U.S. dollar funds back to the country, and the real fell to 1 against the U.S. dollar. Bottom at 6.30. For Brazilian investors, even a 10% nominal return on the local underlying could still be a step back on a U.S. dollar basis. Bitcoin is priced in US dollars, which acts as an international insurance policy: the weaker the real against the US dollar, the higher the price of Bitcoin in real terms. Faced with annual depreciation pressure of 12% to 15%, this "digital shield" can partially hedge against the loss of purchasing power and lock in the global value of assets.

Institutional consensus from Wall Street to Sao Paulo

Itaú’s actions are not alone, but part of the shift in global asset allocation sectors. Bank of America recently also recommended that wealth clients allocate 1% to 4% to crypto assets; BlackRock, which manages more than trillions of dollars, also gave a ratio of about 2%. For Brazil, this is both international integration and local defense. Faced with the rapid deployment of financial technology upstart Nubank, Itaú used Bitcoin ETF BITI11 and its own íon application to convert hedging needs into management fees and handling fees, stabilizing the competitive trenches of century-old banks.

Risk and Discipline: Bankers’ Warning

Itaú did not draw a blueprint for “prices to the moon”, but instead reminded investors that Bitcoin volatility is still three to four times that of the S&P 500. “Don’t think about timing,” the report reads. “Disciplined holding is the key.” As the Brazilian Central Bank implements a new regulatory framework for crypto assets in 2025, Itaú, which is subject to strict supervision, has become a compliant portal for conservative funds to enter the crypto field. Investors have an extra umbrella available, but they also have to bear the weight of holding the umbrella.

The conclusion is simple: At a time when the U.S. dollar has drained global liquidity and the real is in turmoil, Bitcoin has transformed from a "casino chip" into a defensive tool. Itaú’s 3% suggestion is not a drumbeat of wealth-making propaganda, but a warning in the era of inflation: putting a small amount of capital on the chain may be the insurance premium to protect the last mile of wealth.