Bitfinex Alpha #183》BTC bottoming signal emerges

Bitfinex released a research report this week, stating that after BTC rebounded, sellers' momentum gradually depleted and there were signs of bottoming.

(Preliminary summary: Bitfinex Alpha #182》Bitcoin has fallen by more than 30% since its high point, and the price bottom is still difficult to confirm)

(Background supplement: The U.S. Bitcoin reserve is only 90,000 at most? Analysis: 108,000 BTC must be returned to Bitfinex victims)

Bitcoin experienced a significant rebound last week, rising more than 15% from the recent low to hit 93,116 USD; This comes after the market experienced its most dramatic correction of the cycle, with a 35.9% retracement from all-time highs. However, selling pressure persisted, with Bitcoin immediately opening the week down 4.1%.

This rebound is in line with our previous view: from the "time dimension", the market is gradually approaching a local bottom, although it remains to be seen whether the bottom has been established at the "price level". With the rapid liquidation of leverage, capitulation selling by short-term holders, and gradual exhaustion of seller momentum, we believe that the market has the foundation to enter the stabilization stage.

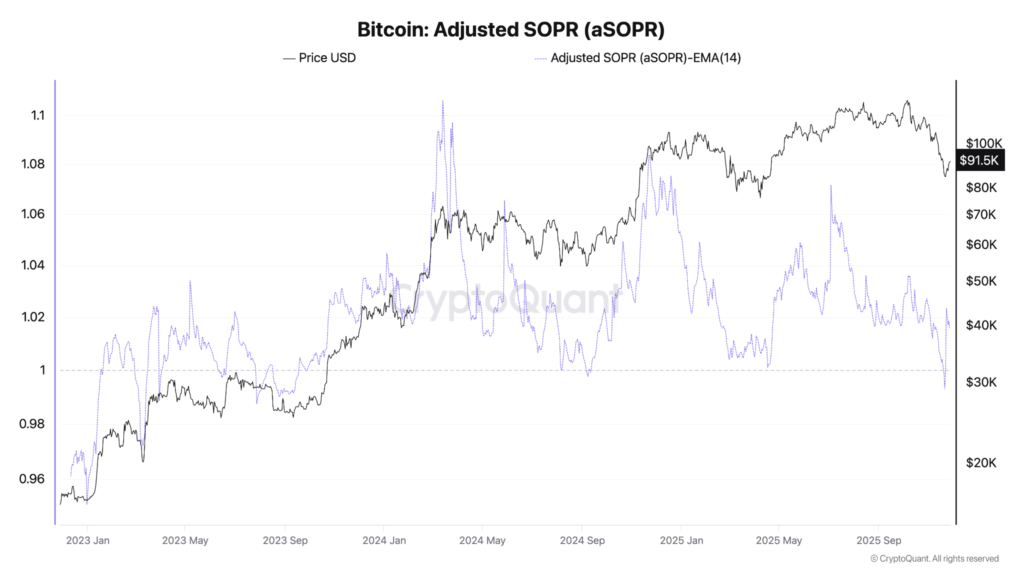

On-chain data further strengthens this argument: the adjusted cost-output profit margin (aSOPR) has fallen below 1. This is the third time this signal has occurred since the beginning of 2024, and the dynamics of loss realization are the same as those at the cyclical lows in August 2024 and April 2025.

The current depth of losses is also quite significant. "Entity-Adjusted Realized Losses" have risen to $403.4 million per day, exceeding losses seen at previous major cycle lows.

Such losses typically signal the end of panic selling rather than the beginning of a deeper decline. The derivatives market has also shown a similar "orderly reset": Bitcoin's market-wide open interest (OI) has fallen back to US$59.17 billion, far lower than the high of US$94.12 billion, indicating that leverage has been cleared out in an orderly manner.

The continued contraction of OI is accompanied by an increase in spot prices, which means that this wave is more of "short covering" rather than a rebound in speculative risk appetite. This strengthens the view that "the market is transitioning to a more stable consolidation period", with reduced vulnerability and the hope of laying the foundation for a more sustainable rebound in the fourth quarter.

Recent U.S. macro data show a growing divergence between slowing consumer activity and strong business investment. Retail sales slowed sharply in September, rising just 0.2%, while the GDP-related comparison even fell into negative territory. High prices and stagnant income growth due to tariffs continue to squeeze household spending. At the same time, PPI increased by 0.3% month-on-month and energy costs soared by 3.5%, indicating that upstream price pressures remain sticky. Consumer confidence subsequently deteriorated, with the Conference Board confidence index falling to 88.7, reflecting households becoming more cautious about the job market and cutting back on commodity consumption.

In contrast, American companies are actively increasing capital expenditures. Orders for core capital goods, a key indicator of business investment, rose 0.9% in September, continuing momentum from August and well above expectations. Even as tariff uncertainty weighs on parts of the manufacturing industry, companies continue to invest more in AI, automation and productivity equipment. This wave of business investment supports strong growth prospects, with Atlanta Fed GDPNow forecasting Q3 GDP annualized growth of 3.9%. The sharp contrast between cautious consumers and confident businesses highlights the growing divergence in economic signals, leaving the Federal Reserve facing limited visibility and uneven signals at its December policy meeting.

The market saw a clear shift last week, with institutions further deepening their integration into Bitcoin. BlackRock's latest SEC filing shows that its "Strategic Income Opportunities Portfolio" increased its holdings of IBIT by 14%, with total exposure reaching 2.39 million shares. This move highlights that even traditional conservative bond funds are now beginning to use Bitcoin ETFs as a diversification tool for asset allocation; at the same time, market structural support is growing, including a proposed increase in IBIT’s option position limits to accommodate larger institutional strategies.

Although the overall sector is facing liquidity pressure, ARK Invest continues to increase its investment in crypto assets. The firm bought more than $93 million in a single day, adding to its holdings in Coinbase, Circle, Block and its own ARK 21Shares Bitcoin ETF. With Coinbase's weighting in the ARKK fund surpassing 5%, the agency's aggressive accumulation reflects long-term confidence in digital assets even as crypto-related stocks face a sharp monthly pullback.

Further strengthening this wave of institutionalization, Texas became the first state government in the United States to publicly invest in Bitcoin, allocating US$5 million to buy IBIT as part of its newly launched state-level Bitcoin reserve plan. Although the amount is small, it is symbolically significant and marks the beginning of the transition from ETFs to "direct custody of BTC" once the infrastructure is in place.