Bitcoin falls below $81,000, global asset ranking drops to 10th! CryptoQuant founder: It is difficult to rebound strongly in the short term

As Bitcoin continues to fall, its ranking among global assets has dropped to 10th. Regarding the current market conditions, Ki Young Ju, founder and CEO of CryptoQuant, also analyzed that the current market is more bearish than expected, and it is difficult for Bitcoin to rebound strongly in the short term (3–6 months).

(Preliminary summary: Bridgewater Fund Dalio: I have Bitcoin, but it only accounts for 1% of the investment portfolio; BTC will never be a reserve currency of a sovereign country)

(Background supplement: Bitcoin fell 30%, has it really entered a bear market? Five analysis frameworks will take you to examine)

Bitcoin has been falling continuously recently, and even fell below US$81,000 today (21st), the highest level since April this year. With new lows since the beginning of the month, market bulls have been liquidated one after another, and investors are wailing.

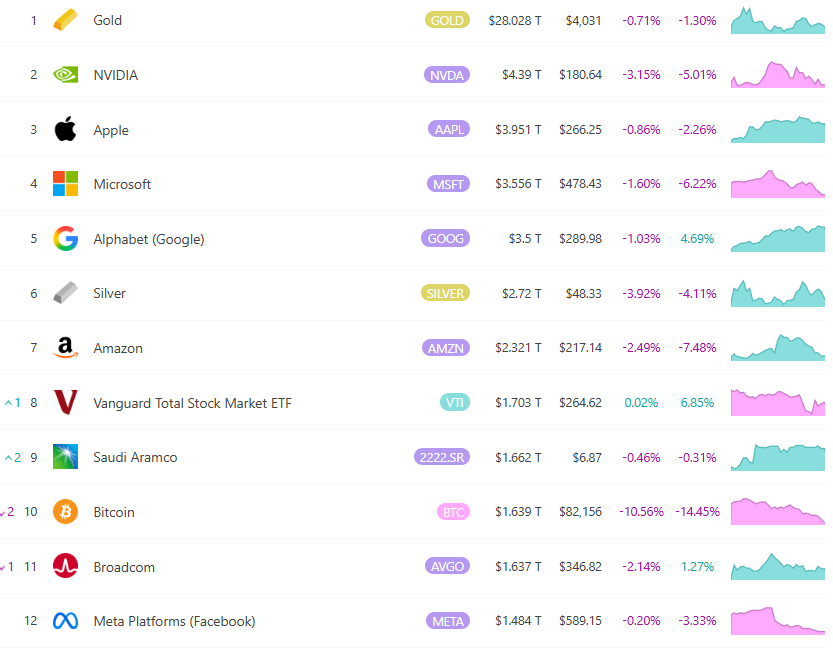

Bitcoin’s global asset ranking fell to 10th

According to 8MarketCap The latest data shows that as Bitcoin continues to decline, Bitcoin's ranking among global assets is also declining. It has now fallen to 10th place, only better than the US semiconductor company Broadcom and the technology giant Meta; but behind Saudi Aramco, Vanguard Total Stock Market ETF, Amazon and other companies.

CryptoQuant Founder: It is difficult for Bitcoin to rebound in the short term

Regarding the current market conditions, Ki Young Ju, founder and CEO of CryptoQuant, latest analysis pointed out that the current market is more bearish than expected, Bitcoin will be difficult to rebound strongly in the short term (3-6 months), and the real bull market may not start until macro liquidity returns in 2026. He emphasized that US dollar liquidity is tightening and risk assets continue to be sold off, which are more important factors to overcome the on-chain cycle. Although it is not ruled out that Bitcoin may rebound to US$100,000 in the short term, if it cannot effectively break through, the probability of setting a new low in the future is very high.

He reiterated that the on-chain bull market cycle is over according to the classic theory. His current view is still consistent with that of macro analyst Luke Gromen: the U.S. fiscal deficit is too large and the demand for U.S. debt is weak. Only when liquidity becomes loose again next year will scarce assets such as gold and Bitcoin experience a surge.

The market looks more bearish than I expected. If this continues, Bitcoin will probably not see a strong recovery for the next 3–6 months. The real bull rally would begin once liquidity returns next year.

Macro liquidity matters more than the on-chain cycle. Dollar liquidity is…

— Ki Young Ju (@ki_young_ju) November 21, 2025