$500 million bet on BNB! Pharmaceutical company Liminatus Pharma establishes "US BNB Strategy" subsidiary: optimistic about the ecological benefits of Binance Chain

U.S. pharmaceutical company Liminatus Pharma issued an announcement announcing that it will establish a "U.S. BNB Strategy" subsidiary, which is expected to use up to US$500 million to invest and hold BNB for the long term.

(Previous summary: BNB broke through $860 and set a new high! The market value overtook MicroStrategy, Nike, SoftBank, and Nano Labs added 8,000 BNB)

(Background supplement: When BNB enters mainstream digital assets: from Nasdaq to sovereign reserves, what opportunities does the era bring?)

Contents of this article

BNB Reserve Company welcomes new members! Liminatus Pharma, a US-based pharmaceutical company that originally focused on cancer immunotherapy, issued an announcement announcing that it will establish a "US BNB Strategy" subsidiary and is expected to use up to US$500 million to invest and hold BNB for the long term.

Why traditional biotechnology is betting on BNB

According to the press release, Chris Kim, CEO of Liminatus Pharma, pointed out three core reasons to explain why he chose to bet on BNB: First, BNB Chain’s technology and global user base have formed a network effect; second, Binance’s Launchpool, staking and other mechanisms provide stable and sustained income; third, BNB’s overall ecosystem is in decentralized finance (DeFi) A clear value bridge is established with physical applications. He bluntly stated in the conference call:

"This is not short-term speculation. We believe in BNB's long-term growth potential, which can strengthen the company's capital efficiency and allow shareholders to obtain additional returns in addition to our drug research and development business."

Risk control behind US$500 million

It is worth noting that US$500 million is not a small sum of money. Therefore, Liminatus Pharma stated that it will use Ceffu’s institutional-grade custody services and invest in tranches so that it can reduce the risks caused by market volatility and compliance issues.

At the same time, in internal planning, Liminatus Pharma also has three mechanisms: phased release of funds, dynamic position limit tied to cash flow, and quarterly review by the board of directors.

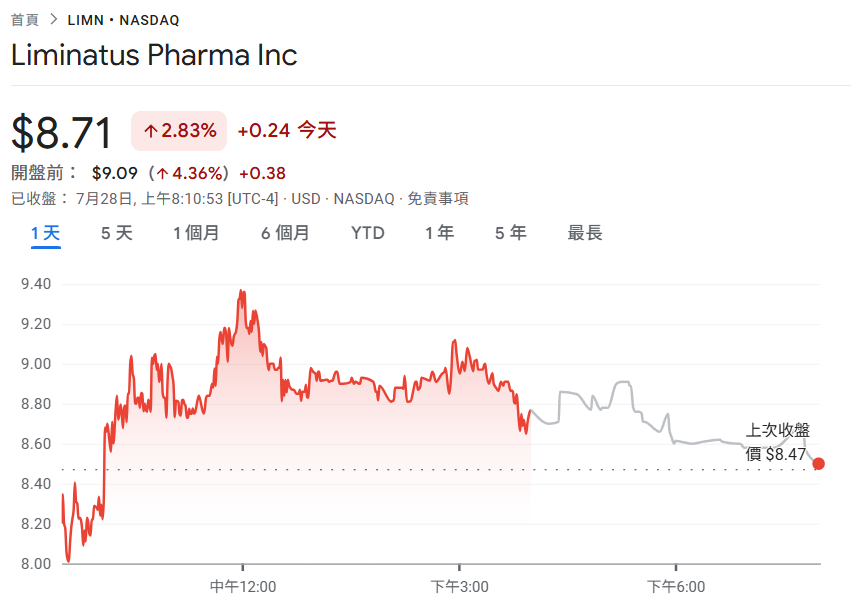

LIMN rose 4.3% before the market opened

According to Google Finance data, or affected by this news, Liminatus Pharma shares rose slightly before the US stock market opened, with an increase of about 4.3%. The stock price was temporarily quoted at US$9.09 before the market opened, with a market value of approximately US$227 million.