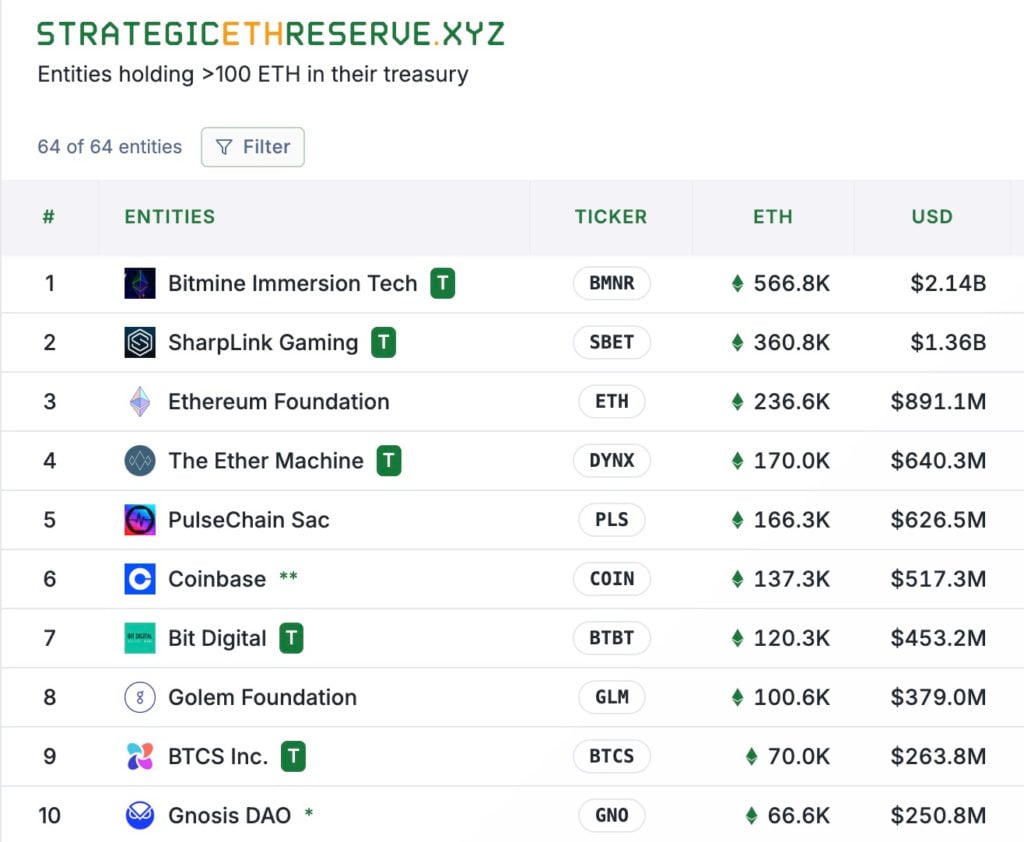

Holding the most ETH but the worst situation? Bitmine holds 560,000 Ethereum, and its stock price has evaporated by 80% in less than a month

Bitcoin mining company Bitmine Immersion Tech has continued to buy Ethereum this month and currently holds 566,000 Ethereum, ranking first among listed companies. But the stock price seems to be going in the opposite direction. In less than a month, the stock price has evaporated by nearly 80%.

(Preliminary summary: Palantir founder Peter Thiel invested 9.1% of the shares in BitMine mining company, optimistic about betting on Ethereum)

(Background supplement: Female stock goddess is on board Ethereum! Ark invested $182 million in BitMine; SharpLink Gaming bought another 80,000 ETH)

Contents of this article

According to Strategicethreserve According to the latest data, among the companies currently buying Ethereum as reserves, Bitmine Immersion Tech currently ranks first, with a holding of 566,000 Ethereum (worth approximately US$2.1 billion).

ARK Invest invested US$182 million in BitMine

Just last week 22 On the same day, the company also announced that it had received a US$182 million investment from ARK Invest, an investment company run by female stock goddess Cathie Wood. This funding allowed the female stock goddess to buy 4,773,444 ordinary shares of BitMine. BitMine said that all of the funds will be used to invest in Ethereum.

BitMine was originally a Bitcoin mining company. Since June 2025, BitMine has announced that it will use Ethereum as its main treasury reserve asset and accelerate the accumulation of ETH through a US$25 million private placement financing (completed on July 3).

We are delighted that Cathie Wood has taken a large stake in BitMine, she sees an opportunity for exponential growth and our goal is to reach 5% ETH share.

BitMine is currently supported by Founders Fund and other institutions, and Tom Lee, the founder of Fundstrat and a Wall Street fortune teller, serves as the chairman of the board of directors.

BitMine's stock price fell 11.78% in a single day

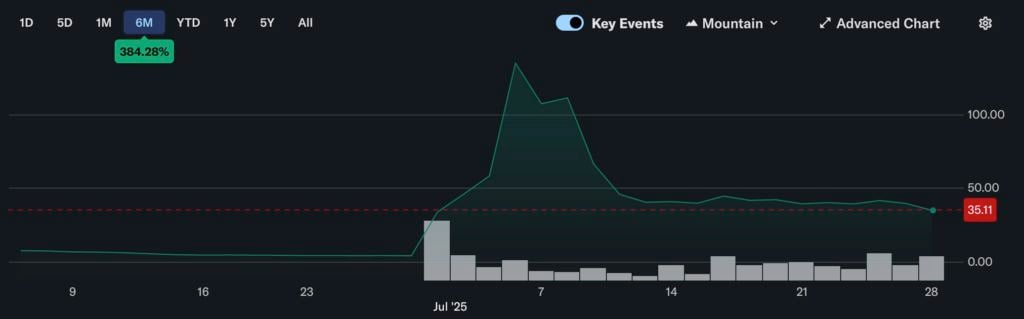

However, although BitMine currently holds a large amount of Ethereum reserves, and the ETH price once exceeded 3,900 US dollars yesterday, BitMine's stock price has continued to fall since reaching its peak in early July (reaching a maximum of 161 US dollars, evaporating nearly 80% in less than a month), and closed at 11.78 on the 28th. %, and then fell by 13.1% after the market opened.

If someone treats the company as an Ethereum version of micro-strategy, hoping that the stock price will benefit from the continued rise in ETH currency prices, but if the time to enter the market is not early enough, then these investors are likely to be trapped, or they will become the takers of the major shareholders selling at a high point.

Ethereum fell below US$3,800

In terms of ETH price, Ethereum continued to fluctuate downward after hitting US$3,941 yesterday. It was currently trading at US$3,745 at the time of writing, down 3.65% in the past 24 hours. Whether it can break through the $4,000 level again has become the market's focus.