Beyond the consensus and mind of mankind for thousands of years: Why Bitcoin is a better “gold”

Gold has become the king of wealth storage due to its scarcity and consensus, but there are still risks of storage, liquidation and government intervention. As a decentralized digital currency, Bitcoin is challenging the status of gold and bringing new wealth opportunities with its unique advantages. This article originates from an article written by Bill Qian, organized, compiled and written by PANews.

(Preliminary summary: Gold, Bitcoin and Pokémon cards, who is the "perfect collateral" in this era? )

(Background supplement: China's A-share aunts are shouting about cryptocurrencies: Bitcoin is digital gold, Ethereum is Web3 Huida, and SOL is the leading blockchain casino)

Contents of this article

This article is a companion article to "How to Protect Wealth in War".

Let’s discuss the following questions: First, what is a store of wealth? Second, why gold has become the winner in modern times, and third, why Bitcoin will be a better “gold” in the 21st century and in the future.

For the past 5,000 years, competition for the "best stored value asset" has always existed, but gold has gradually become the king of wealth storage due to its scarcity and value consensus formed over thousands of years. But at the same time, Bitcoin is slowly dissolving and shaking the market position of gold. In the process, it is also bringing epic opportunities for wealth creation and wealth transfer to our generation.

「The History of Money」

Money has three core functions: medium of exchange, unit of account and store of value. From shells and copper coins to modern fiat currencies (such as US dollars and euros), trading media and units of account are constantly iterating. Gold, silver, land and blue chip stocks have long been the mainstream choices for storing value.

In the history of currency, the U.S. dollar during the Bretton Woods System period was one of the few currencies that could simultaneously assume the three functions of a medium of exchange, a unit of account, and a store of wealth. However, this was only a special case and not common; and the U.S. dollar's role as a three-in-one gradually collapsed after Richard Nixon's television speech in 1971. Some people may say: Why do so many people in emerging markets want to use US dollars and save US dollars? Even if the data shows that the dollar continues to depreciate? I think the answer is: because they don't have a better choice; their national currency is worse. This topic involves stablecoins, and we will talk about it next time.

" How did gold become the "gold" it is today? 》

A good target for wealth storage must meet 5 characteristics: scarcity, durability, portability, divisibility and social consensus. It is difficult for silver, land, and diamonds to beat gold in these 5 indicators.

So, after tens of thousands of years, gold finally won the consensus and mind of mankind and became almost the only target for wealth storage.

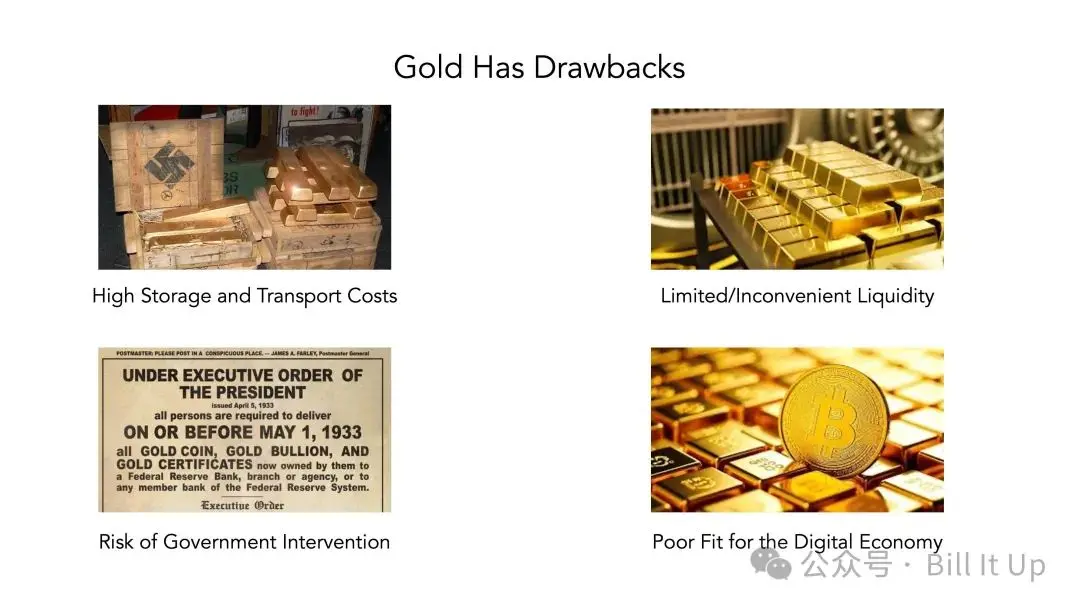

"What are the limitations of gold?"

1. Storing gold requires expensive security vaults, insurance, and sometimes even transportation costs. The larger the quantity, the higher the cost. During World War II, the gold in the safe in the Bank of Paris was directly plundered by the German army. The biggest revelation this incident gave me is: the safe in the bank, is not safe at all.

2. In extreme times, the cost of cashing out gold is very high. A similar situation occurred during World War II. Whether you were in Shanghai, Paris, or Amsterdam, gold transactions usually faced heavy discounts, often 30-50% below the spot price, and the discounts were even greater in high-risk environments. To make matters worse, trading gold in conflict zones often comes with serious personal risks - once others know that you hold gold bars, you can be robbed and ripped off at any time.

3. The government will also further undermine the reliability of gold holdings through confiscation and price controls. In 1933, for example, the United States required citizens to hand over most of their gold at a fixed price below the market or face severe penalties. Note: At the time, the U.S. government required all citizens to surrender their gold at a fixed price of $20.67 per troy ounce. Subsequently, with the passage of the Gold Reserve Act in 1934, the government revalued the official price of gold at $35 per troy ounce. This means that the gold in the hands of all citizens has been "devalued" by about 41% in just one year. The United States confiscated more than 2,600 tons of gold at that time, which directly changed monetary policy and paved the way for the complete end of the gold standard in 1971. All of this happened in the United States in the 20th century, the beacon country that probably respected the private property system the most in the world.

4. In addition, in today's digital economy, the limitation of gold not being "digital" is also obvious. For example, you cannot send one kilogram of gold to your friend or to another of your addresses through any electronic wallet.

"In 2009, Bitcoin appeared! What exactly is it?"

In 2009, led by the pseudonym Satoshi Nakamoto (Satoshi Nakamoto) Bitcoin, founded by Nakamoto, is the first decentralized digital currency. It runs on a global, public, open computer network (commonly known as blockchain, I have always found this name difficult to understand) - a shared digital ledger that anyone can participate in and verify. New Bitcoins are generated through "mining": computers need to solve complex mathematical puzzles to package transactions into new "blocks" and add them to the blockchain, and the "miners" are rewarded with newly generated Bitcoins. This process ensures the security and smooth operation of the entire system.