Are long-term Bitcoin holders starting to sell?

Long-term holders have only slightly shipped, far from the scale seen at the top of previous cycles. This article originates from an article written by Matt Crosby, organized, compiled and written by BitpushNews.

(Previous summary: Trump extended the suspension of the "50% tariff on the EU" to 7/9, U.S. stocks and Bitcoin rebounded by 109,000 mg)

(Background supplement: Trader James Wynn just stopped long orders and opened a short position of $370 million in Bitcoin with 40 times leverage)

Contents of this article

After a period of volatility, Bitcoin has now recovered The $100,000 mark and a record high, injecting new confidence into the market. But as the price rises, a key question arises: Are Bitcoin’s most experienced and successful holders — the long-term holders — starting to sell off?

This article will analyze how on-chain data reveals the behavior of long-term holders, and whether recent profit-taking is cause for concern or is simply a healthy part of the Bitcoin market cycle.

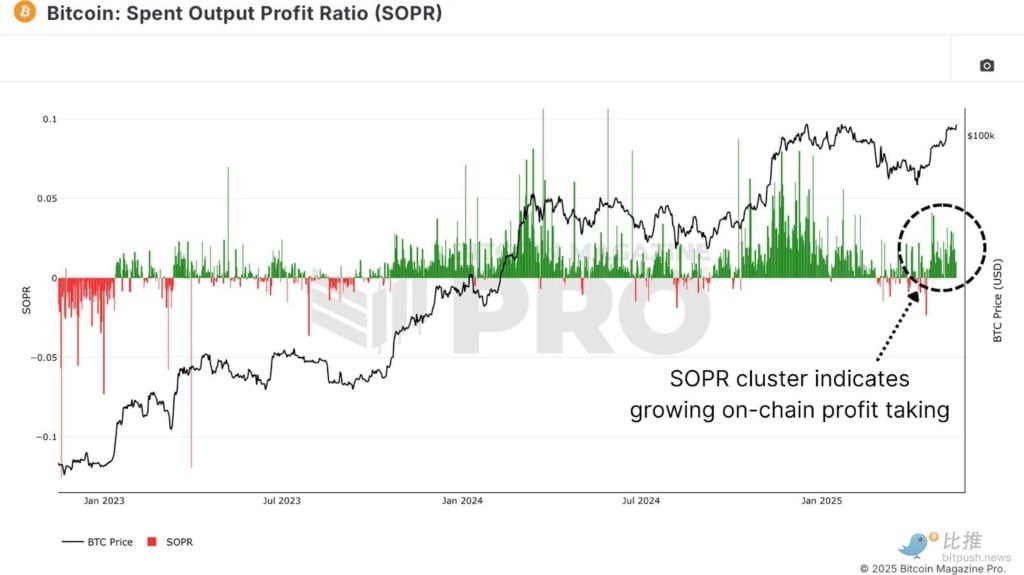

Signs of profit-taking

Spent Output Profit Ratio (SOPR) provides instant insight into realized profits across the entire network. Focusing on the last few weeks, we can clearly observe an upward trend in profit realization. The clustering of green bars shows that there is indeed a significant number of investors selling Bitcoin to realize profits, especially after the price rose from the $74,000–75,000 range to new highs of over $100,000.

Figure 1: Spent output margin indicates significant profit realization in the near term

However, while this may raise concerns about resistance above in the short term, it must be understood within the broader on-chain context. This behavior is not uncommon in bull markets and does not alone signal a cycle top.

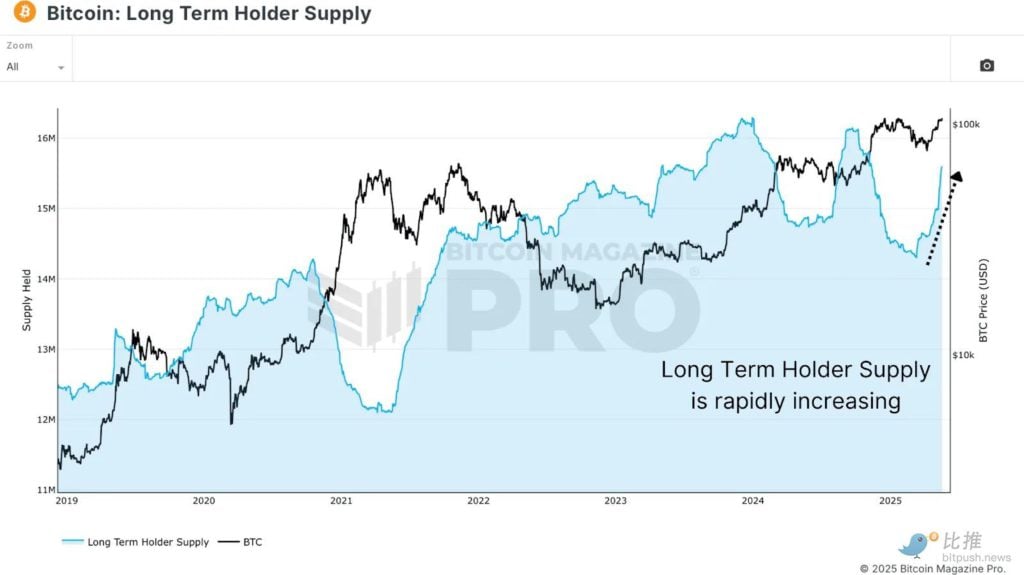

Long-term holder supply still growing

Long-term holder supply, which refers to the total amount of Bitcoin held by wallets that have been held for more than 155 days, continues to climb despite the price surge. This trend does not necessarily mean that new buying activity is currently taking place, but rather that Bitcoin is "aging" over time into a long-term holding state without being moved or sold.

Figure 2: Bitcoin long-term holder supply has increased significantly

In other words, many in late 2024 or 2025 Investors who bought at the beginning of the year are still holding on to their coins and are turning into long-term holders. This is a healthy dynamic that typically occurs in the early or middle stages of a bull market that has yet to show signs of mass distribution.

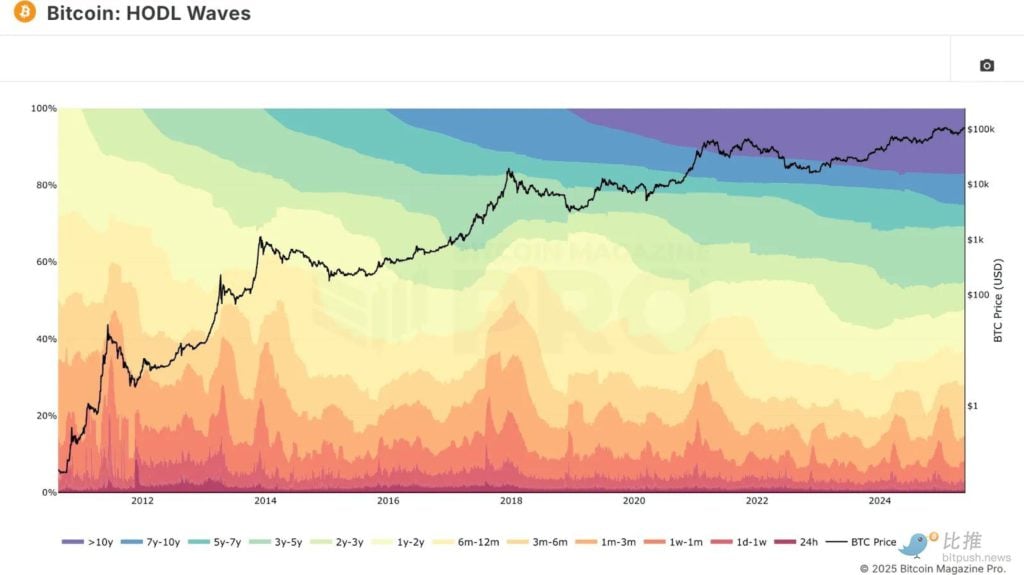

HODL Waves Analysis

To further drill down, we used HODL Waves data, which is stratified by wallet age. Focusing on wallets holding coins for 6 months or more, we find that more than 70% of the Bitcoin supply is currently controlled by medium to long-term holders.

Figure 3: HODL Waves Analysis shows that mid- to long-term investors hold the majority of Bitcoin

Interestingly, while this proportion remains high, it has begun to decline slightly, indicating that some long-term holders may be selling, even as the long-term holder supply is still growing. The main driver of long-term supply growth seems to be the gradual "aging out" of short-term holders into a holding range of more than 155 days, rather than large-scale buying of new funds.

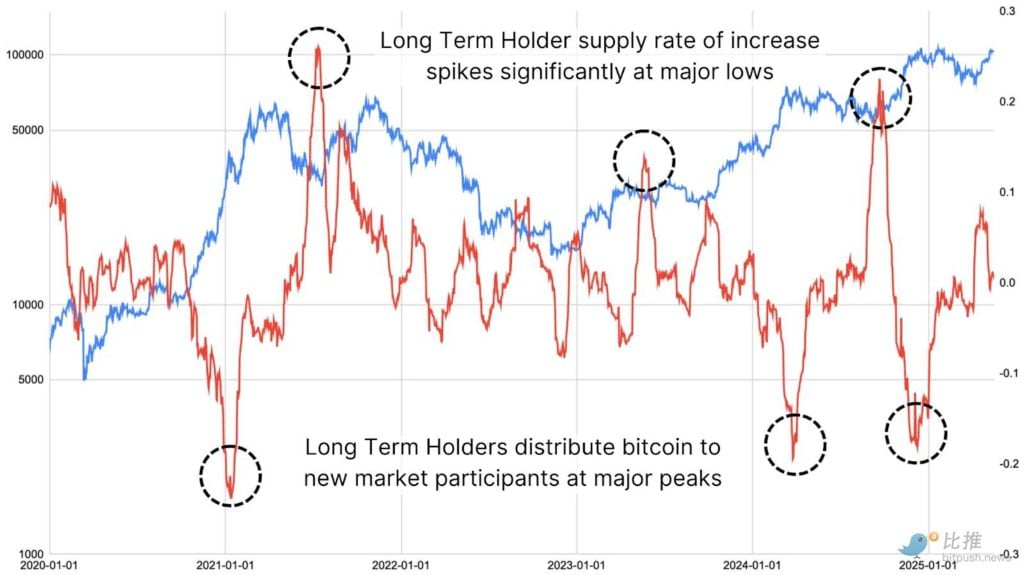

Figure 4: Long-term holder supply change rate has an inverse relationship with Bitcoin price

Using raw data provided by the Bitcoin Magazine Pro API, we analyzed the long-term holder balance change rate by wallet holding age. When this indicator declines significantly, it has historically coincided with cycle tops. On the contrary, when the indicator rises sharply, it often corresponds to the market bottom and deep accumulation stage.

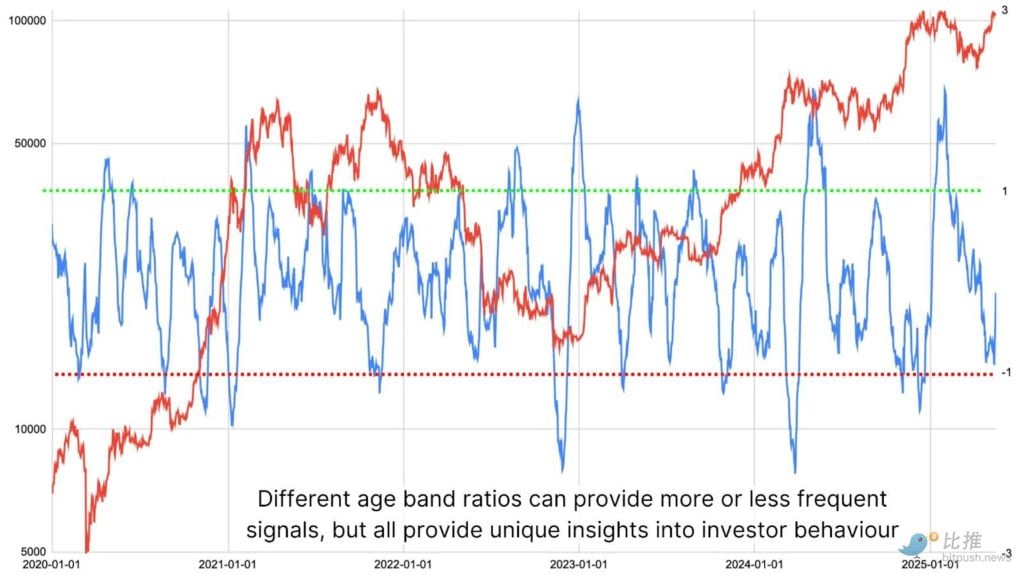

Short-term changes and distribution ratios

To improve the accuracy of these signals, the data can be more granularly segmented by comparing "holders who have recently entered the market (0-1 month)" with "mid-term holders (1-5 years)". This comparison of holding age distribution provides more frequent and immediate insights into distribution behavior.

Figure 5: The currency holding age distribution ratio provides valuable market insights

We found that when 1–5 A sharp decline in the ratio of annual holders relative to new holders has historically coincided with Bitcoin price tops. On the contrary, when the ratio rises rapidly, that is, more Bitcoin flows into the hands of more experienced investors, it is often a precursor to a major price increase.

Changes in long-term investor behavior are one of the most effective ways to assess the sustainability of market sentiment and price movements. Historical data shows that long-term holders often outperform short-term traders in terms of profit performance by buying in panic and holding for a long time. By analyzing the age distribution structure of Bitcoin, we can more accurately capture market tops and bottoms without relying on price movements or short-term sentiment.

Conclusion

At present, long-term holders have only slight shipping behavior, which is far from reaching the scale at the top of previous cycles. There is indeed some profit taking, but the pace at which it occurs appears to be completely controllable and belongs to a healthy market environment.

Taking into account the current bull market stage and the participation of institutional and retail investors, the data shows that we are still in a structurally strong stage, and there is still room for further price growth against the backdrop of continued inflows of new funds.