Singapore’s Davis Commodities announces it will buy $12 million in Bitcoin: Tokenizing sugar, rice and oil targets the RWA market

Singaporean agricultural product trader Davis Commodities Limited (Nasdaq: DTCK) announced on the 16th the launch of a US$30 million strategic growth plan. It will first allocate 40% of the funds as Bitcoin reserves, and the other half will be used to tokenize physical assets such as sugar, rice and edible oil.

(Preliminary summary: Metaplanet added $210 million in Bitcoin positions, "surpassing Coinbase", and BTC exceeded 10,000 and jumped to the seventh largest company)

(Background supplement: Japanese game company Gumi bought 1 billion yen in Bitcoin, and the next step is to launch a crypto fund specializing in institutions)

Singaporean agricultural product trader Davis Commodities Limited (Nasdaq: DTCK) announced the launch of 3,000 on the 16th The US$10,000 strategic growth plan will first allocate 40% of the funds as Bitcoin reserves, and the other half will be used to tokenize physical assets such as sugar, rice and edible oil. The company said the move would strengthen its balance sheet and create new revenue streams.

Bitcoin accounts for 40%, RWA tokenization targets the US$16 trillion market

In the first phase, Davis Commodities will first allocate US$4.5 million (15%) to establish Bitcoin reserves, with the ultimate goal of raising it to US$12 million, accounting for 40% of the total plan.

The company’s press release stated that Bitcoin will surge by 156% and 121% respectively in 2023 and 2024, and has risen by more than 14% so far in 2025. Management estimates that it is expected to bring significant investment income within 36 months, adding a buffer to the already volatile cash flow of agricultural products trading.

At the same time, US$15 million in the plan will be used to tokenize stocks such as sugar, rice and cooking oil, thereby increasing transparency and reducing settlement time. According to public information, the RWA tokenization market size is expected to reach US$16 trillion in 2030. The company estimates that the project will generate an additional $50 million in annual revenue within 24 months. The remaining US$3 million will be invested in technical infrastructure and information security to ensure seamless integration of on-chain and offline processes. The company's CEO said:

"This is a key step in reshaping the global commodity trade pattern."

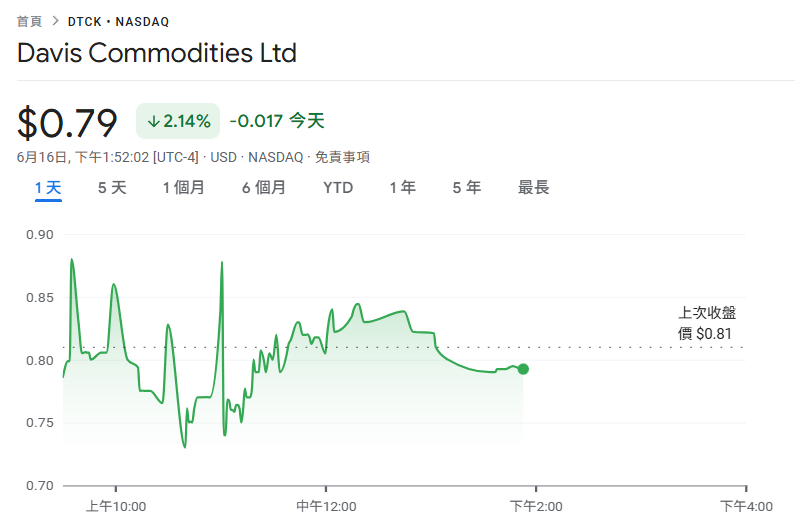

Share price reaction and potential risks

However, after the news was announced, Davis Commodities Limited stock DTCK did not seem to be particularly motivated. The stock price fell by 2.14%, temporarily trading at US$0.79, with a market value of approximately US$19.41 million.