Coin price rise vs. reserve strategy: Who has more credit for driving Bitcoin company stock prices to soar?

How does MicroStrategy’s Bitcoin treasury strategy affect stock prices? How much is the reason for BTC price? This article originates from an article written by Tom Lee and is organized, compiled and written by Deep Chao TechFlow.

(Preliminary summary: Jack Dorsey payment company Block landed on the "S&P 500 Index", and the stock price jumped 8.5%! Stick to investing in Bitcoin)

(Background supplement: Peter Thiel's exchange Bullish applied to be listed on the New York Stock Exchange, stock code BLSH, Bitcoin trading volume ranks among the top five in the world)

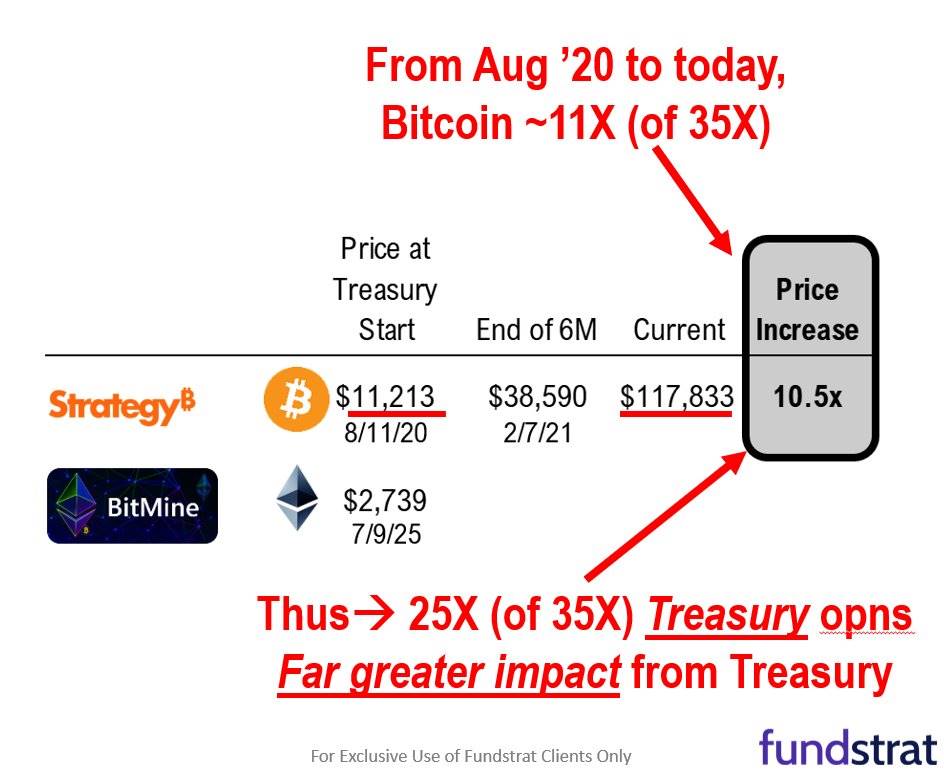

Case study: $MSTR created a template for cryptocurrency treasury strategies. Strategy's stock price has soared from $13 to $455 since the $BTC strategy began in 2020.

Question: How much of the stock price increase is attributable to rising Bitcoin prices and how much to crypto reserve strategies?

Behind the 35x increase in $MSTR stock price:

- The 11x increase in Bitcoin ($BTC) price from $11,000 The rise to $118,000

- The 25x increase is due to the treasury strategy

- That is, the increase in the number of Bitcoins held per share

In other words: the impact of the treasury strategy far exceeds the increase in the token price.

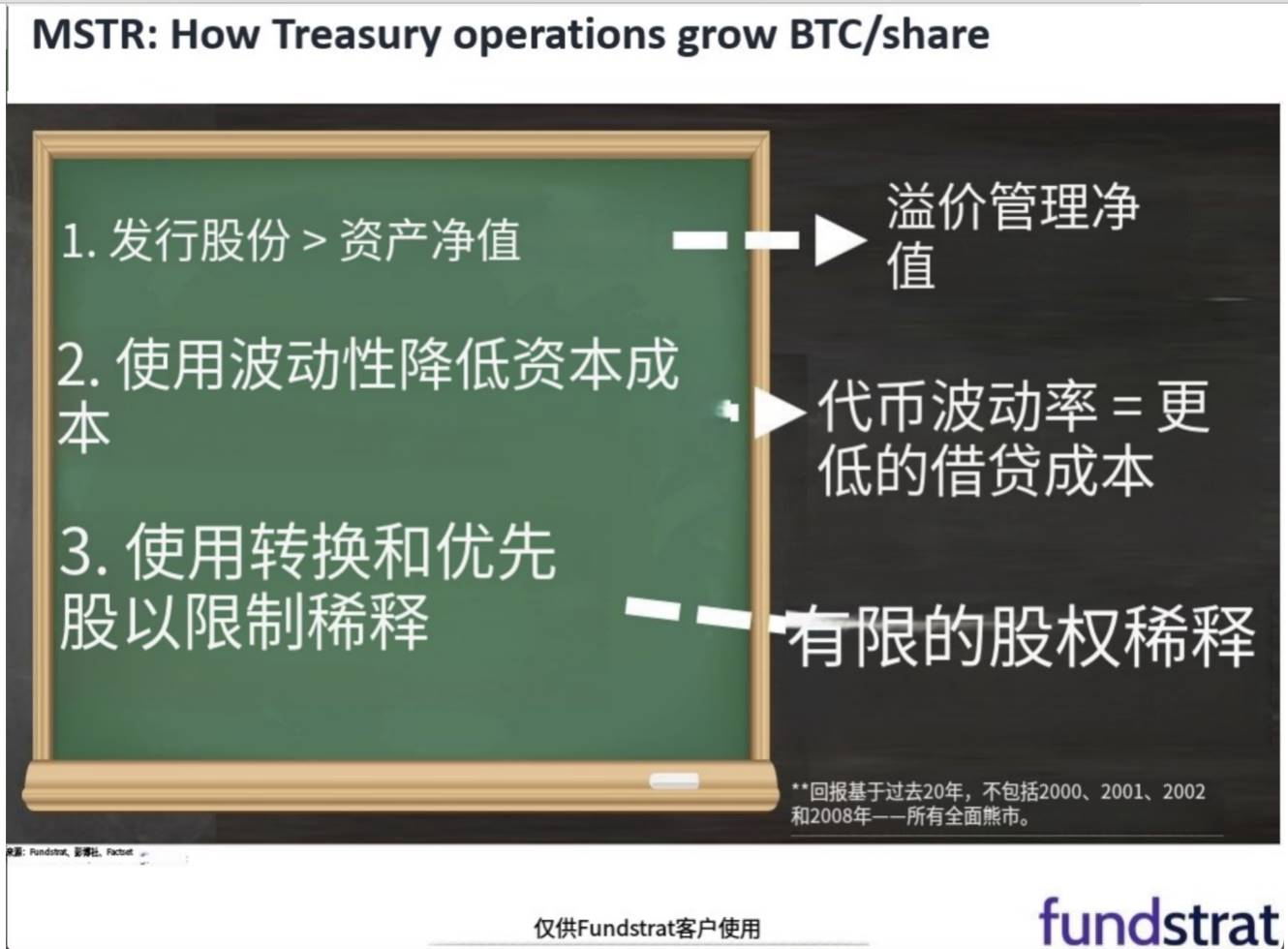

$MSTR's treasury DAT (Digital Asset Treasury, Digital Asset Treasury) Treasury) strategy increases the number of tokens held per share by:

- Issuing shares > P/NAV (Price to Net Value) = Number of tokens per share rising

- Token price volatility reduces borrowing costs = higher return on investment (ROI)

- Using convertible bonds/preferred stock = limits dilution

By the way:

- $ETH is more volatile than $BTC

- So this volatility affects ETH DAT more than BTC DAT.

@grok produced the following table (excerpt)

Deep tide note: This table shows some of the financing activity of MicroStrategy (MSTR) since it started using Bitcoin as part of its treasury in 2020. This includes internal cash, Convertible Senior Notes, Senior Secured Notes, Secured Loans and the ATM Equity Program, with almost all funds used to purchase Bitcoin.

Bitmine announced its ETH treasury strategy on June 30, 2025, and completed the transaction on July 9, 2025.

$MSTR’s example shows that buying tokens can:

- Increase the number of tokens per share

$BMNR 7 days after initial transaction:

- Acquired $1 billion worth of ETH

- $MSTR acquired $250 million in tokens in the same timeframe