Silver hits another all-time high above $76! Market value approaches $4.3 trillion, overtaking Apple, analysts: There is room for upside next year

Silver keeps rising! On December 27, the spot silver price broke through 76 US dollars per ounce in one fell swoop, setting a new all-time high again. The increase during the year has reached as high as 160%.

(Preliminary summary: The status of the US dollar is shaken? Analysts: Gold and silver will continue to rise in 2026, and Bitcoin is expected to catch up with the rise)

(Background supplement: Silver broke through 70 US dollars and hit a new all-time high! The market value is approaching 4 Trillion US dollars, is the next step to overtake Apple and Huida? )

The international precious metal market is still hot at the end of the year, and spot silver prices continue to rise, setting historical records for many consecutive days, becoming the biggest highlight of the commodity market in 2025. On December 27, the spot silver price broke through 76 US dollars per ounce in one fell swoop, setting a new all-time high again, with an increase of 160% during the year; New York COMEX silver futures performance was equally strong, with the main contract soaring 7% within the day, also setting a new historical high again.

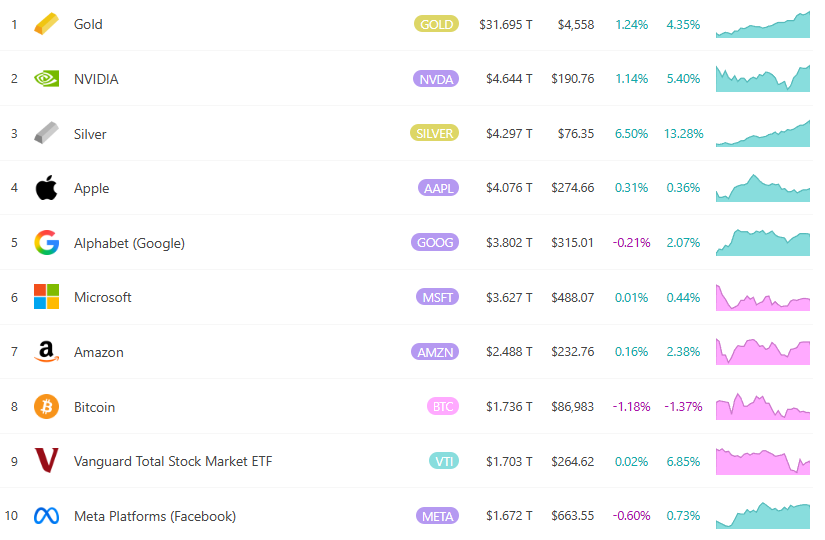

Silver has jumped to become the world's third largest asset

As silver prices hit new highs, its total global market value has exceeded the US$4.2 trillion mark and is close to US$4.3 trillion, surpassing the technology giant Apple (market value of approximately US$4.076 trillion) and becoming the third largest asset in the world, second only to gold (approximately US$31 trillion) and Huida (approximately US$31 trillion) 4.6 trillion U.S. dollars).

Analyst: Gold and silver still have room to rise next year

The main reasons for silver's strong rise this year include several aspects: First, the structural imbalance between global supply and demand continues to expand, with the silver gap expected to exceed 200 million ounces in 2025, and inventories continue to shrink; secondly, industrial demand has exploded, including photovoltaic solar energy, electric vehicles, and AI. The amount of silver used in fields such as data centers and semiconductors has increased significantly; in addition, expectations of interest rate cuts by the U.S. Federal Reserve, geopolitical tensions, the weakening of the U.S. dollar, and silver's inclusion in the U.S. list of critical minerals have all attracted a large inflow of investment and safe-haven funds.

Since the beginning of this year, silver has experienced a cumulative increase of more than 160% from about $30 at the beginning of the year. Although gold’s 80% increase is equally eye-catching, it still lags behind in comparison. In this regard, in the face of the recent market conditions in which gold and silver have continued to rise, but Bitcoin has continued to retreat, Ramnivas, director of economic research and corporate research at the research institution GlobalData. Ramnivas Mundada (Ramnivas Mundada) pointed out that this is not a simple risk aversion, but a deeper structural change. He believes that the international monetary system is gradually moving from a unipolar structure with the US dollar at its core to a more multipolar structure. According to its forecasts, gold prices still have room to rise by 8% to 15% by 2026, while silver prices may rise by 20% to 35%.

It is also worth mentioning that Robert Kiyosaki, the author of "Rich Dad Poor Dad", also boldly predicted in November that silver will rise to $100 or even higher in 2026. He believes that silver still has huge potential, driven by currency depreciation and industrial demand.