How to achieve 40% annualized returns through Polymarket arbitrage?

Practical analysis of prediction market arbitrage strategies: Using the cross-market price differences of the Polymarket platform to lock in arbitrage space through three different hedging strategies, the annual return rate can reach 41%. Detailed explanation of the key points of firm operation and risk control. This article originates from the article Arbitrage in Polymarket. 30.000$/month. written by @igor_mikerin BlockBeats. It is organized, compiled and written by BlockBeats.

(Preliminary summary: Assets dropped to zero in one week after making a profit of US$4 million: The fall of the sports gambling king of Polymarket)

(Background supplement: Polymarket announced its return to the United States: it was approved by the CFTC to operate an intermediary trading platform as a "designated contract market")

Contents of this article

As the U.S. election approaches, trading in the prediction market continues to heat up. On December 9, 2025, the discussion about Polymarket arbitrage on the X platform focused on cross-platform spreads, automated trading robots, and hidden risks. With the frequent occurrence of price differences between Kalshi and Polymarket and the continuous improvement of technical thresholds, the prediction market is evolving from a "speculation field" to a real arbitrage infrastructure.

Short-lived opportunities, thin liquidity, rule differences and black swan events remain major challenges. The author of this article uses a real offer to demonstrate the arbitrage structure, providing a clear reference for the increasingly fierce arbitrage competition in the prediction market.

The following is the original text:

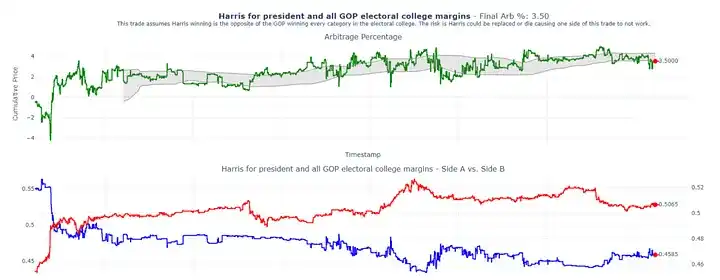

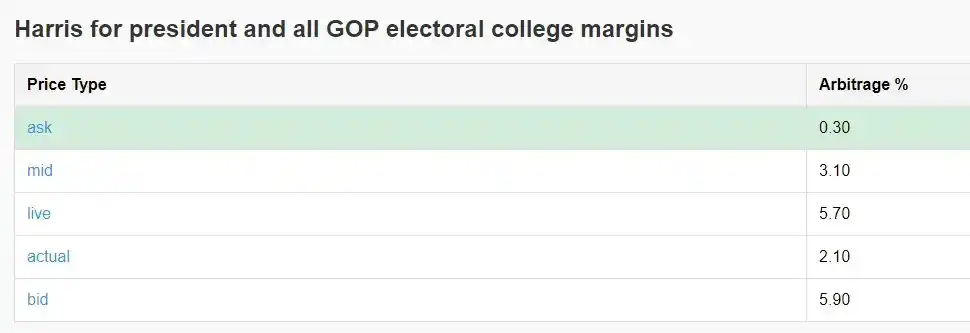

Arbitrage 1: Buy "Harris is elected president" and simultaneously buy all the results of "Republicans win different electoral college vote margins"

This strategy is quite straightforward: Bet on Kamala Harris to win the presidential election while buying all possible Republican victory margins in the Electoral College. In essence, these two types of positions hedge each other. If the total price of both positions is less than 1, then the difference is the rate of return that can be locked - that is, the arbitrage space. As of today, the arbitrage margin on the deal is 3.5%, with 41 days until the election. Converted to an adult, this equates to approximately 41% annualized compensation.

The diagram below shows how I structured this deal. You can see that I bought close to the same amount of shares in almost every possible outcome.

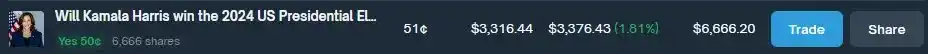

This is my position on Polymarket.com. You can see that I basically bought the same amount of shares on every possible outcome.

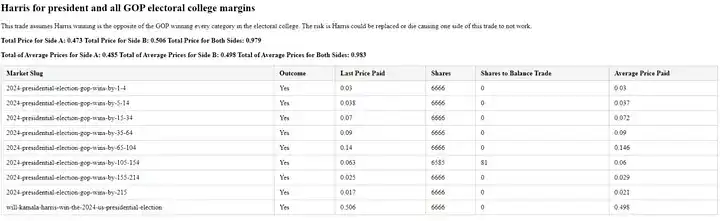

This is a summary of my real-time orders on Polymarket. The average cost of these positions is 0.983, which means my expected return is 1 – 0.983 = 1.7%. My most recent trade had a cost basis of 0.979, which corresponds to a yield of 2.1%.

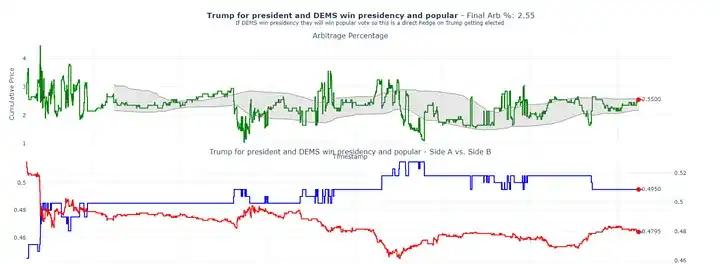

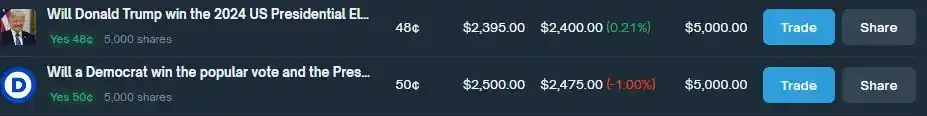

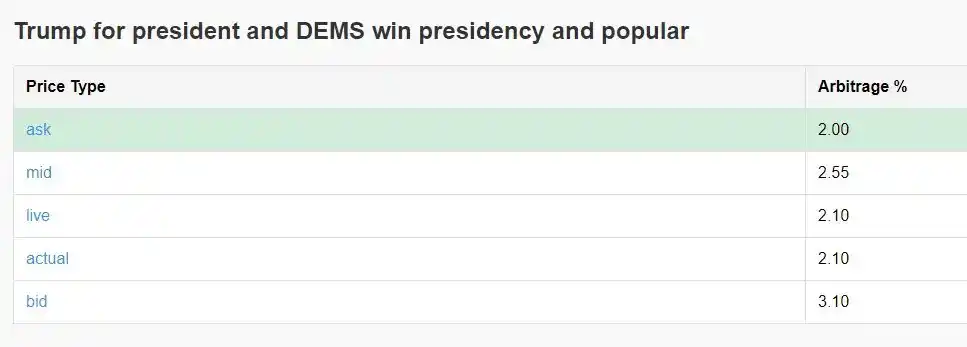

Arbitrage 2: Bet on Trump's election and hedge with "Democrats win the popular vote + win the presidency"

This strategy currently shows 2.55% arbitrage space. In this combination, we bet on Trump to win and hedge by betting on the Democrats to win both the popular vote and the presidency. While this is not a perfectly equivalent hedge (as it is possible for a Democrat to win the presidency without winning the popular vote), according to my model, the odds of this happening are extremely low. Therefore, I think this hedging structure is robust.

Here are my actual transactions, you can see that I held the same number of shares on both sides of the bet.

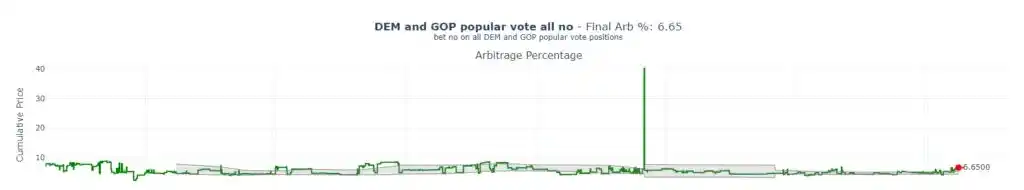

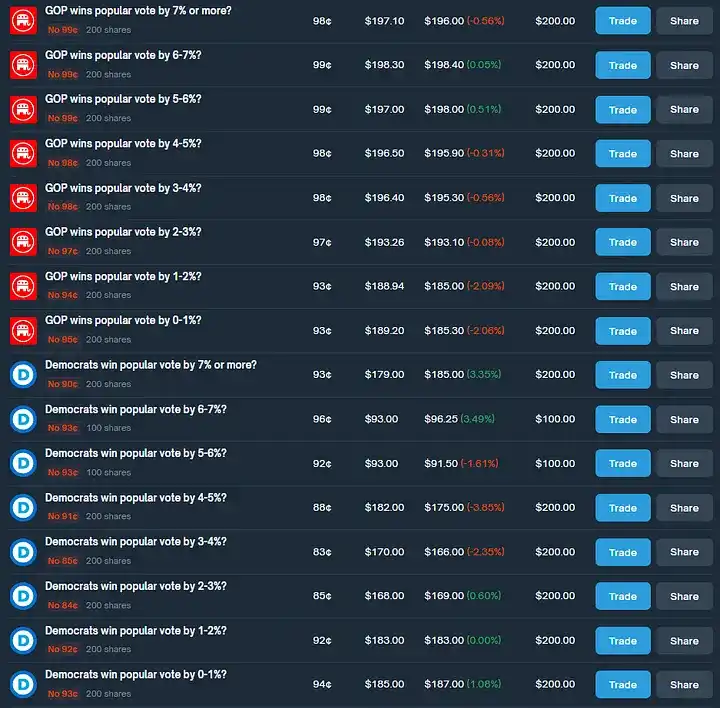

Arbitrage 3: Buy "No" for all possible outcomes of the Democratic and Republican popular votes

In this transaction, I bought the "No" option for all possible outcomes of the popular vote. Currently, the room for this arbitrage is 6.65%.

The following is the order I actually placed. All but 1 of these trades would have won on election day. Therefore, the total profit from all winning positions on these trades (minus 1 loss) needs to be greater than the amount of that loss.

Be sure to read the rules carefully

An important tip: Be sure to read the rules of each market carefully. Some positions look like arbitrage opportunities, but may hide huge risks. For example, if a candidate is assassinated, even if you think you have set up a "sound arbitrage", you may lose all your principal.

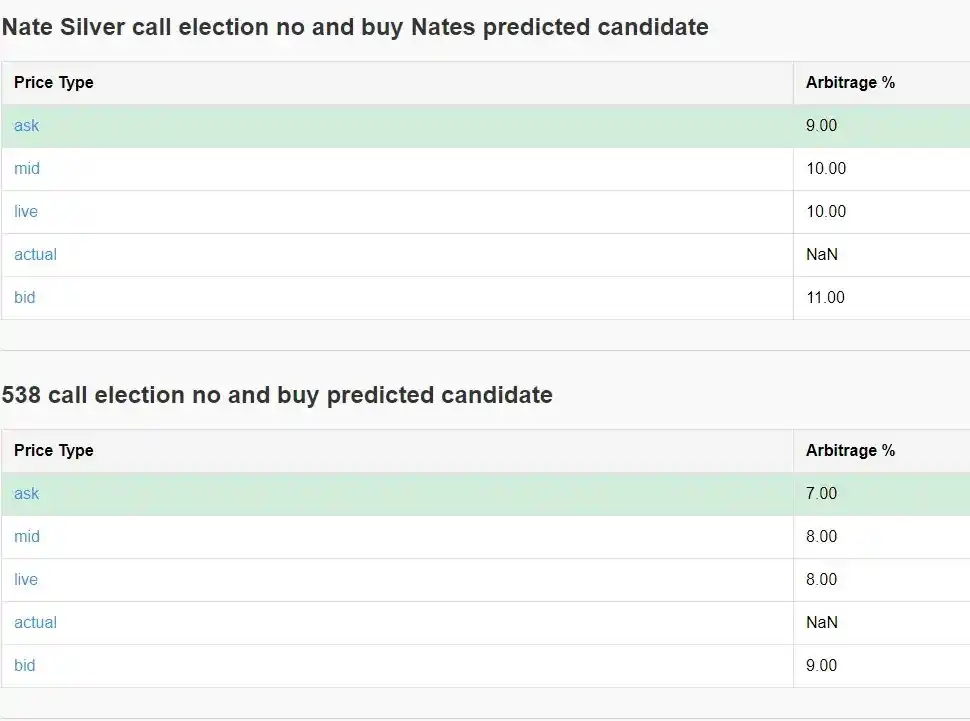

Spreads Matter

One of the biggest challenges I encounter is market shocks. Due to the low liquidity of the platform, once I place an order, I tend to push the price of the entire market in my direction. This will cause deviations between the buying price, selling price, middle price, real-time price and the actual transaction price. Below is a typical example that occurred in the transaction mentioned earlier.

Good luck!

[Original link]