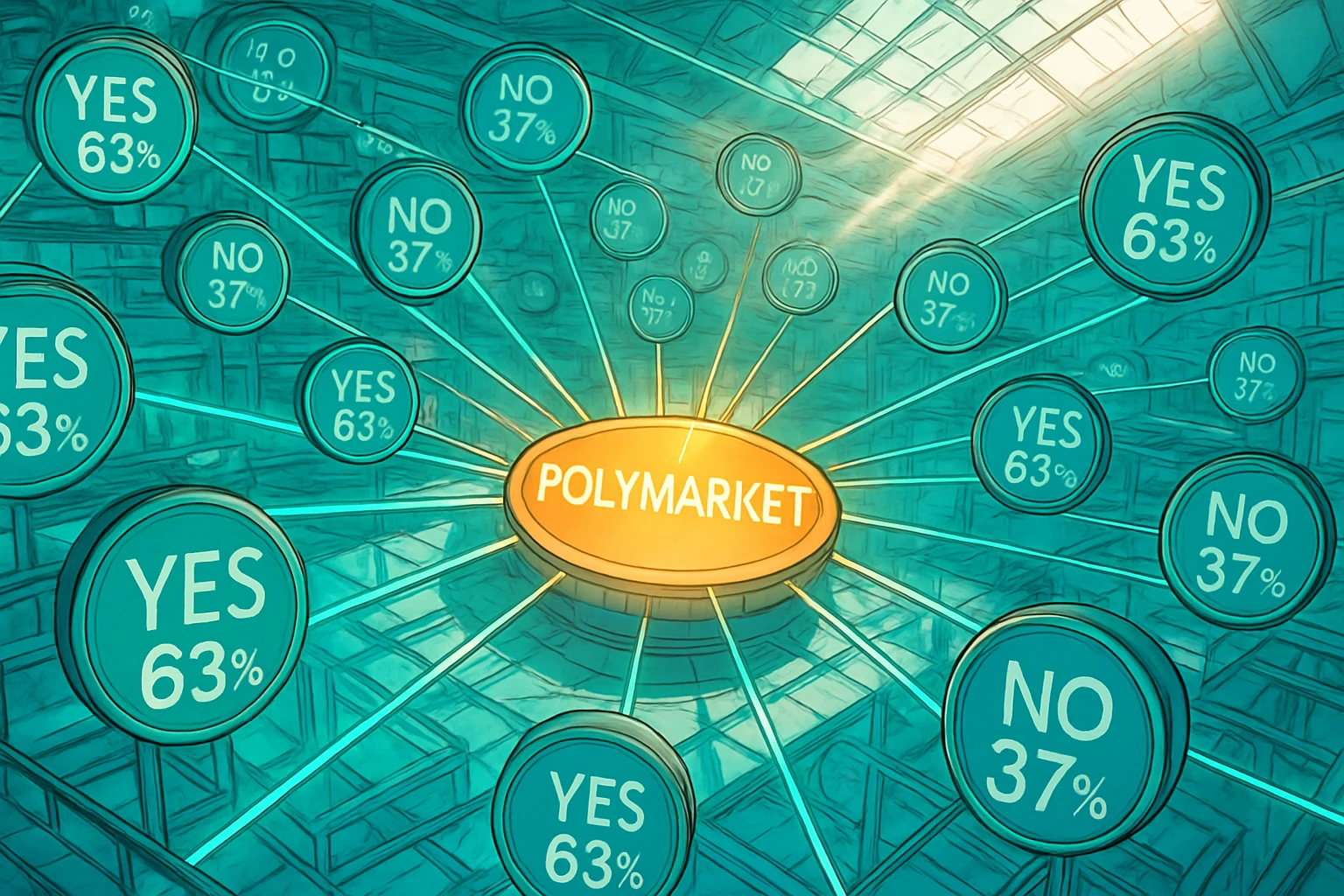

U.S. Survey: Half of high-income young people have abandoned financial advisors because there are no "cryptocurrency services"

An investigation in the United States by Zero Hash, a stablecoin issuer, found that young, high-income customers canceled financial advisory appointments because they did not have “cryptocurrency services.”

(Preliminary summary: Binance and Franklin Templeton join hands! Promote digital asset products and plans)

(Background supplement: Bitwise survey: 99% of invested cryptocurrency advisors will maintain or increase their investment in 2025)

Contents of this article

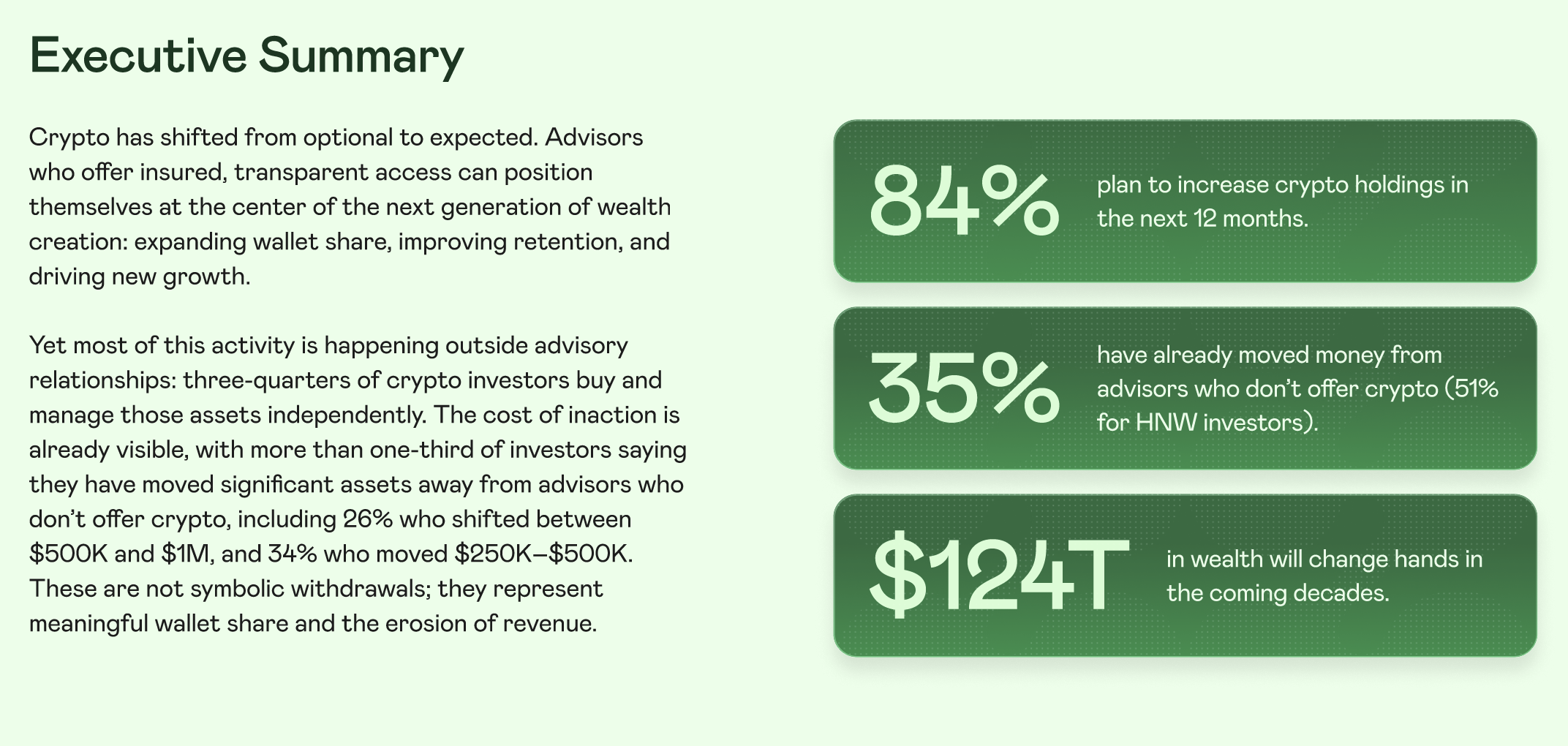

The appearance of financial advisory companies in Manhattan is still glamorous, but the customer management funds behind them are losing. The latest survey released by Zero Hash, a stablecoin issuance infrastructure, in November pointed out that 35% of high-income people in the United States aged 18 to 40 have changed financial advisors due to the inability to obtain "encrypted asset services."

For high-income investors with an annual income of more than $500,000, this proportion jumps directly to 50%. The departure of funds proves that cryptocurrencies are an important part of wealth management for the younger generation.

The scale and speed of capital outflows

The report shows that the funds leaving the country mainly fall in the range of US$250,000 to US$1 million, which is the most profitable battle zone for most independent financial advisors (RIAs) and private banks. Overnight, the originally stable fee income turned into thin air. What’s even more cruel is that most of the customers who leave are those who are most likely to be promoted to the ultra-high net worth class in five years, which is equivalent to emptying out future profit lines in advance.

Besides the amount, speed is the real warning sign. Young customers rarely have the burden of having close relationships with advisors. Once they discover that they can buy spot Bitcoin ETFs with a FinTech button on their mobile phones, and get compliant custody and insurance at the same time, the transfer process is often completed on weekends. When competitors use API connections to close deals while account managers are scheduling calendars, trust has evaporated.

"Allocation" rather than "Gamble"

Many traditional banks still misunderstand the crypto market as a simple casino, but the data gives the opposite signal. The Zero Hash survey found that 84% of respondents plan to increase their holdings of crypto assets again next year, and 92% expect advisors to provide multiple token options other than Bitcoin and Ethereum. The core of the demand is not speculation, but the inclusion of cryptocurrencies in the complete asset allocation and rebalancing process. Avaloq and Morgan Stanley's long-term observations also indicate that Millennials want to move into a familiar framework of regulation and insurance, rather than working alone on an exchange.

Zero Hash The report concluded:

Cryptocurrency has become the standard for modern asset allocation

For consultants, the importance of encryption infrastructure has been alongside that of online banking and telephone customer service. This represents a structural gap in the entire revenue pipeline.

Financial Advisors’ Survival Choices

Facing changes in user behavior, there are only two options: upgrade or be eliminated. For financial advisors, upgrading is not about changing investment views, but quickly accessing secure and compliant encryption infrastructure to provide them. Diverse paths such as ETFs, direct token holdings, or third-party custody will not turn the advisor into a trader, but will continue the advisor’s value dominance in the overall asset allocation.