Say goodbye to buying houses and speculating in stocks, the younger generation will use cryptocurrency as the main battlefield for wealth

Young investors such as Generation Z and Millennials are more inclined to actively invest than any previous generation, are more willing to embrace non-traditional assets, and regard cryptocurrency as a core component of the future of personal finance.

(Preliminary summary: Hollywood director Carl Rinsch misappropriated Netflix investment to speculate in stocks and currencies. He once made a huge profit of 27 million US dollars in Dogecoin, and now faces a 90-year sentence)

(Background supplement: The US military is addicted to stock speculation and currency speculation, and everyone on the aircraft carrier deck is "recommending stocks")

Contents of this article

Z Younger investors, such as Generation X and Millennials, are more inclined to proactively invest than any previous generation and are more willing to embrace non-traditional assets.

For decades, Americans’ wealth accumulation path has been almost the same: find a good job, buy real estate, invest in stocks, and then wait for time to bring compounding returns. Our latest "Cryptocurrency Industry Report" shows that the younger generation of investors no longer believe in this traditional path and are adjusting their investment behavior.

To understand how different generations are responding to the market and the role cryptocurrencies play in their investment portfolios, Coinbase conducted a survey in partnership with Ipsos, interviewing 4,350 U.S. adults, including 2,005 investors with investment accounts. The core conclusions of the survey are as follows: Young investors such as Generation Z and Millennials are more inclined to actively invest than any previous generation, are more willing to accept non-traditional assets, and are more likely to regard cryptocurrency as a core component of the future of personal finance.

The generation excluded from the traditional wealth ladder

Young investors are far more optimistic about the economy than the older generation, but they believe that the existing financial system is not designed for them. Survey data shows that nearly 70% (73%) of young people say that compared with their parents’ generation, it is more difficult for their generation to accumulate wealth through traditional channels; while only 57% of the older generation hold the same view.

They have witnessed rising housing costs, mounting student debt and sluggish wage growth. Against this background, more and more young people are beginning to seek alternative wealth accumulation methods beyond the traditional model of "home equity + stock investment portfolio".

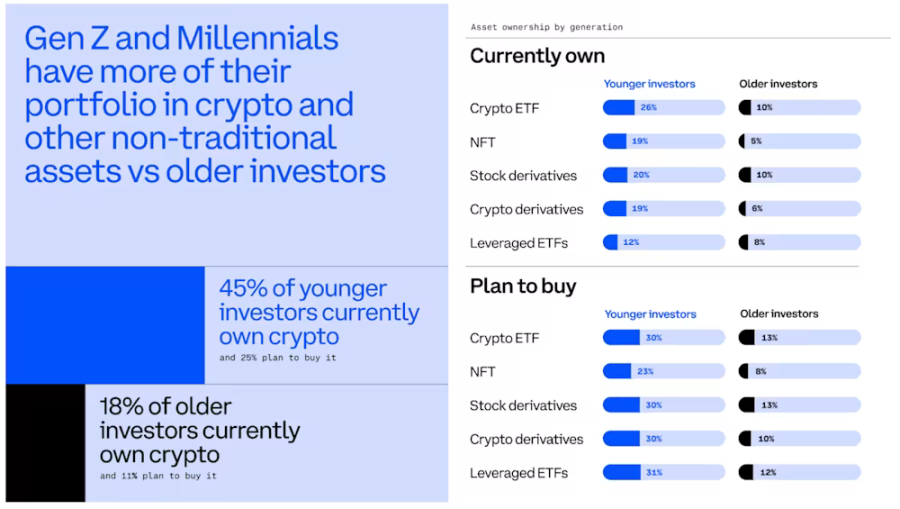

The proportion of non-traditional asset allocation is three times that of the older generation

This anxiety is directly reflected in their asset allocation strategies. Research shows that young investors allocate 25% of their portfolios to non-traditional asset classes such as cryptocurrencies, financial derivatives, non-fungible tokens (NFTs) and other emerging products. This is three times the share of older generations of investors, who only have 8% of their allocation to non-traditional assets.

The stock holding proportions of different generations are roughly the same. The core difference is that young investors have added more diverse allocations in addition to stocks. They are more actively seeking income opportunities beyond traditional stock dividends, and in order to narrow the wealth gap, they are more willing to try various new investment tools and emerging markets.

Cryptocurrency is by no means a sideline investment, but a core configuration

This generational change in investment philosophy is most vividly reflected in the acceptance of cryptocurrency. The report shows that 45% of young investors already hold cryptocurrencies, compared to just 18% of older generation investors. Additionally, nearly half (47%) of younger investors want to be the first to gain exposure to new cryptoassets before the general market does, compared to just 16% of older investors.

In the eyes of the younger generation, cryptocurrency is by no means a mere speculative transaction, but an important way to help them catch up with wealth. 80% of young people believe that cryptocurrency has provided their generation with more financial opportunities outside of the traditional financial system; at the same time, another 80% of young people firmly believe that the status of cryptocurrency in the future financial system will be greatly improved. Among the older generation of investors, only about 60% agree with this view.

The younger generation’s enthusiasm for exploring emerging markets goes beyond spot cryptocurrencies. They are also eager to be exposed to more non-traditional assets. Data shows that 80% of young investors express their willingness to try new investment opportunities first, while less than half of the older generation hold this attitude. Young investors have always had a strong interest in emerging non-traditional products such as cryptocurrency derivatives, prediction markets, 24×7 stock trading, early token sales, altcoins, decentralized financial lending and so on.

The impact of this trend on the future market

Young investor groups have shown completely different characteristics: they trade more frequently, are willing to take greater risks in pursuit of higher returns, and shift a considerable proportion of their investment portfolios to non-traditional assets with cryptocurrency as the core. At the same time, they are promoting the transformation of the entire financial industry in a direction that is more suitable for the needs of the Internet-native generation, creating a platform that operates around the clock and supports multi-asset transactions.