Don't panic! Over 2 million ETH are queuing up to be unstaking, let’s first understand the reason

Ethereum's large-scale unstaking was due to the security precautions taken by the service provider Kiln to withdraw the verification nodes. This move is not a sell-off, most ETH is expected to be re-pledged, and there is no need for the market to panic.

(Preliminary summary: The Ethereum staking market has reversed! 830,000 ETH are queuing up to be pledged and overtaken to unpledge. Is ETH going to rise?)

(Background supplement: The Ethereum staking market continues to expand! 1.07 million ETH is queuing to be unpledged and 730,000 ETH is waiting to enter, but there is one thing worth paying attention to)

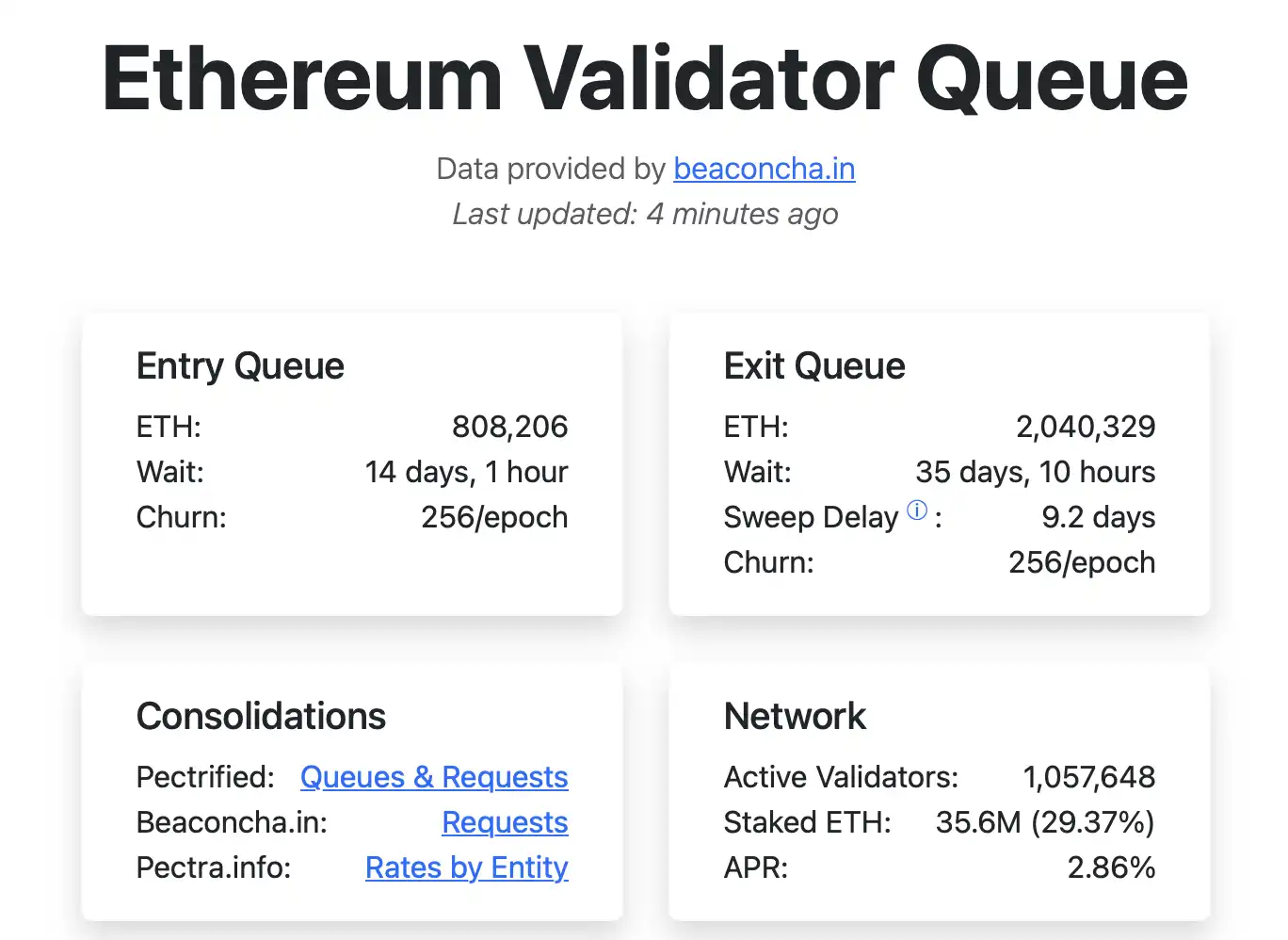

Ethereum pledge tracking website Validator Queue Data shows that as of 16:00 pm on September 10th, Taipei time, the number of ETH queued to be unpledged on the Ethereum network has surged to 2,040,329 pieces, almost double the historical peak of 1,058,531 pieces set on August 29, and the withdrawal time has been significantly delayed to about 35 days 10 Hours; At the same time, the number of ETH currently queued for staking is temporarily reported to be 808,206 pieces, and the admission queue length is approximately 14 days and 1 hour.

It is rare for such a large-scale ETH to suddenly be unstaking. Is any super whale about to retreat? If this is true, millions of selling pressure will inevitably have a huge whale impact on ETH and even the entire cryptocurrency market...But after we comprehensively understand the market dynamics related to this, we find that there are actually traces of this matter, and users with ETH positions do not need to panic too much.

The cause of the incident starts with a security incident yesterday. On the evening of September 8, 192,600 SOLs (valued at approximately US$41.3 million) were stolen from Switzerland-basedcryptocurrency platform SwissBorg . Later, SwissBorg revealed that the theft was due to a staking partner’s API being compromised, which allowed hackers to access the staking wallet and transfer related assets without authorization.

The hacked partner was later found to be the staking service provider Kiln, which later issued an announcement saying: "SwissBorg and Kiln are investigating an incident that may involve unauthorized access to the wallet for staking operations. We were informed of this earlier on September 8, 2025. The incident resulted in an SOL in the wallet used for staking operations. The tokens were transferred abnormally. After discovering the situation, SwissBorg and Kiln immediately activated the incident response plan, curbed the relevant activities, and contacted our security partners. SwissBorg has suspended Solana staking transactions on the platform to ensure that other users are not affected. "

So what does this have to do with the centralized de-staking of ETH? The key reason is thatKiln is not a staking service provider that only focuses on the Solana ecosystem. Its staking services cover almost all PoS networks, which naturally includes Ethereum.

This morning, Kiln officially announced again that "for security reasons, all its ETH will be withdrawn in an orderly manner" Pledge", the main content of its announcement is as follows:

Following yesterday's announcement regarding the Solana incident involving SwissBorg, Kiln is taking additional precautions to ensure the security of all online client assets. As part of its response, Kiln began an orderly withdrawal of all of its Ethereum (ETH) validator nodes today. This exit procedure is a precautionary measure designed to ensure the ongoing integrity of the pledged assets.

This decision prioritizes the interests of customers and the wider industry and is based on collaboration with key stakeholders and advice from leading security companies.

Customer assets remain safe at all times. The withdrawal process is expected to take 10 to 42 days (the specific length varies depending on the validator), after which the network will complete the withdrawal of funds within 9 days as planned. Validation nodes can still receive rewards during the exit period. The delay is enforced by the protocol layer based on the number of exiting validator nodes and cannot be changed by Kiln.

Withdrawals are automatically handled by the Ethereum protocol and will be returned directly to your wallet or the smart contract used in the wallet staking process, where they can then be withdrawn.

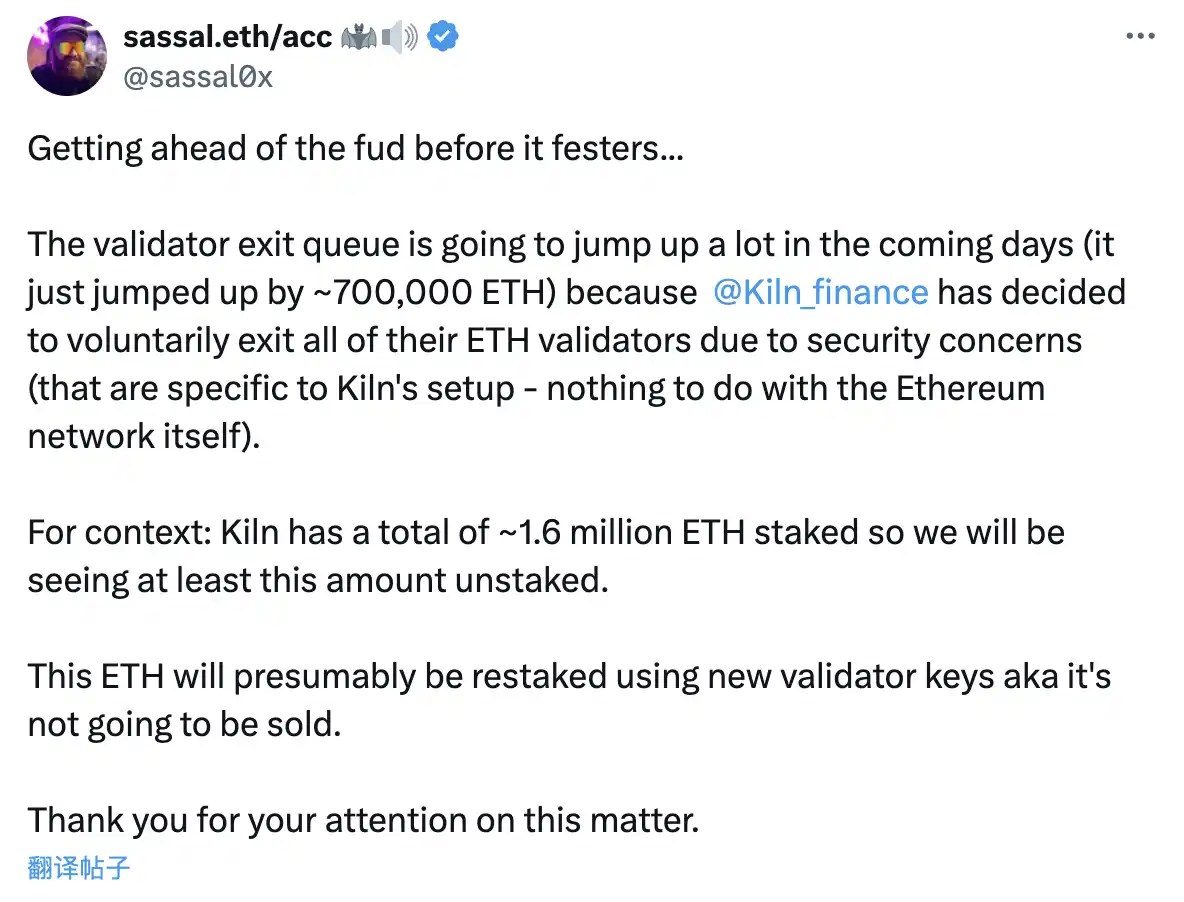

According to disclosures from well-known Ethereum developer sassal.eth, Kiln has pledged a total of about 1.6 million ETH, so the market may see a corresponding size of ETH appear in the unpledge queue in a short period of time, but this does not mean that these ETH will be sold. Kiln may use the new verification node key to put these ETH back into pledge.

In short, the surge in the number of ETH queuing up to be unstaked today is essentially Kiln's risk aversion operation. Most of these ETH belong to exchanges like SwissBorg. Customers who pledge through Kiln's servicesAlthough it is not ruled out that some customers will take this opportunity to sell, it is expected that most of the ETH will be pledged again through Kiln (after risk elimination) or other pledge solutions, so the market does not need to panic excessively.