Analyst: If Bitcoin does not reach 112,000, there is no reason to be bullish. Has BTC bottomed out based on its fair and realized price?

Bitcoin did not fluctuate much over the weekend. Let’s take a look at how market analysts observe the changes in BTC’s market outlook.

(Preliminary summary: US$1.8 billion cashed out, can Bitcoin survive?)

(Background supplement: Why did Bitcoin hit US$103,000? This week’s tens of billions of liquidations triggered a large withdrawal of ETF funds)

Bitcoin became less volatile during the weekend and continued to fluctuate within a narrow range between US$106,000 and US$108,000. It was currently trading at US$106,891 at the time of writing. Crypto KOL Ansem earlier posted on X that unless Bitcoin returns above $112,000, it will not change its view on the market turning bearish.

I am absolutely not bullish on this market, just looking at the SFP (swing failure pattern) on the weekly charts of XRP, SOL and ETH.

This reminds me of the SFP type that will appear in LTC in 2021. Combined with the fact that BTC is now back below its 2024 all-time highs, I don’t see any bull case.What I see is momentum ending and prices starting to weaken and slide. A large 10-month allocation period is coming to an end. There is no new narrative for the market either.

MSTR peaked in November 2024 and is now below the 200-day moving average for the first time since 2023, with even this line turning into a resistance level.ETH/BTC has had a rally, as it does at the end of every cycle.

The only scenario where I would change my opinion is -BTC is back above 112K ($112,000).

There’s is no way for me to be bullish on this market looking at the sfps on XRP, SOL & ETH weekly charts. It reminds me of the sfp that Ltc had in 2021 and when I couple this with BTC trading back below its 2024 ATH. I don’t see a bull case. I see an end of momentum and price…

— Ansem (@blknoiz06) October 19, 2025

Fair price: a value anchor through bulls and bears

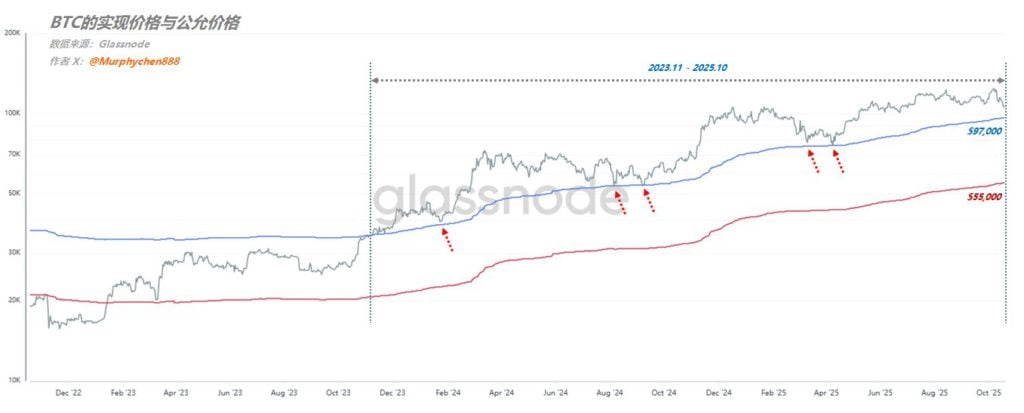

Another analyst Murphy drew the realization and fair price of Bitcoin to help investors judge the current BTC Where is the price?

. The realized price is the weighted average of the price of each BTC when the last on-chain transfer occurred, which represents the average cost price of all existing BTC in the entire market. This price standard is usually significantly lower than the market price of BTC, mainly because the long-term holding of BTC after early low-cost purchases has pulled down the overall average.

. The fair price is to calculate the historical cumulative average of mvrv and derive the long-term average valuation level of the market. If the market valuation level (mvrv) is at the historical average, then the price of BTC should be around this level. Therefore, fair price can be regarded as a "center of mean reversion."

In the past 10 years, in BTC In the past three cycles, the fair price (blue line) has almost served as the dividing line between bull and bear cycles. After the bull market starts, there is a high probability that BTC will not fall below the blue line even if there is a retracement; whenever the value returns, it will stimulate strong buying.

On the contrary, if BTC is suppressed by the blue line for a long time, it means that the market has ignored whether the price has returned to fairness and has begun to become cautious; everyone pays more attention to risk aversion than value. This is also the first signal that the foundation of the bull market is gradually disappearing!

As can be seen from the above figure, except for the 5.19 black swan event that caused the BTC price to break through the blue line, the other times were the beginning of bullish turns to bearish (marked 1).

Since then, BTC has entered a long-term downward trend, and there is a high probability that it will be lower than the realized price (red line); in other words, when the price is lower than the red line, it is the time of the deep bear; because this means that all investors holding BTC will lose money on average. The market has entered a period of despair, and it is also an excellent buying point that can only be found (mark 2).

In this cycle, since the hype of BlackRock's application for ETF, BTC has been operating above a fair price for nearly 2 years. It was close to the blue line three times during the period:

1. Sell the news after the adoption of ETF;

2. The liquidation of the Japanese yen carry trade in August 2024;

3. The tariff crisis in April 2025.But it has never fallen below, showing that when prices return, the market pays more attention to value than risk. Under the basis of the bull market, the return of BTC to a fair price is the best buying point.

The blue line is now at $97,000, and the red line is at $55,000; if you think the bull market foundation is still there, then buying when BTC is close to $97,000 will be very cost-effective. It can be said that BTC at this time has almost no bubble. If you think it has entered a bear market, you can continue to wait for the deep bear moment, and you may have a chance to pick up cheap chips below $55,000.

Therefore, the judgment of the bull-bear cycle will determine the broad framework of our trading strategy; if it is the former, it should be dominated by "buying thinking", and what we are waiting for is a cost-effective range. If it is the latter, then the "selling mentality" should be the leading factor, and we are waiting for the deepest pit that may appear in the next few years or even more than ten years.