Is DAT hype dying? SEC investigates 200 “crypto treasury companies” for insider trading

SEC and FINRA investigate more than 200 companies planning to use cryptocurrencies as treasury stocks, focusing on information disclosure and insider trading concerns

(Previous summary: Standard Chartered warned DAT digital treasury: the narrative is heading for a death spiral, and many mNAV fell below 1)

(Background supplement: The wind direction has changed! Bloomberg exploded Wall Street’s "questioning the DAT narrative": Strategy stock price plunged, the market lost confidence in cryptocurrencies )

Contents of this article

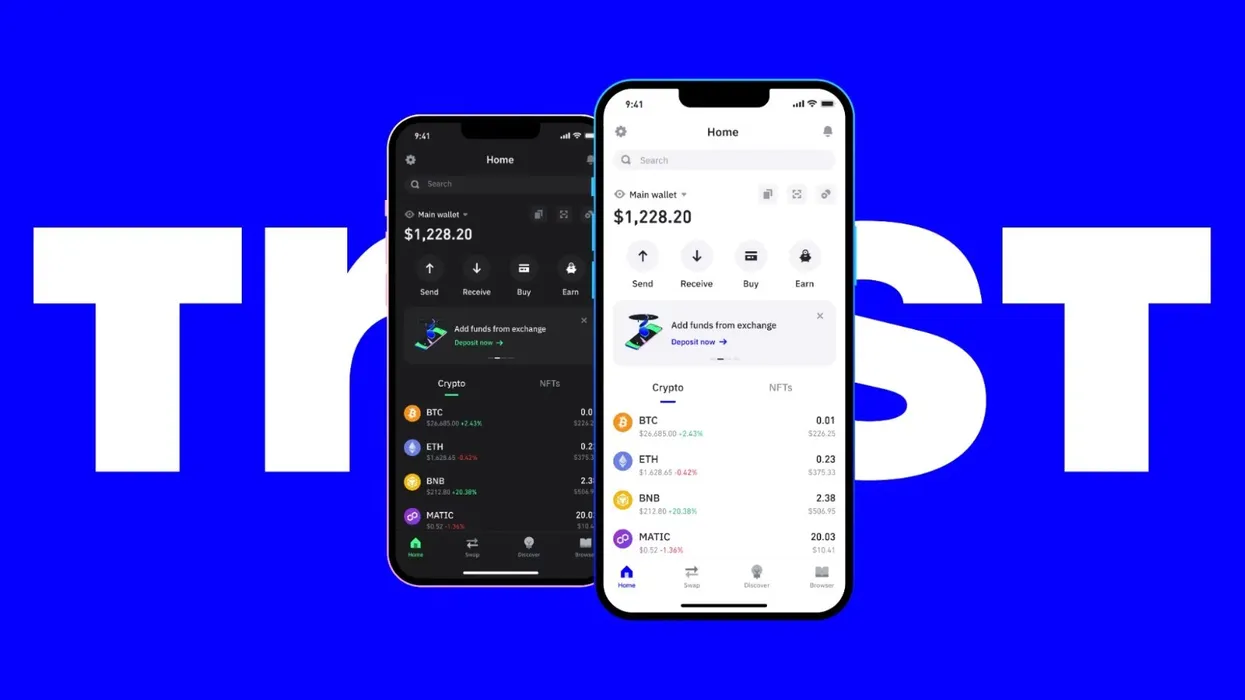

Cryptocurrency is pulling Wall Street and Silicon Valley into the same track, and now regulators have decided to set a clear dividing line. The U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) are simultaneously investigating more than 200 listed companies that have announced that digital assets such as Bitcoin will be listed as core treasury stock strategies to clarify the reasons for the abnormal surge in stock prices and trading volumes before major policy announcements. This is the first large-scale move since the Trump administration pledged to provide "clear rules" to the market, targeting the two red lines of fair disclosure and insider trading.

Multiple chaos: stock prices move first, announcements follow

According to statistics from encryption consulting firm Architect Partners, 212 new startups and listed companies plan to raise approximately US$102 billion this year to purchase cryptocurrencies and include them in treasury. Investigators found that before most companies disclosed the strategy, their stock prices and trading volumes suddenly rose like the air pressure outside the eye of a storm. The SEC invoked Regulation Fair Disclosure (Reg FD) to request disclosure of whether it had selectively shared non-public information with specific investors. Former SEC enforcement lawyer David Chase described these investigation notice letters:

"When these (investigation letters) are sent out, it will really stir up a pool of spring water."

The turn from "weaponization" to "clear rules"

SEC Chairman Paul Atkins recently criticized the previous leadership's tough enforcement of the encryption industry as "like using regulation as a weapon" and emphasized that the new government must provide predictable rules of the game. This investigation is seen as a touchstone for transformation: it must both warn of violations and explain the road map for the future.

Justin Platt, a partner at the law firm Goodwin, pointed out that companies usually require external investors to sign confidentiality agreements, but information may still leak out, causing prices to fluctuate violently before the plan is announced. He reminded:

“If the stock price fluctuates violently in the days before the transaction is priced, it may make it difficult to agree on the transaction price, and even expose the transaction to execution risks.”

Market shock cases have surfaced

The most striking example comes from Eightco. Shares soared more than 5,600% in just a few days after the company announced it would increase its Worldcoin holdings and consider adding Ethereum (ETH) to its treasury holdings. According to Stocktwits, this trend attracted a large number of short-term buying orders and also caused regulatory authorities to target it as a sample. The SEC clearly stated in the 2025 spring regulatory agenda that it will extend the scope of traditional brokerage record keeping regulations 17a-3 and 17a-4 to orders, custody and transfers involving crypto assets, and keep records throughout the process.

Next step: Compliance becomes the threshold for competition

The industry generally expects that once the investigation results are released, the "minimum line of defense" such as the disclosure time point, information synchronization scope and internal audit process will be set for the encryption treasury stock strategy. Companies that violate Reg FD may face civil fines or even criminal prosecution of their executives. More importantly, if the transaction is determined to contain insider elements, subsequent capital increases or merger and acquisition plans may be discounted by the market.

Cryptocurrencies were once regarded as wild children subverting financial rules. Now the magnifying glasses of SEC and FINRA remind all participants: No matter how new the asset form is, fairness and transparency are still the passport of the capital market. For enterprises, knowing how to keep a firm balance between innovation and compliance may be the key to surviving in the long run of digital assets.