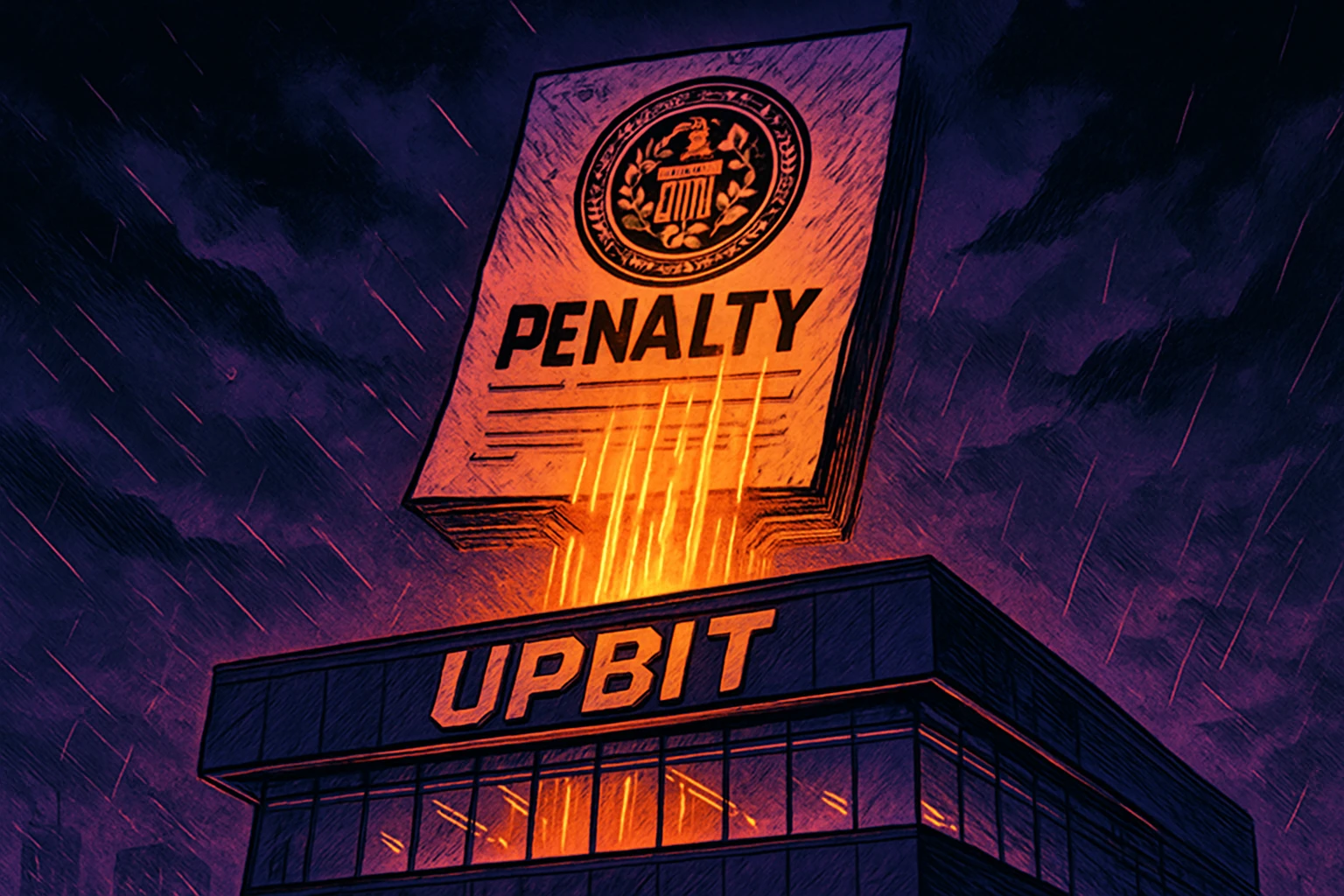

U.S. Bitcoin profits will be deducted 5% when repatriated to Taiwan! Trump plans to introduce new bill: tax on transfers from non-U.S. citizens

Trump’s implementation of the Big Beauty Act exposed relevant details, one of which states that a 5% consumption tax will be levied on cross-border remittances sent by non-US citizens, visa workers, and green card holders. The purpose is to attract overseas workers and keep US dollars in the United States for consumption.

(Preliminary summary: 2025 latest "Tax filing regulations for cryptocurrency investors: What is the difference between domestic/foreign income, and can virtual currency losses be recognized as losses?)

(Background supplement: The U.S. House of Representatives passed the "Taiwan-U.S. Double Taxation Avoidance Act", why should cryptocurrency investors pay attention?)

Attention U.S. stock investors and overseas cryptocurrency investors! The details of the "one big beautiful bill" promoted by the Republican Party have recently been exposed. One of the provisions will state that all non-US citizens, including visa workers and green card holders, will be levied a 5% tax on overseas remittances. If implemented, it will have an impact on overseas investors.

Details of the Big Beauty Act

Last Friday, the 389-page Big Beauty Act promoted by US President Trump was rejected by the House of Representatives Budget Committee. The Republicans who passed the bill will revise the details and continue to push it. However, a clause in the bill has attracted attention. For non-US citizens including H-1B work visa, F-1 student visa and green card holders, a 5% excise tax (excise tax) will be levied on international remittances sent overseas.

It is understood that it is clearly written on page 327 that this clause does not have a minimum or maximum limit on the remittance amount, so this means that small overseas retail investors who invest in U.S. stocks and cryptocurrencies may be affected.

Reason for taxation

According to statistics, nearly 2.3 million Indians stay in the United States to work through various visa programs. However, according to reports, the U.S. government discovered that Indians are used to "frugally remitting U.S. dollars earned to India." Therefore, they were attacked by the Trump administration. The report said that the Trump administration suspected that it reduced the chance of U.S. dollars being consumed in the United States. In 2023 alone, they remitted more than 23 billion U.S. dollars.

In addition to Indians, Taiwanese who rely on foreign securities firms and brokers in the United States to subscribe to U.S. stocks, as well as those who use overseas exchanges such as Bitfinex, Kraken, Bitgo, etc., remit the annual US$7 million tax limit in Taiwan to declare overseas exemption. Tax customers may also be affected. It is currently unclear when the bill will actually be passed. However, under the dominant Republican administration in the United States, it may only be a matter of time before the Great Beauty Bill is passed. Therefore, relevant investors must understand the risks that relevant regulations bring to international exchange to avoid unnecessary losses.