I planned to spend 20 years saving 10 Bitcoins for my children, but found that the hardest thing was not the money.

A father shared on Reddit that he hopes to accumulate a 20-year Bitcoin fixed investment plan for his children, revealing a new blueprint for the inheritance of wealth from generation to generation in the encryption era.

(Preliminary summary: Bitcoin has its strongest month! The average return rate in November was 42.5%. Is BTC still expected to hit US$150,000 by the end of the year?)

(Background supplement: Standard Chartered: Bitcoin may "never" return to below US$100,000, four major forces support BTC)

Contents of this article

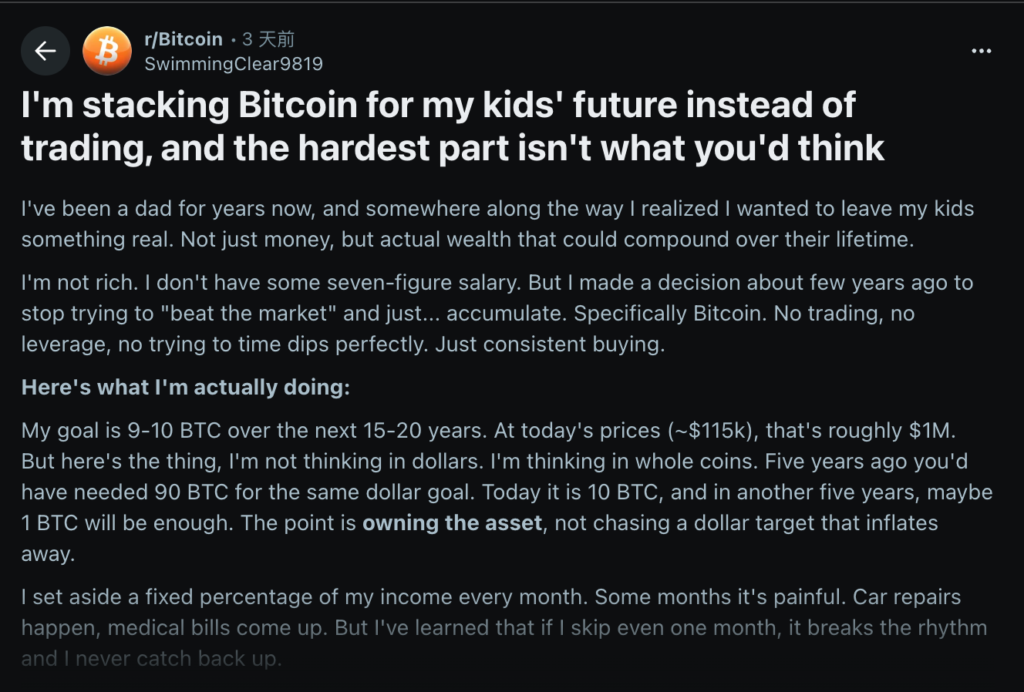

Do you believe that Bitcoin will become "digital gold"? In a Reddit post this week, the protagonist is an ordinary working father. He refuses short-term operations and high leverage, and chooses to buy BTC with a fixed monthly amount. He wants to leave 9 to 10 Bitcoins for his children in 15 to 20 years. Let’s take a look at the challenges he encounters.

The core of the "boring" strategy, regular quotas

This father admitted that his income is not generous, but he is willing to pursue regular fixed quota investments for a long time (DCA) principle. He explained that the goal is simple: not to chase the rise and fall of the U.S. dollar’s market value. The focus is to eventually hold a sufficient amount of Bitcoin. Based on the price of about $110,000 at the time of writing, 10 Bitcoins are already a considerable asset, but he is more concerned about scarcity. He mentioned in the post:

"Five years ago, it might have taken 90 Bitcoins to be worth the current $110,000. Maybe in another five years, only 1 will be enough."

This kind of thinking shifts the focus from price to the scarcity nature of the supply limit, echoing the concept of "exchanging time for average cost" emphasized by the Bitcoin fixed investment principle.

Discipline versus fluctuation: psychological pull

However, DCA is simple to imagine, but the actual execution tests your sanity. The author of the post confessed that in the early days, because he could not see the excitement caused by the short-term sharp rise and fall, the feeling of "boring" emerged from time to time, and he even thought about "trying 5x leverage once", but fortunately he suppressed it in the end.

When the cumulative progress reached about the 40% target, a 20% intraday drop in the price of Bitcoin brought new pressure. He spent a lot of time convincing himself that the drop meant "buying Satoshis" at a cheaper price.

This experience coincides with DCA's view on how to reduce emotional trading: regular buying can minimize the urge to "chase highs and kill lows."

20-year blueprint: from investment to inheritance

Bitcoin is just the starting point. The longer-term issue is how to safely hand over digital assets to the next generation. The author of the post also studied the design of multi-signature wallets, wills and trusts, and referred to the Secure Digital Asset List, Private Key Inheritance Agreement and Legal Framework recommendations to try to ensure that accounts, mnemonic phrases and legal documents can be correctly activated when risk events occur.

If the final asset size reaches a high net worth level, he will also consider introducing professional custody or establishing a family office to create a stable cross-generational structure.

What is left to the next generation is not only money, but also methods

Today, when crypto-native assets are gradually becoming a mainstream option, the traditional "real estate + stock" combination is no longer the only answer. This father’s story highlights two things: first, long-term and disciplined action can cultivate patience in highly volatile markets; second, sound legal and technical solutions are also critical to asset inheritance.

Whether Bitcoin can eventually become "digital gold" remains to be tested by the market, but this father used his "boring" actions day after day to demonstrate the possibility of moving forward steadily amid huge fluctuations. His 20-year plan reminds investors that patience, discipline and a sound inheritance mechanism may be the three most practical keys in the digital asset era.