Mentougou Mt. Gox Exchange has extended the repayment date to October 2026. How many Bitcoins are still outstanding?

Nobuaki Kobayashi, the restructuring trustee of Mt. Gox, announced today that the creditor repayment deadline originally scheduled for October 31, 2025 will be extended again to October 31, 2026.

(Preliminary information: Fraudsters are eyeing the Mt. Gox theft case, which contained $8.6 billion in stolen Bitcoin wallets, beware of the OP_RETURN phishing scam)

(Background supplement: Strive acquired 75,000 bitcoins from "Mt. Gox Debt" at a low price, with the goal of establishing a BTC reserve for listing)

Contents of this article

Once the world's largest Bitcoin exchange, Mt. After 10 years of bankruptcy proceedings and several delays, Mt. Gox finally began repaying its debt in July last year (2024). Mt. Gox will pay a total of 142,000 BTC and 143,000 BCH to creditors.

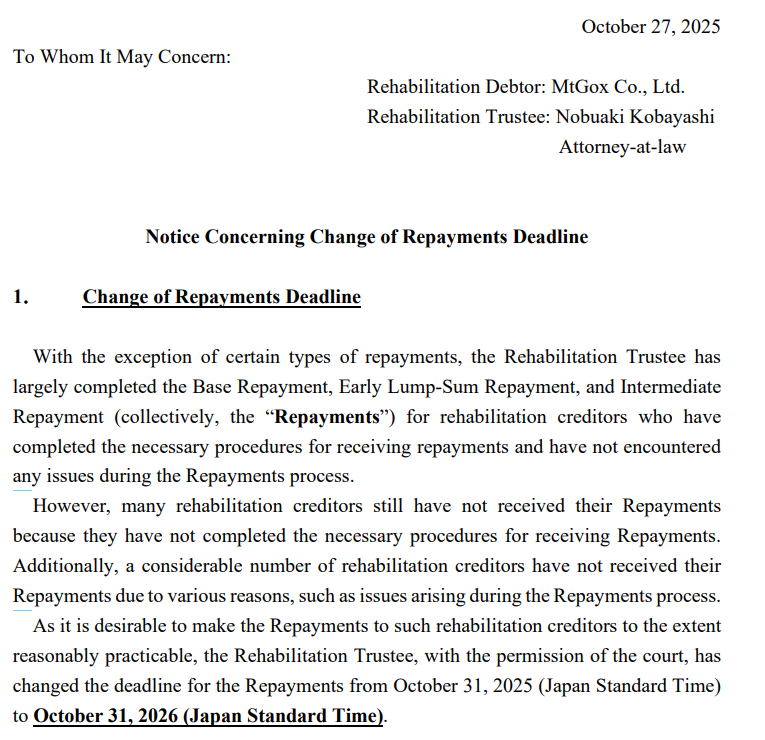

Nobuaki Kobayashi, the restructuring trustee of Mt. Gox, issued an announcement today (27th), announcing that the repayment deadline originally scheduled for October 31, 2025 will be extended by one year to October 31, 2026 with the permission of the Tokyo District Court. This move is intended to provide more time to creditors who have not completed relevant procedures or have not received repayment due to problems and ensure that the repayment process proceeds smoothly.

Reason for postponement: Unfinished creditor procedures and technical issues

According to the announcement, although most qualified creditors have completed basic repayment, early one-time repayment and mid-term repayment, there are still a large number of creditors who have not received repayment because they have not completed necessary procedures (such as identity verification, KYC or payment information registration).

In addition, some creditors also encountered technical problems during the repayment process, such as double deposits that needed to be returned, which hindered progress. Therefore, in order to ensure that all creditors can receive fair compensation, the trustee decided to extend the deadline and emphasized that assets will be released in stages through over-the-counter transactions (OTC) to mitigate the impact on the Bitcoin market.

Review of the Mentougou Bankruptcy Event

Mentougou Exchange was once the world's largest Bitcoin trading platform, handling more than 100 bitcoins worldwide during its peak period. 70% of Bitcoin transactions. However, in February 2014, the exchange suffered a hacker attack and lost approximately 850,000 Bitcoins, causing the platform to collapse and file for bankruptcy protection. This incident is regarded as the most shocking bankruptcy case in the history of cryptocurrency, affecting tens of thousands of users.

After bankruptcy, the Tokyo District Court of Japan appointed Nobuaki Kobayashi as the trustee to manage the remaining approximately 140,000 Bitcoins (BTC) and the corresponding Bitcoin Cash (BCH). In June 2018, it was transferred to civil rehabilitation procedures with the aim of repaying creditors to the greatest extent possible.

Timeline of the repayment process

The following are the key nodes of the Mentougou repayment process:

February 2014: Suffered a hacker attack, lost 850,000 BTC, and the exchange filed for bankruptcy.

June 2018: Entered civil rehabilitation proceedings and began to handle creditor claims.

September 2023: First extension of repayment deadline to October 31, 2024.

July 2024: Initial repayment will be initiated, and compensation will be paid to customers through platforms such as Kraken and Bitstamp.

October 2024: First extension of deadline to October 31, 2025.

March 2025: Transfer some BTC to a new wallet to speed up the repayment process.

October 27, 2025: Announced another extension of the deadline to October 31, 2026.

The scale of remaining repayment funds

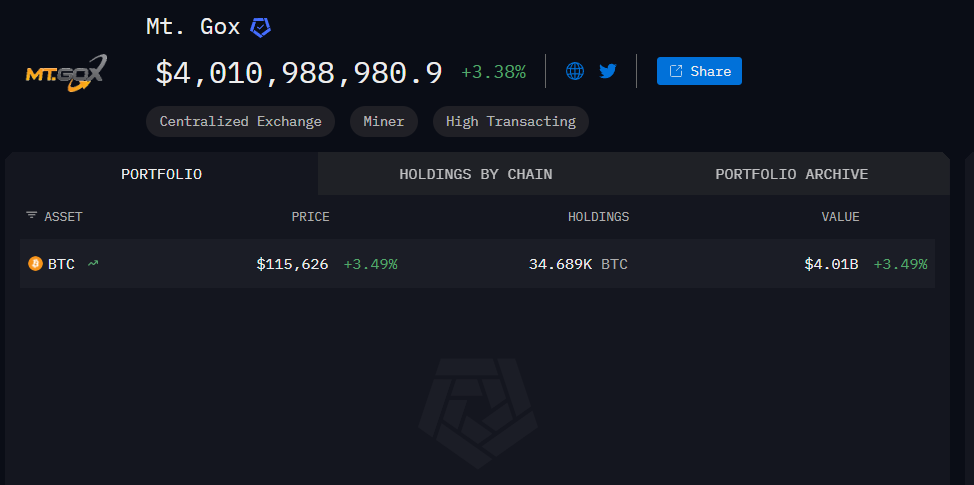

As for how many Bitcoins Mt. Gox still has on hand that has not yet been repaid to creditors? According to Arkham tracking data, it currently holds about 34,000 Bitcoins (worth about $4 billion).

Since there is more time for repayment, the selling pressure on Bitcoin is expected to be less concentrated. In addition, the official stated that it may be released in stages through OTC, which may help reduce the selling pressure on the market.