Nvidia earnings day could be embarrassing? Analyst: Even if the results are strong, the market will be "nervous"

Technology investor Gene Munster believes that Huida is facing a dilemma: if the performance guidance is too strong, it will cause concerns about over-investment, and if it is only a mild increase, it will be regarded as a slowdown in growth, which may lead to market volatility in any case. This article originates from an article written by Foresight News and is compiled, compiled and written by Foresight News.

(Previous summary: Bitcoin plummeted by US$5,000 overnight, down by US$98,000! The chance of an interest rate cut in December was greatly reduced, Huida fell more than 3%, and technology stocks dived)

(Background supplement: Nvidia’s market value exceeded US$5 trillion! One article takes stock of the history of Huida’s fortune: from gaming giant, encryption mining tyrant to AI arms dealer )

Although the market is generally expecting Huida to deliver another strong performance report, the artificial intelligence chip giant is facing a "dilemma", that is, regardless of the financial report results, it may trigger investor nervousness and market volatility.

Well-known technology investor and Deepwater Asset Management analyst Gene Munster warned in a report released on Wednesday that Huida is facing a dilemma. He noted that an overly strong guidance could exacerbate concerns about overinvestment in artificial intelligence, putting pressure on stock prices.

However, a guidance that is only a modest upward revision may be interpreted by the market as an initial sign that growth is normalizing faster than expected, which may also trigger a negative reaction. Munster believes that this "nothing can be done wrong" situation adds significant volatility risk to the financial report to be released next week.

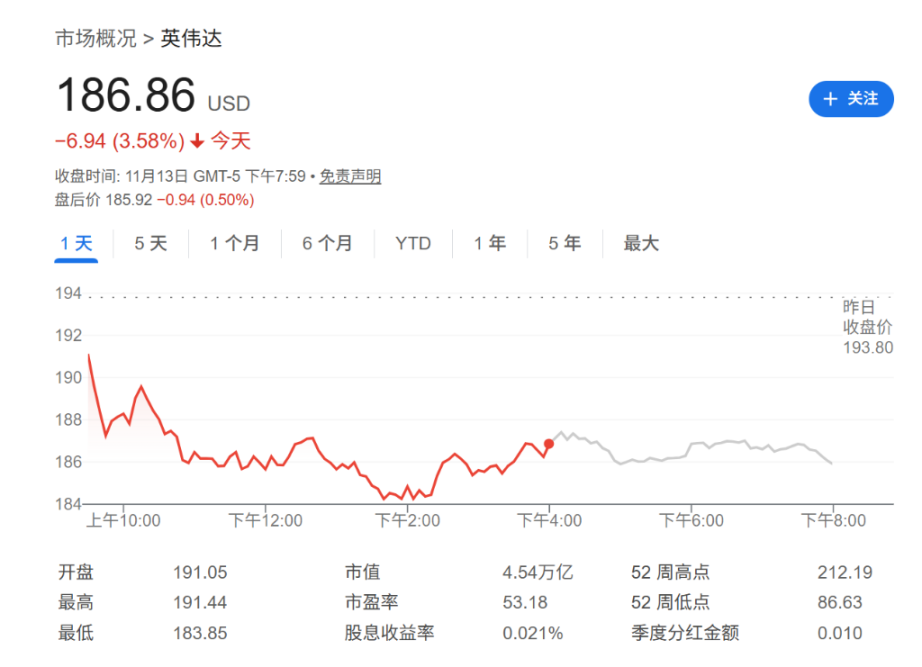

The nervousness reflects the mixed mentality of investors amid the AI boom, with growing concerns about short-term valuations and the pace of investment despite promising long-term prospects. Huida shares fell 0.5% to $186.86 in premarket trading.

Wall Street expectations still have room to increase

Despite the complex short-term market sentiment, Munster pointed out that Wall Street's growth expectations for Huida still have considerable room for improvement. Huang Renxun revealed at an event that the market demand for the company's Blackwell and Rubin series chips may reach $500 billion.

Munster analysis said that this outlook means that there is at least a 10% increase potential for the current Wall Street forecast, which means that there is still about 4% increase in the current Wall Street forecast. Room for 10% growth." Analysts are cautious in part because of ongoing supply constraints and the uneven pace of forecast revisions across agencies.

Nonetheless, Munster expects that as the market gradually digests Huida’s expanding AI product line, analysts’ revenue growth forecast for the company’s calendar year 2026 will increase to about 45% from the current 39%.

Investor sentiment cools, but long-term outlook remains positive

Munster acknowledged that investor sentiment has cooled recently. SoftBank Group’s liquidation of its Huida position and Meta’s warning that its spending will grow faster than revenue next year have heightened concerns about overinvestment in AI.

However, he emphasized that the long-term opportunities remain bright. Munster remains bullish on Huida's stock and believes that over the next two years, its growth will "maintain higher levels for longer periods of time":

"The use cases, practicality and ultimately commercial monetization models for AI will eventually emerge because intelligence at scale is inherently valuable."

As more profitable AI applications emerge, "AI "The deal flywheel will accelerate," which will boost investor confidence and likely drive gains for Huida and other AI infrastructure stocks in the coming years.

At the same time, other analysts also expressed confidence in Huida. Bank of America analyst Vivek Arya reiterated his "buy" rating on leading data center and semiconductor equipment stocks.

Arya specifically noted that Huida's stock is "particularly compelling" due to its strong visibility into the data center business. He said that based on Huida's current order backlog, the chipmaker is expected to achieve 50% revenue growth and 70% earnings per share growth in 2026, while its forward price-to-earnings ratio is only a relatively modest 24 times.