Heavy! NVIDIA spends US$100 billion to cooperate with OpenAI to build a 10GW AI data center, NVDA jumps 3.9%

Chip giant NVIDIA and AI giant OpenAI announced that the two parties have signed a strategic cooperation intention to deploy at least 10GW of NVIDIA systems in the next few years, with NVIDIA investing up to US$100 billion in phases.

(Preliminary summary: Why did Oracle’s $300 billion contract with OpenAI sound the alarm for the AI bubble?)

(Background supplement: Huida’s Q2 financial report was better than expected, but why did the stock price drop by 5%? NVIDIA faces these three major challenges)

Contents of this article

Chip giant NVIDIA (Huida) and AI giant OpenAI announced on September 23 Late at night, a major announcement was made at the same time, announcing that the two parties had signed a strategic cooperation intention to deploy at least 10GW of NVIDIA systems in the next few years, and NVIDIA would invest up to US$100 billion in phases. This unprecedented investment in AI infrastructure marks the formal escalation of the AI arms race into a global construction race for "super-giant AI factories."

10GW computing power: AI has officially entered the gigawatt era

According to a press release issued by both parties, the huge scale of 10GW can accommodate the simultaneous operation of millions of GPUs, far exceeding the maximum load of traditional cloud data centers. The announcement pointed out that the first batch of facilities are expected to go online in the second half of 2026 and will directly support OpenAI’s next-generation model. The goals of both parties are very clear: moving towards superintelligence. In this regard, OpenAI CEO Sam Altman commented:

"Computing infrastructure will be the foundation of the future economy."

NVIDIA invests hundreds of billions of dollars: from selling chips to co-building AI infrastructure

The announcement continued that NVIDIA will invest a total of US$100 billion at the pace of "one GW, one investment". This cooperation between the two parties shows that Huida is no longer limited to playing the role of a hardware supplier, but will further form a capital and technology community with OpenAI to work together in optimizing the model, software and hardware ecology.

OpenAI estimates that training costs alone may reach $19 billion in 2026, and may rise to hundreds of billions of dollars by 2030. But the huge capital investment will also bring huge returns: with NVIDIA's funds and hardware, it is equivalent to building an exclusive AI cloud tailored for OpenAI.

Vera Rubin Platform: The heart of the next generation AI factory

In terms of technology, the overall deployment of this system will use NVIDIA's Vera Rubin platform. This architecture combines Rubin GPU, Vera CPU, HBM4 high-bandwidth memory and NVLink 6 network, and the FP4 performance of each node will be as high as 50 PFLOPS.

NVIDIA likens this kind of data center to an "AI factory" that can be expanded from hundreds of megawatts to gigawatts. After being equipped with advanced power and cooling systems, it will be able to provide long-term computing power guarantee for the training and inference of very large models. NVIDIA CEO Jensen Huang also bluntly said that this cooperation will "promote the next major leap in AI."

Global layout: Stargate UK has become a touchstone

It is worth mentioning that the cooperation between the two parties has also spread to regions outside the United States. Public information shows that OpenAI and NVIDIA are advancing the Stargate UK project in the UK, with the goal of deploying 10,000 Blackwell GPUs locally by 2026, with an investment of approximately US$3 billion.

By collaborating with local partners such as Nscale, the two companies hope to establish a "sovereign computing power" network at the regional level, reduce dependence on a single cloud giant and transnational data paths, and further consolidate the security of the AI industry chain.

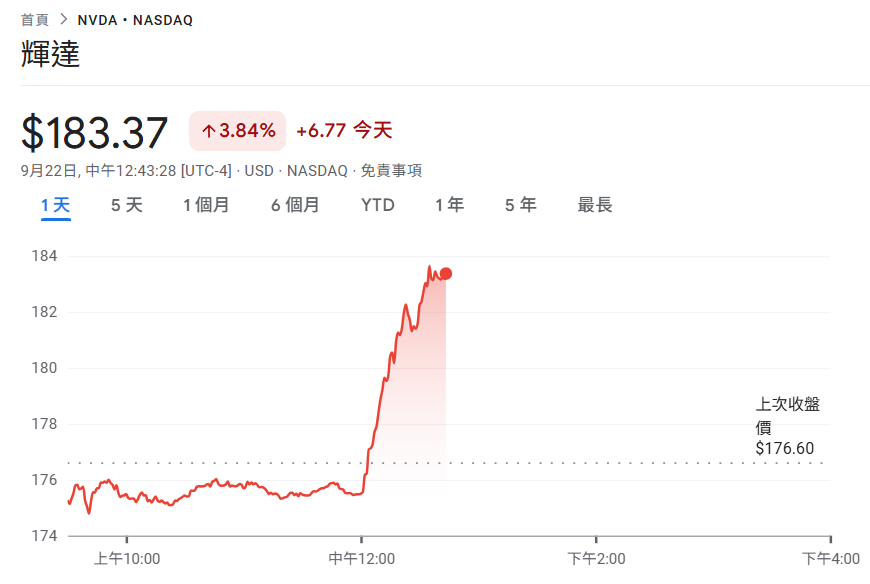

Huida shares rose 3.9%

Spurred by this news, Huida shares rose during the US stock market, with the stock price reaching US$183 and the market value rising to US$4.45 trillion.